Economic indicators provide insight into the overall health and performance of an economy. They play a crucial role in enabling policymakers, advisors, investors, and businesses to assess current economic conditions, facilitating informed decisions regarding business strategies and financial markets. In the week ending January 4, the SPDR S&P 500 ETF Trust (SPY) fell 1.97%, while the Invesco S&P 500® Equal Weight ETF (RSP) was down 1.99%. Among all economic indicators, some of the most closely watched are those related to the labor market due to their significant impact on overall economic health.

Last week was full of employment updates, including November’s Job Openings and Labor Turnover (JOLTS) report, December’s ADP Private Employment Report, and the BLS’ December Employment Report. These reports offer insights into different aspects of the U.S. labor market. They also contribute to a better understanding of the broader economic picture. This article will highlight the key data points from these three reports and explore their potential implications.

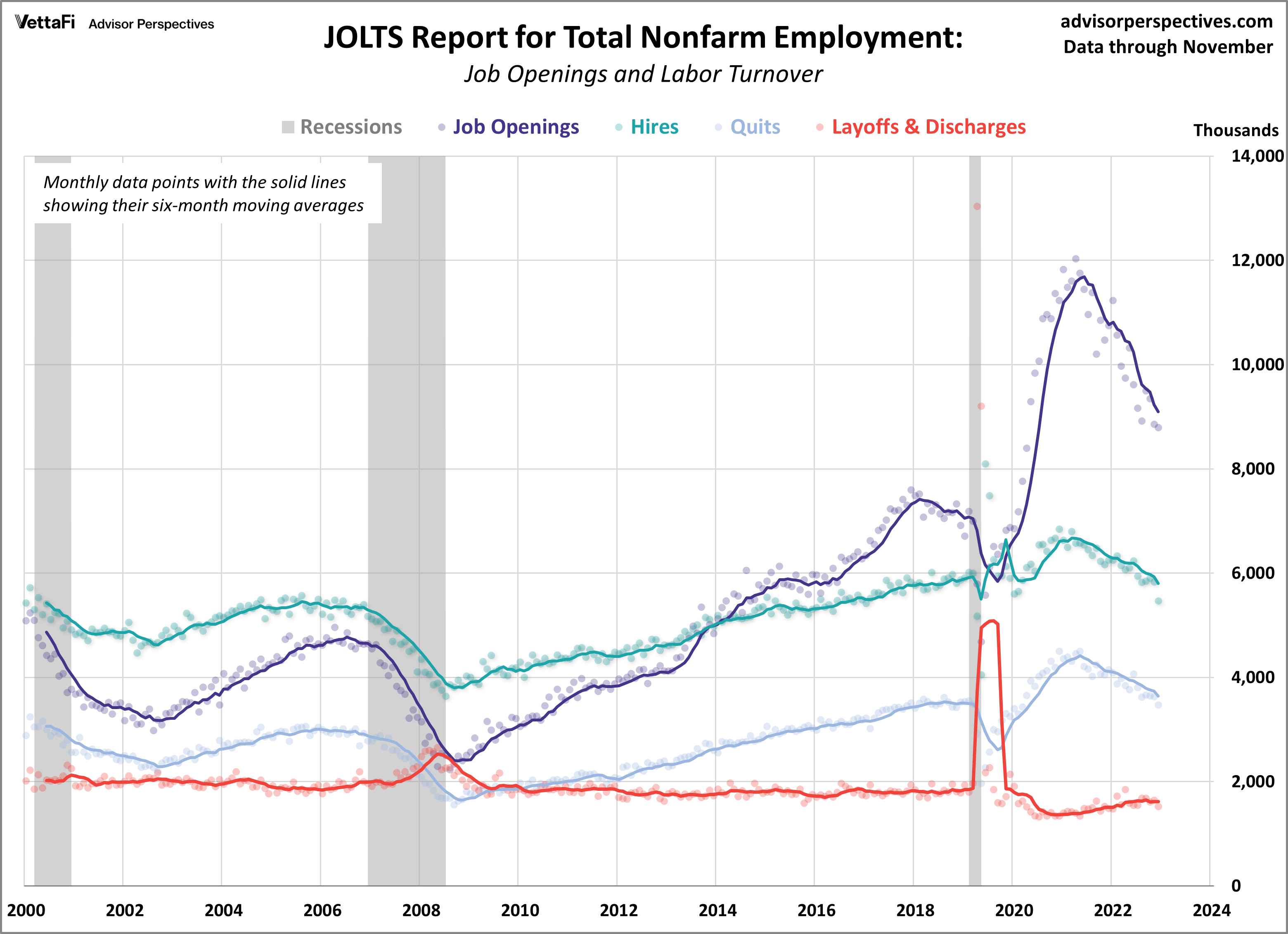

Job Openings and Labor Turnover (JOLTS)

The November JOLTS report continued to showcase a cooling labor market as job openings fell further, dropping to a 32-month low. In November, job openings dropped by 62,000 to 8.790 million. The recent decline was larger than anticipated, as the latest reading was below the expected 8.850 million vacancies. Other key data points from the report showed that the number of quits, hires, and layoffs decreased from the previous month. The quits rate dropped to 2.2% and the hires rate fell to 3.5%. Those are the lowest level for each series since 2020.

The JOLTS data serves as a barometer for assessing labor demand. Any disparity between workforce demand and supply could potentially exert upward pressure on inflation. Over the last seven months, the gap between the two has consistently narrowed as the overall trend in job openings has steadily declined from its 2022 peak. In November, the number of job openings per unemployed worker was little changed at 1.40. That was well off its 2022 high and inching closer to prepandemic levels.

