Economic indicators provide insight into the overall health and performance of an economy. They play a crucial role in enabling policymakers, advisors, investors, and businesses to assess current economic conditions. They facilitate informed decisions regarding business strategies and financial markets. In the week ending on January 11, the SPDR S&P 500 ETF Trust (SPY) rose 1.94% while the Invesco S&P 500® Equal Weight ETF (RSP) was up 0.73%.

Inflation has been a popular topic of conversation over the past few years since it plays a crucial role in the Fed’s interest rate policy. In 2022 inflation climbed to historic levels and then slowly eased for much of 2023. With inflation still above the Fed’s 2% target level, the conversation will most likely continue in 2024. This article highlights two important inflation indicators from the past week – the consumer price index and the producer price index – and explores their potential implications.

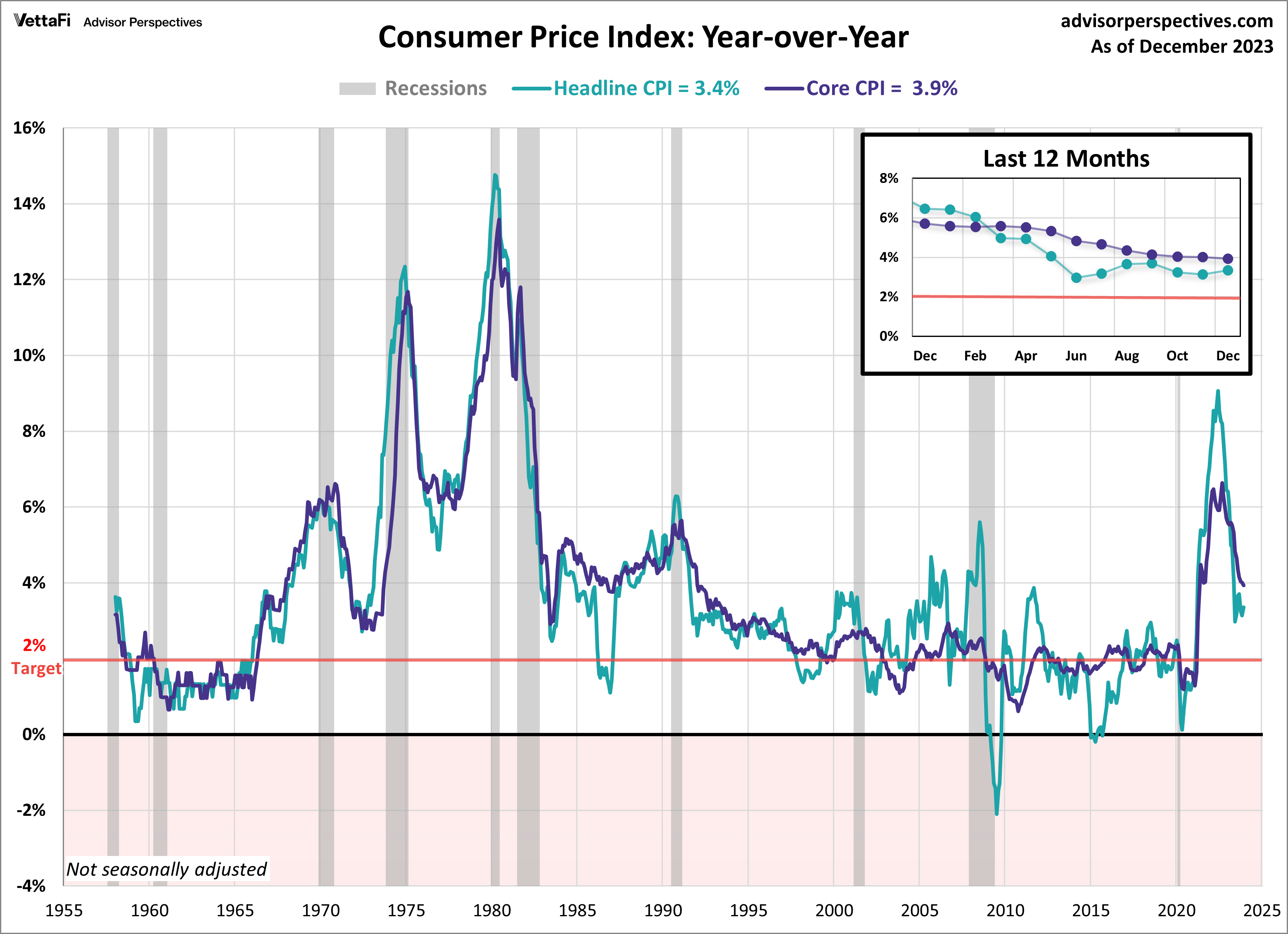

Consumer Price Index

Consumer prices rose more than expected to end 2023, showing that the inflation conversation is far from over. The Consumer Price Index (CPI) rose 3.4% in December, up from 3.1% in November and more than the expected 3.2% growth. This is the first-time consumer price growth has picked up since September. Compared to the previous month, consumer prices rose 0.3%, higher than the expected 0.2% increase. The primary driver for the monthly increase was a rise in shelter costs.

Core inflation, which excludes food and energy prices, declined further in December, reaching its lowest level since May 2021. Core CPI fell from 4.0% in November to 3.9% in December on an annual basis. That’s higher than the expected 3.8% growth. Additionally, core prices increased 0.3% from the previous month as expected.

The Fed will have its first meeting of 2024 later this month. And rates are largely expected to remain where they are at. However, the more closely watched conversation will be when the Fed feels it can begin cutting rates. The latest CPI report gives cause for the Fed to hold rates steady over their next few meetings. With that said, the CME Fed Watch Tool currently shows a 77% probability that the first rate cut will occur at their March meeting. Inflation is still above the Fed’s 2% target rate and there will be a few more inflation reports due before the March meeting. So it’s safe to say that nothing is certain at this point.

