Economic indicators provide insight into the overall health and performance of an economy. They serve as essential tools for policymakers, advisors, investors, and businesses because they allow them to make informed decisions regarding business strategies and financial markets. In the week ending December 7, the SPDR S&P 500 ETF Trust (SPY) rose 0.40% while the Invesco S&P 500 Equal Weight ETF (RSP) was down 1.21%.

Among all economic indicators, some of the most closely watched are those surrounding the labor market. Last week featured a handful of employment updates. Those included October’s Job Openings and Labor Turnover (JOLTS) report, November’s ADP Private Employment Report, and the BLS’s November Employment Report. These reports offer unique insights into different aspects of the U.S. labor market. They contribute to a clearer understanding of broader economic picture.

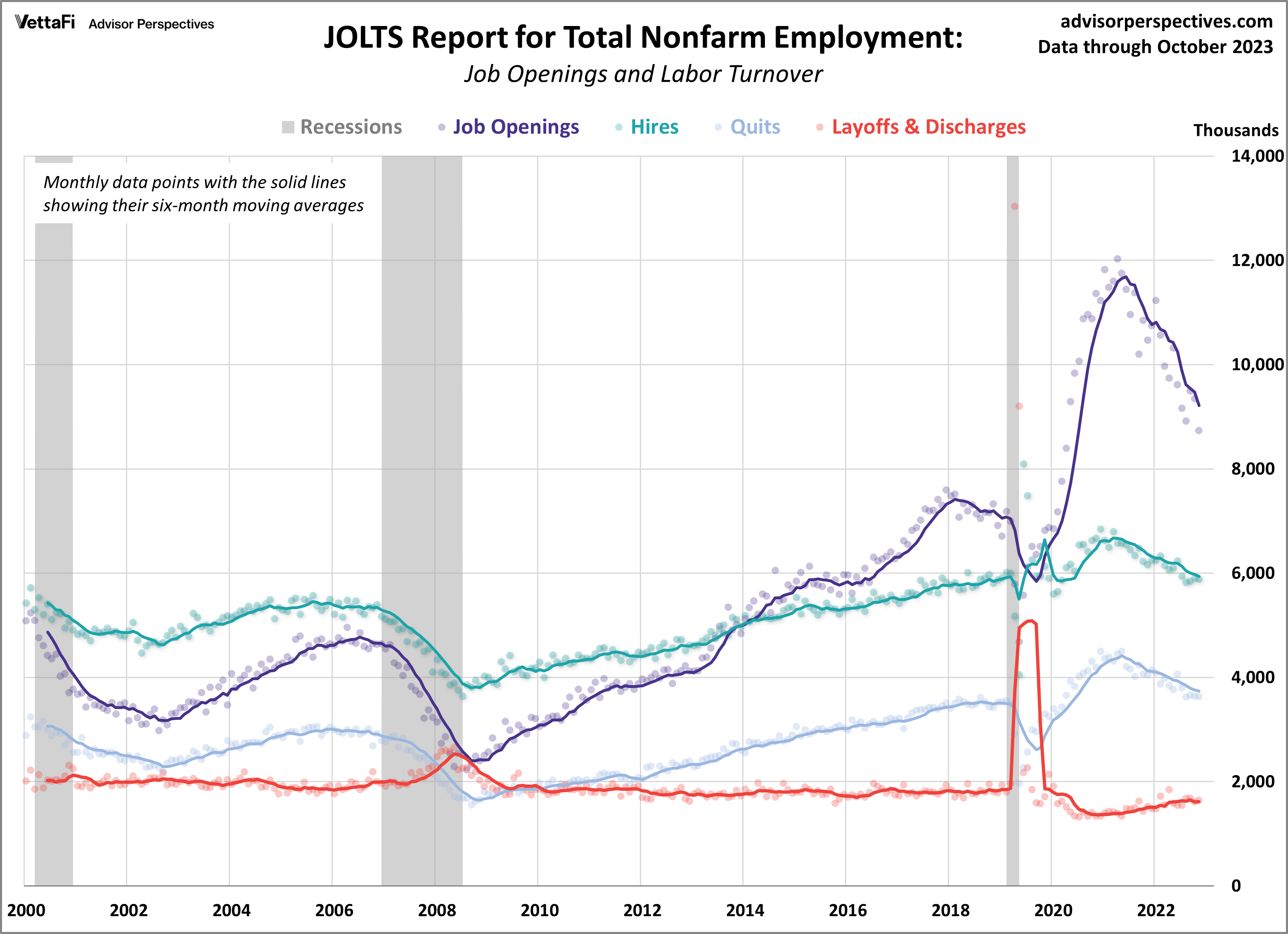

Job Openings and Labor Turnover (JOLTS)

The October JOLTS report showcased a cooling labor market. That is because job openings fell to their lowest level in two and a half years. In October, job openings dropped by 617,000 from September to 8.733 million. While a drop in vacancies was expected, the recent decline was much larger than anticipated. Economists predicted vacancies would fall to 9.300 million. Other key data points from the report showed the number of quits, hires, and layoffs were little changed from the previous month.