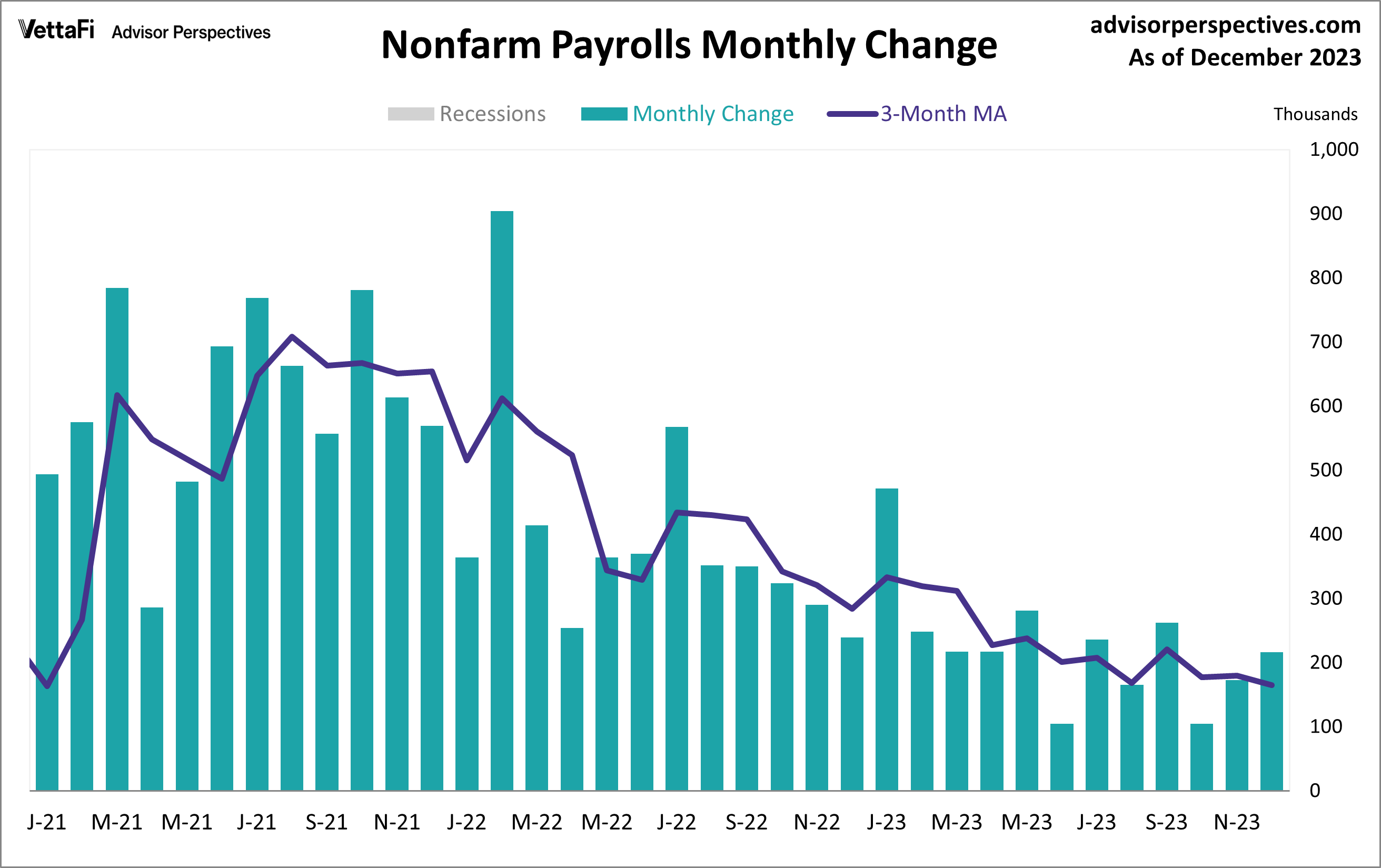

Employment Report

The U.S. labor market closed out 2023 with the resiliency that it had displayed for most of the year. The December employment report revealed 216,000 jobs were added last month, coming in higher than the expected 170,000 addition. This is the second straight month that job growth has picked up. But December’s jobs numbers are still relatively low compared to the past few years.

Additionally, the report indicated that the unemployment rate held steady at 3.7%, while wage growth picked up for the first time since July to 4.1%. The labor force participation rate dropped to 62.5%. That is its lowest level since February. Overall, the jobs report showed solid job growth for a moderating labor market. However, the latest numbers could impact the timeline for the Fed’s first interest rates cuts for this cycle.

