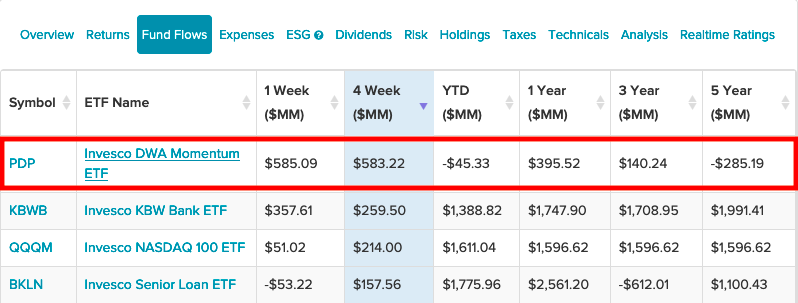

When it comes to fund flows within the past month for Invesco exchange traded funds (ETFs), it appears that momentum is on the side of the Invesco DWA Momentum ETF (PDP).

Market momentum can be a difficult force to stop once it gets going. As such, PDP tops the fund flows within the past month despite a recent volatile bout in the major stock market indexes.

PDP seeks to track the investment results (before fees and expenses) of the Dorsey Wright® Technical Leaders Index. The fund generally will invest at least 90% of its total assets in securities that comprise the underlying index. The underlying index is composed of approximately 100 securities from an eligible universe of approximately 1,000 securities of the largest constituents by market capitalization within the NASDAQ US Benchmark Index.

The Index is constructed pursuant to Dorsey Wright Associates LLC’s proprietary methodology that is designed to identify companies that demonstrate powerful relative strength characteristics. Relative strength is the measurement of a security’s performance in a given universe over time as compared to the performance of all other securities in that universe.

Backed by Academic Research

One of the strengths of the momentum factors is the availability of research. Momentum has proven itself to be a time-tested strategy that can consistently perform to the upside.

“Nowadays, momentum strategies are well-known and generally accepted in both the public and academic worlds,” a Quantpedia article explained. “Yet, the momentum strategy is based on a simple idea, the theory about momentum states that stocks which have performed well in the past would continue to perform well. On the other hand, stocks which have performed poorly in the past would continue to perform badly. This results in a profitable but straightforward strategy of buying past winners and selling past losers.”

As mentioned, academic research supports the use of momentum in riding rallies.

“Overall, academic research shows strong support for the momentum effect,” the article said further. “The most common explanations and probably the main reasons for the persistence of the momentum anomaly are behavioral biases like investor herding, investor over and underreaction, and lastly, the confirmation bias. For example, if a firm releases good news and the stock price reacts only partially to the good news, then buying the stock after the initial release of the news will generate profits.”

For more news, information, and strategy, visit the Innovative ETFs Channel.