Benchmark U.S. crude futures fell nearly 3% on Tuesday, with oil prices poised for their lowest close since August.

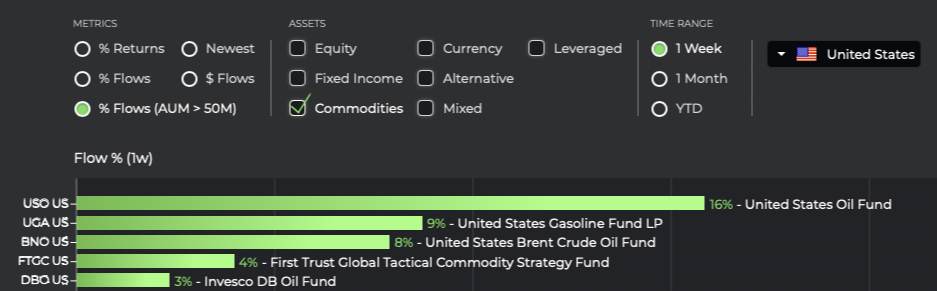

As crude futures reach lows, investors may be tempted to overweight oil ETFs while prices are low, to position for a rebound. In fact, over the past one-week period, oil and gasoline ETFs have seen the greatest percentage growth from inflows of all commodity ETFs per Logicly.

Source: Logicly

See more: “Invesco’s Oil and Energy ETFs Are This Week’s Top Performers”

Rather than buying oil ETFs, a better solution may be to maintain an allocation to a broad-basket commodity ETF. Diversified commodity ETFs can reduce volatility and help diffuse risk.

The Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC) is actively managed, enabling the fund to adjust exposure when market conditions warrant more exposure to a specific commodity.

With $5.9 billion in assets under management, PDBC is the largest commodity ETF available to investors, according to ETF Database. PDBC accreted an impressive $1.8 billion in net flows last year as commodities outperformed fixed income and equity markets.

The fund offers exposure to 14 of the world’s most heavily traded commodities. As of October 31, the fund has the most exposure by weight to gasoline (12.96%), WTI crude oil (12.61%), and NY Harbor ULSD (11.55%).

PDBC also offers meaningful exposure to gold (9.70%) as well as agricultural commodities, including sugar (9.54%), soybeans (5.69%), and corn (4.04%).

Additionally, the fund provides access to copper (4.62%), aluminum (4.10%), wheat (4.04%), zinc (3.86%), natural gas (2.86%), and silver (2.23%).

Many investors avoid commodity ETFs due to misconceptions that all commodity ETFs require investors to file K-1 tax forms. Importantly, PDBC does not issue a K-1 form.

The ETF charges 59 basis points.

For more news, information, and analysis, visit the Innovative ETFs Channel.