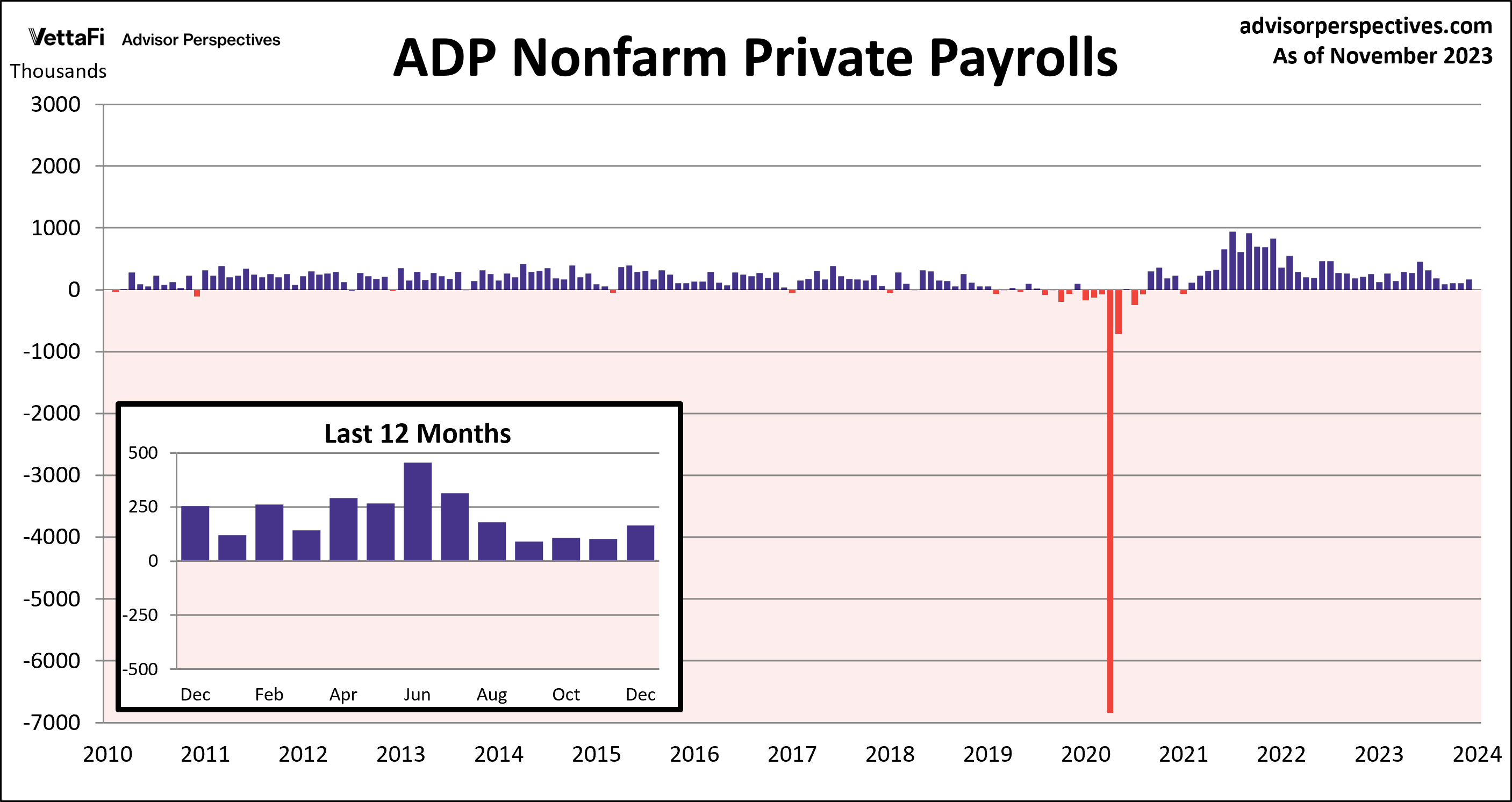

ADP Employment Report

Private sector hiring picked up more than expected in December, although hiring levels remain relatively low and somewhat reminiscent of prepandemic levels. The ADP employment report showed that 164,000 private jobs were added last month, less than the projected 115,000 addition. Private sector job growth has now slowed for four of the past six months, with the latest six-month moving average dropping to its lowest level since December 2020. The pickup this month was most notable among the leisure and hospitality industry. They added 59,000 jobs, while the manufacturing industry continued to struggle for a second straight month.

Another significant detail from the report was the continued deceleration of annual pay growth that started in September 2022. Annual pay growth for job stayers rose 5.4%, the slowest pace since August 2021. Private sector job and pay growth continue to trend downwards. That serves as a positive signal for the Fed that inflationary pressures, such as wage gains, are continuing to ease.

Economic Indicators and the Week Ahead

This week will shed light on small business sentiments, with the release of December’s NFIB Small Business Optimism Index on Tuesday. Over the past year and a half, small business owners have shown subdued optimism as they’ve constantly faced challenges such as inflation and labor quality.

However, the focal point for the week will be the release of the latest inflation data. On Thursday, the Bureau of Labor Statistics will release December’s Consumer Price Index (CPI), followed by the Producer Price Index (PPI) on Friday. Current forecasts show that headline CPI increased 0.2% and core CPI increased 0.3% from November, while headline and core PPI are each projected to have risen 0.2% from November.

For more news, information, and strategy, visit the Innovative ETFs Channel.