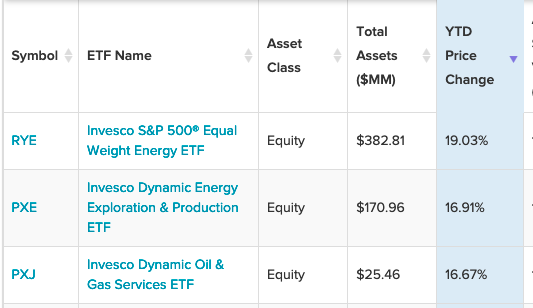

With the first month of 2022 in the books, it was energy-focused funds that led gains for Invesco ETFs during a dismal month for most equities.

At the top of the list with gains of 19% was the Invesco S&P 500 Equal Weight Energy ETF (RYE). An equal-weight strategy can help minimize concentration risk so investors are not too heavy with one stock.

The energy sector in particular can experience strong momentous moves, but right now, things are headed in the right direction. RYE seeks to track the investment results (before fees and expenses) of the S&P 500® Equal Weight Energy Index, which contains the common stocks of all companies included in the S&P 500® Index that are classified as members of the energy sector.

“Like many Rydex ETFs, RYE is equal-weighted, meaning that exposure is spread evenly across portfolio components,” an ETF Database analysis says. “This methodology may be particularly appealing in the top-heavy energy industry, where traditional cap-weighting can result in significant concentration issues.”

2 More Energy Options From Invesco

With a 17% gain, the Invesco Dynamic Energy Exploration & Production ETF (PXE) came in second. PXE seeks to track the investment results of the Dynamic Energy Exploration & Production Intellidex Index, which is composed of common stocks of U.S. companies involved in the exploration and production of natural resources used to produce energy, including fossil fuels.

With a gain of just under 17%, the Invesco Dynamic Oil & Gas Services ETF (PXJ) rounded out the top three. The fund seeks to track the investment results of the Dynamic Oil Services Intellidex Index, which is composed of common stocks of U.S. companies that assist in the production, processing, and distribution of oil and gas.

“PXJ is likely too targeted for those with a long-term focus, but can be useful as a tactical overlay or as part of a sector rotation strategy,” an ETF Database analysis points out. “PXJ is part of the suite of Intellidex product from PowerShares, meaning that this ETF is linked to an index designed to outperform traditional cap-weighted benchmarks. Those who believe this methodology has the potential to generate excess returns may find PXJ to be the ideal way to access this corner of the U.S. energy market.”

For more news, information, and strategy, visit the Innovative ETFs Channel.