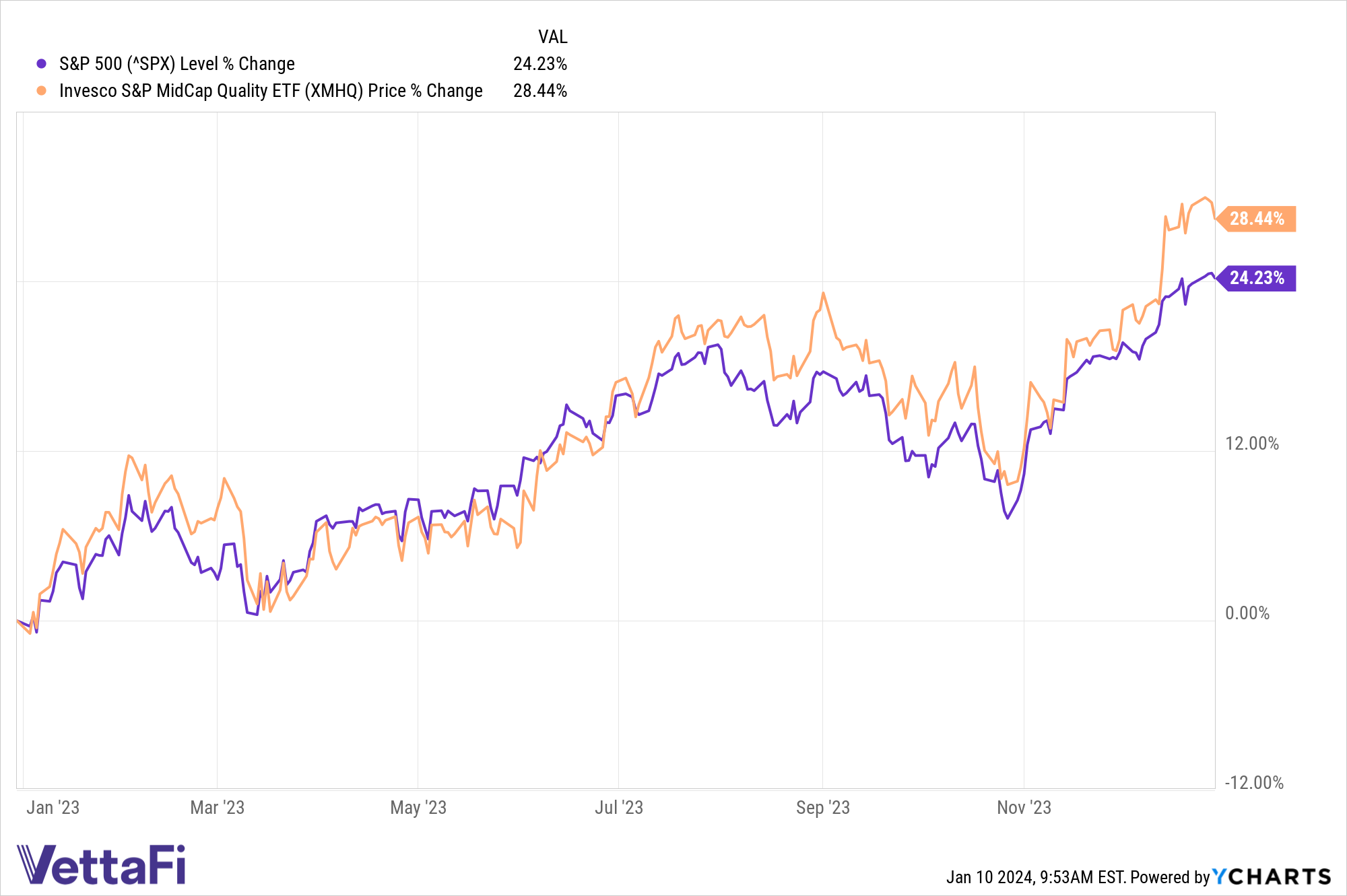

Large-caps are getting a lot of attention and making a lot of headlines these days. And why wouldn’t they? Rather than nosedive (as many pundits and investors believed), the S&P 500 went up more than 24% over the course of 2023. Plus, large-caps tend to offer stability and balance sheet strength.

But large-cap stocks tend to be slow growers and don’t trade at a value. Apple Inc. (AAPL), for example, closed at more than $185 a share on Tuesday. So, while large-cap funds tend to be seen as safe bets, midcaps can offer both the stability of large-caps and the growth potential of small-cap stocks.

“Midcap looks more attractive than in the last several years,” Michael Sheldon, executive director at the Westport, Connecticut-based wealth management firm Hightower RDM Financial Group, told the Wall Street Journal. RDM’s clients on average have about 20% of their stock portfolios in midcaps.

See more: “Use XMHQ, XSHQ to Fill Gaps in Quality SMID-Cap Exposure”

The S&P MidCap 400 was up 14.5% in 2023, which the Journal noted was just 5% shy of its record high.

The Journal added that, “some professionals say midcaps could be poised to outperform large-caps and now is a good time to build a position.” That’s where the Invesco S&P MidCap Quality ETF (XMHQ) comes into play.

Build a Midcap Position With XMHQ

XMHQ invests most of its assets in the securities that comprise the S&P MidCap 400 Quality Index. The Index holds about 80 securities in the S&P Midcap 400 that have the highest quality scores. The index provider computes these scores based on three fundamental factors: return on equity, accruals ratio, and financial leverage ratio.

Each stock is weighted in the index by its quality score multiplied by its market cap in the eligible universe. Stocks with higher scores receive relatively greater weights.

XMHQ outperformed the S&P 500 by 421 basis points in 2023.

XMHQ charges 25 basis points.

For more news, information, and analysis, visit the Innovative ETFs Channel.