The JOLTS data serves as a barometer for assessing labor demand. Any disparity between workforce demand and supply could potentially exert upward pressure on inflation. Over the last six months, the gap between the two has consistently narrowed. That is because the overall trend in job openings has steadily declined from its 2022 peak. In November, the number of job openings per unemployed worker fell to 1.34. That is the lowest level since August 2021 and nearing pre-pandemic levels.

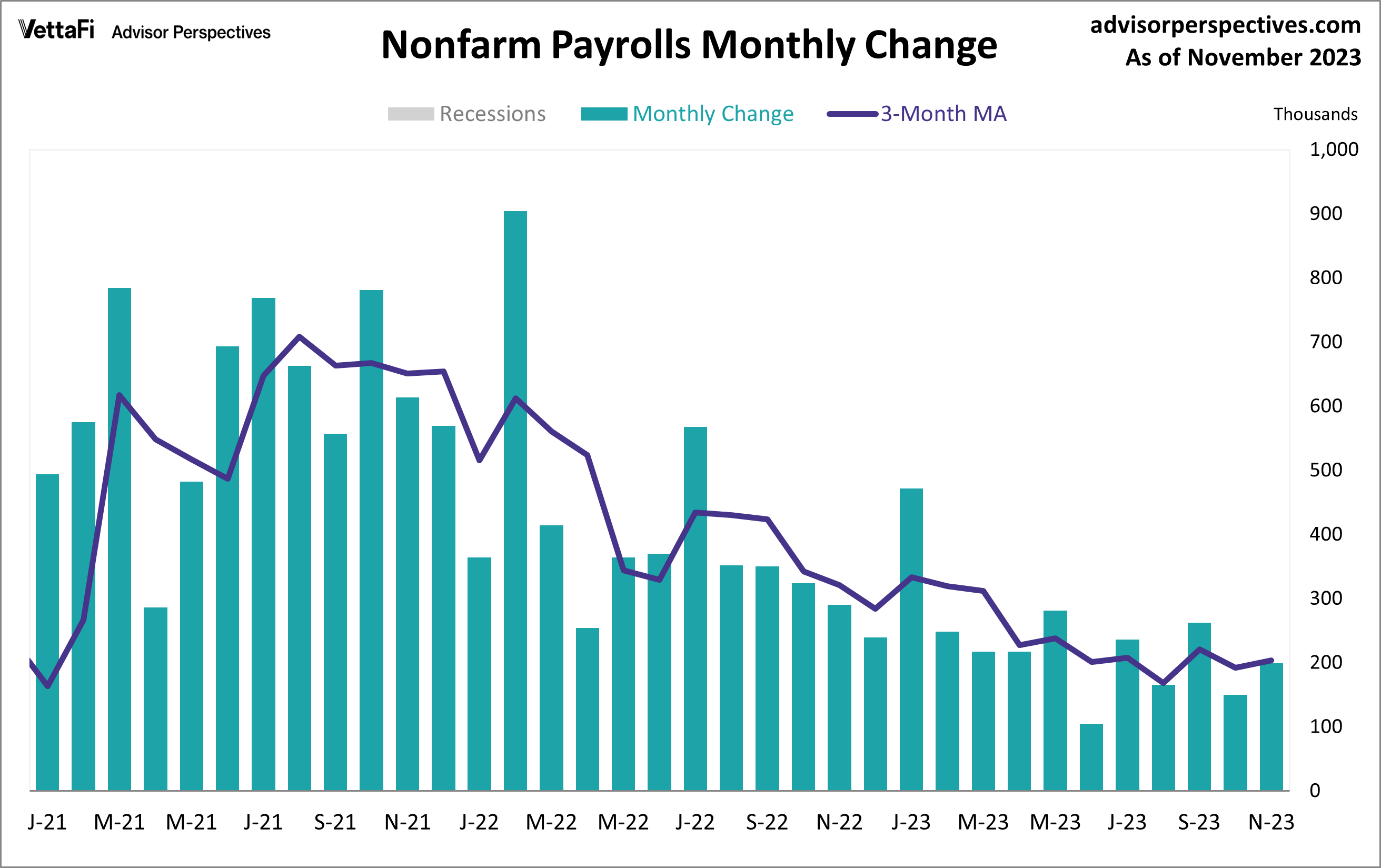

Employment Report

The U.S. labor market continued to normalize last month as job growth remained healthy and the unemployment rate ticked down. The November employment report revealed 199,000 jobs were added last month, coming in just above the expected 180,000 addition. November’s jobs numbers represented a slight pickup from last month’s unrevised 150,000 addition but still remain at a relatively low level compared to the last few years. Moreover, the report indicated that the unemployment rate fell to 3.7% while wage growth was flat at 4.0%. The labor force participation rate inched up to 62.8%. Overall, the jobs report showed solid job growth for a moderating labor market. The latest numbers should give the Fed further cause to keep rates where they are.