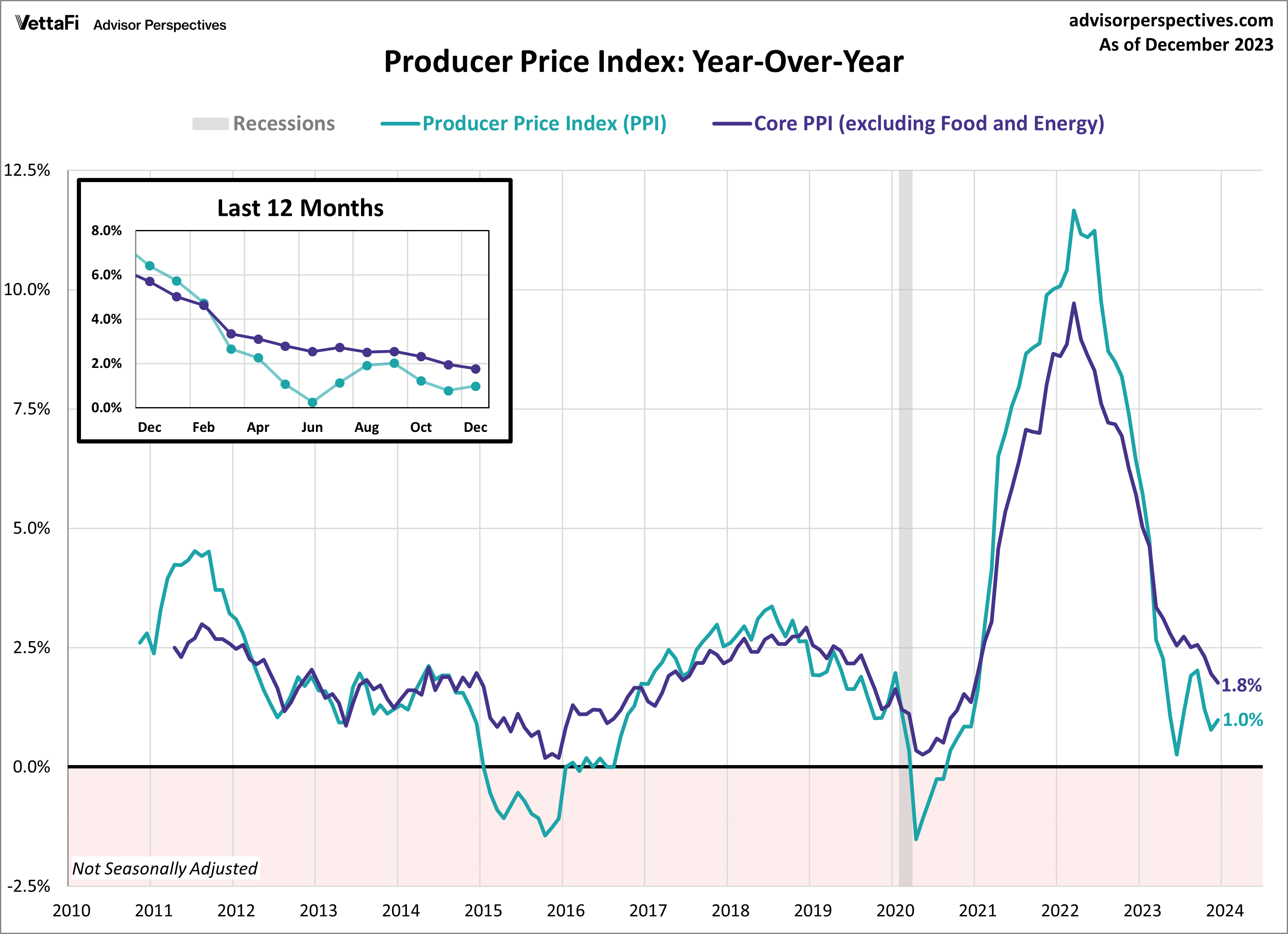

Producer Price Index

Wholesale prices unexpectedly declined last month, marking the third straight month prices have fallen. Last month, the Producer Price Index (PPI) decreased 0.1% from November, lower than the expected 0.1% increase in wholesale prices. On an annual basis, the PPI rose 1.0%, a slight pickup from November’s 0.8% annual increase and below the expected 1.3% increase.

Additionally, the Core Producer Price Index (PPI), which excludes food and energy, also came in lower-than-expected showing a 1.8% annual increase, down from last month’s 2.0% rise in prices and falling below the projected 1.9% increase. On a monthly basis, core wholesale prices were unchanged for a third straight month, lower than the expected 0.2% monthly increase.

The producer price index is widely considered a leading indicator of consumer inflation, as shifts in producer-level prices often trickle down to consumers. With the latest PPI report showing inflation softening at the wholesale level, consumers can feel some relief that inflation at the consumer level may soon follow suit.

Economic Indicators and the Week Ahead

In the upcoming week, attention will shift to the housing market as we await the release of key housing data for December. Over the course of the week, we will receive the latest news on builder confidence in home sales, housing starts, and existing home sales.

These housing market indicators will have an impact on homebuilders and residential real-estate ETFs such as iShares U.S. Home Construction ETF (ITB), SPDR S&P Homebuilders ETF (XHB), and iShares Residential and Multisector Real Estate ETF (REZ).

The National Association of Home Builders housing market index will shed light on builders’ confidence levels regarding home sales, which rose for the first time in five months last month because of falling mortgage rates. Housing starts are expected to fall to a seasonally adjusted annual rate of 1.415 million while existing home sales are projected to remain at a seasonally adjusted annual rate of 3.82 million units.

For more news, information, and strategy, visit the Innovative ETFs Channel.