Invesco’s semiconductor ETFs were among the best-performing ETFs last week.

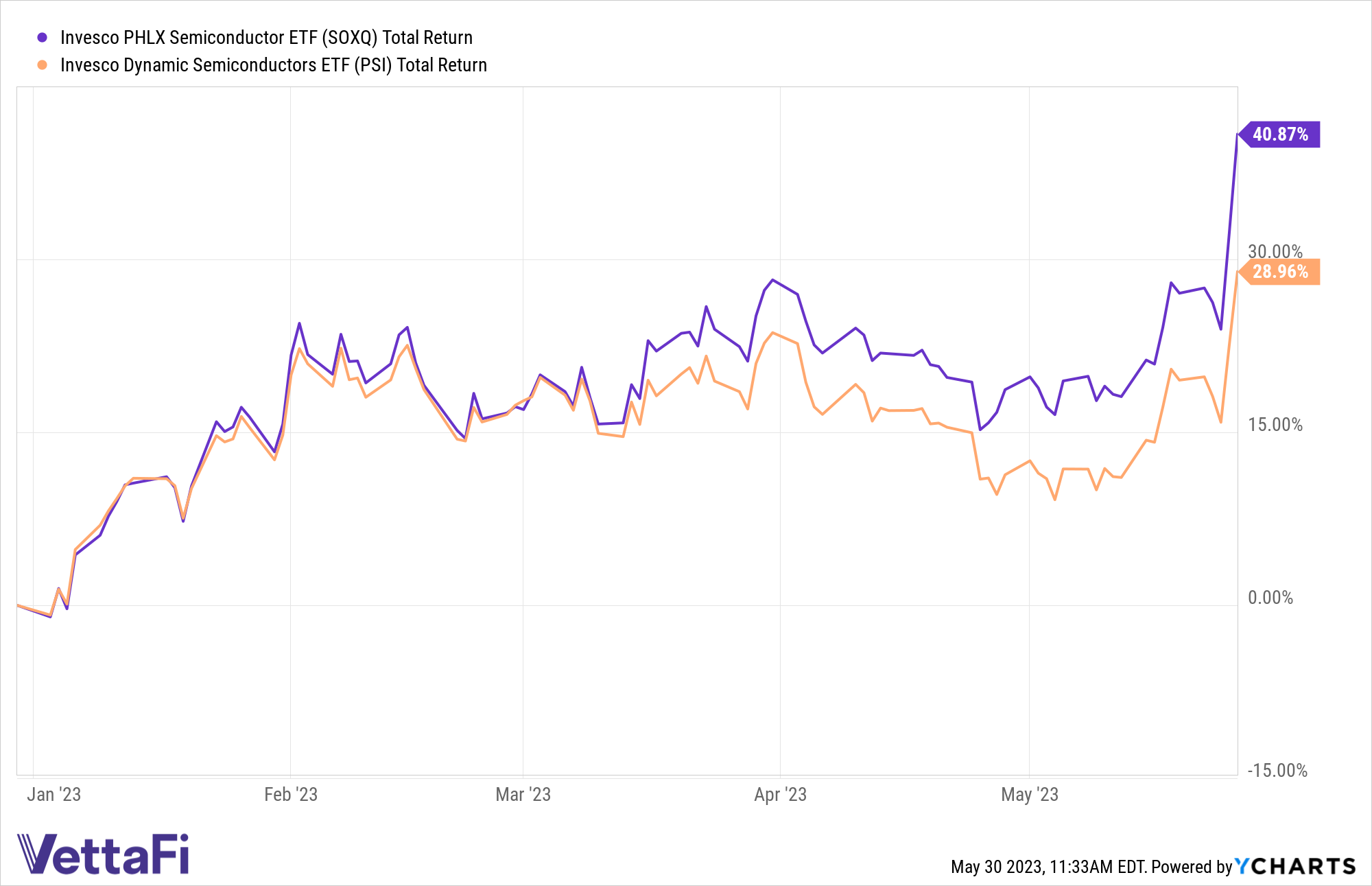

The Invesco PHLX Semiconductor ETF (SOXQ) and the Invesco Dynamic Semiconductors ETF (PSI) stood out for providing impressive gains last week as semiconductor stocks rallied. SOXQ climbed 11.6% while PSI climbed 9.2% during the week.

Semiconductor stocks were lifted by NVIDIA Corporation (NVDA) reporting blockbuster first quarter earnings last week. Shares of Nvidia have climbed around 33% over the past five days and, on Tuesday, the company became the first semiconductor company to reach a market value of $1 trillion.

See more: “7 Fixed Income ETFs to Consider in the Current Environment”

Semiconductors include products such as memory chips, microprocessors, integrated circuits, and related equipment that serve a wide variety of purposes in various types of electronics, including personal household products, automobiles, and computers.

Semiconductor ETFs SOXQ and PSI were among the best-performing ETFs last week

Nvidia is the top holding in PSI, weighted at 7.20%. Meanwhile, Nvidia is the second holding in SOXQ, weighted 9.85%, trailing Advanced Micro Devices (AMD), which has a 10.24% weight.

Both funds have posted standout year to date returns. SOXQ is up 40.9% as of May 26, while PSI has advanced 29% during the same period.

SOXQ tracks the PHLX Semiconductor Sector Index. The index measures the performance of the 30 largest U.S.-listed securities of companies engaged in the semiconductor business.

SOXQ charges 19 basis points and has $112 million in assets under management.

See more: “Too Late to Buy TIPS? Invesco Fixed Expert Says ‘No’”

PSI is based on the Dynamic Semiconductor Intellidex Index. The index is designed to provide capital appreciation by thoroughly evaluating companies based on a variety of investment merit criteria, including price momentum, earnings momentum, quality, management action, and value. The index comprises 30 U.S. semiconductors companies.

PSI has accreted $572 million in assets since its inception in 2005. The pricier of the two semiconductor ETFs, PSI charges 56 basis points.

For more news, information, and analysis, visit the Innovative ETFs Channel.