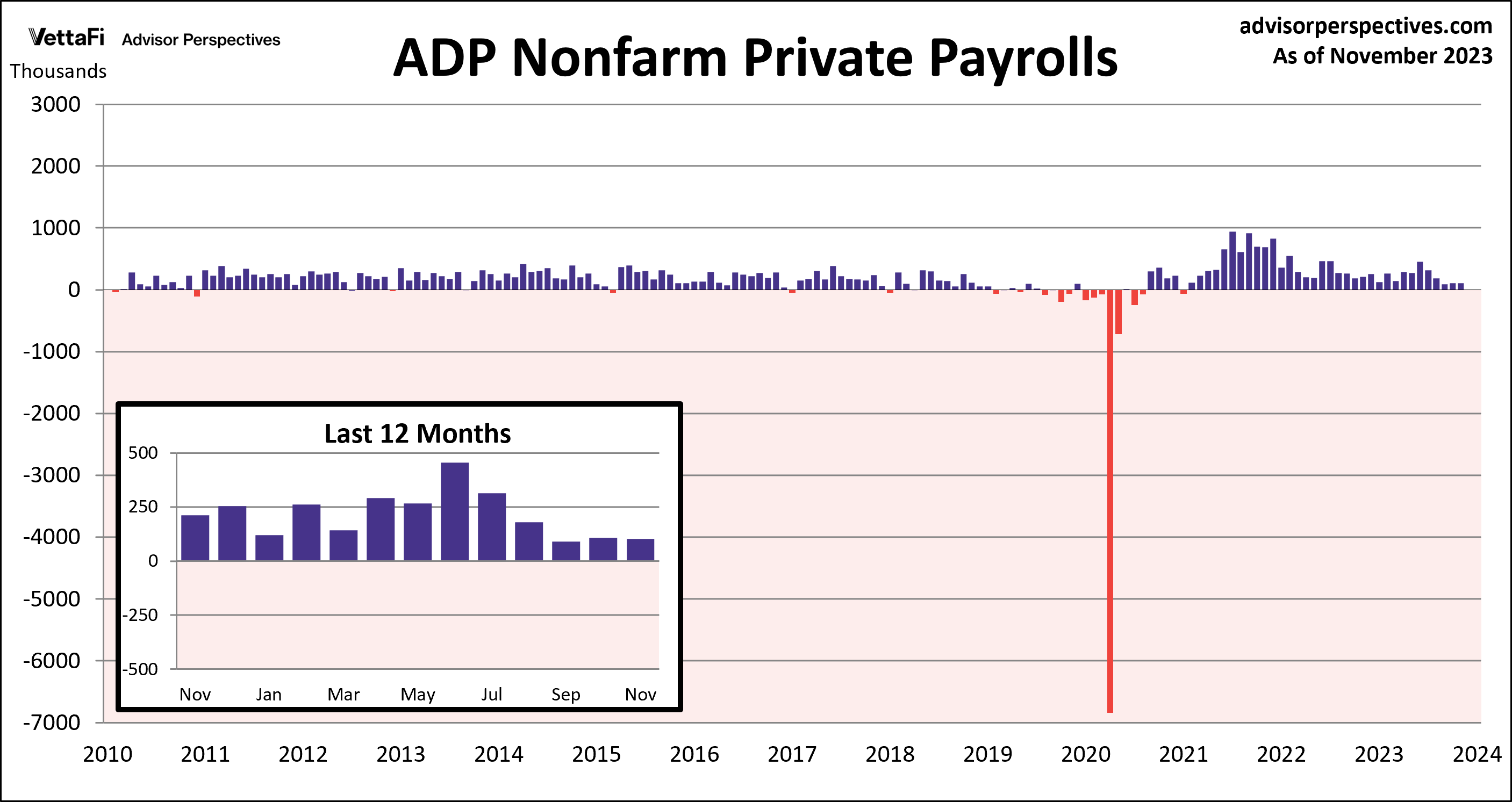

ADP Employment Report

Private sector hiring eased more than expected in November, yet another sign of a cooling labor market. The ADP employment report showed that 103,000 private jobs were added last month, less than the projected 130,000 addition. Private sector job growth has now slowed for four of the past five months, with the latest figure marking the second smallest monthly increase since January 2021. The pickup this month was most notable among companies with 50-249 employees, as they added 71,000 jobs, accounting for 69% of November’s job growth. Another significant detail from the report was the continued deceleration of annual pay growth, which fell to its slowest pace in over two years to 5.6%. The continued slowdown in job and pay growth serves as a positive signal for the Fed that inflationary pressures, such as wage gains, are continuing to ease.

Economic Indicators and the Week Ahead

The upcoming week will feature the latest inflation and consumer spending data. On Tuesday, the Bureau of Labor Statistics will release November’s Consumer Price Index (CPI) followed by the Producer Price Index (PPI) on Wednesday. Current forecasts show that headline CPI was flat and core CPI increased 0.3% from October, while headline and core PPI are projected to have risen 0.1% and 0.2% from October, respectively. Then on Thursday, the Census Bureau will release retail sales data for November. Retail sales, which will impact interests in the SPDR S&P Retail ETF (XRT), are expected to fall 0.1% from October, marking a second straight month of decreased consumer spending.

For more news, information, and strategy, visit the Innovative ETFs Channel.