Economic indicators provide insight into the overall health and performance of an economy. They serve as essential tools for policymakers, advisors, investors, and businesses alike because they allow them to assess the current state of the economy, make informed forecasts, and consequently, make sound decisions. As a result, this data holds the power to influence business strategies and financial markets significantly. In the week ending on October 12th, the SPDR S&P 500 ETF Trust (SPY) rose 2.16% while the Invesco S&P 500® Equal Weight ETF (RSP) was up 1.30%.

In this article, we highlight a handful of recent indicators that shed light on both inflationary trends and sentiment within the market. The Consumer Price Index (CPI) and Producer Price Index (PPI) reflect the pricing dynamics in the economy, while the NFIB Small Business Optimism Index and Michigan Consumer Sentiment gauge sentiment and outlook, providing a comprehensive picture of the economic landscape from different angles. These indicators collectively enable us to understand the intricate relationship between economic conditions, market sentiment, and inflationary pressures.

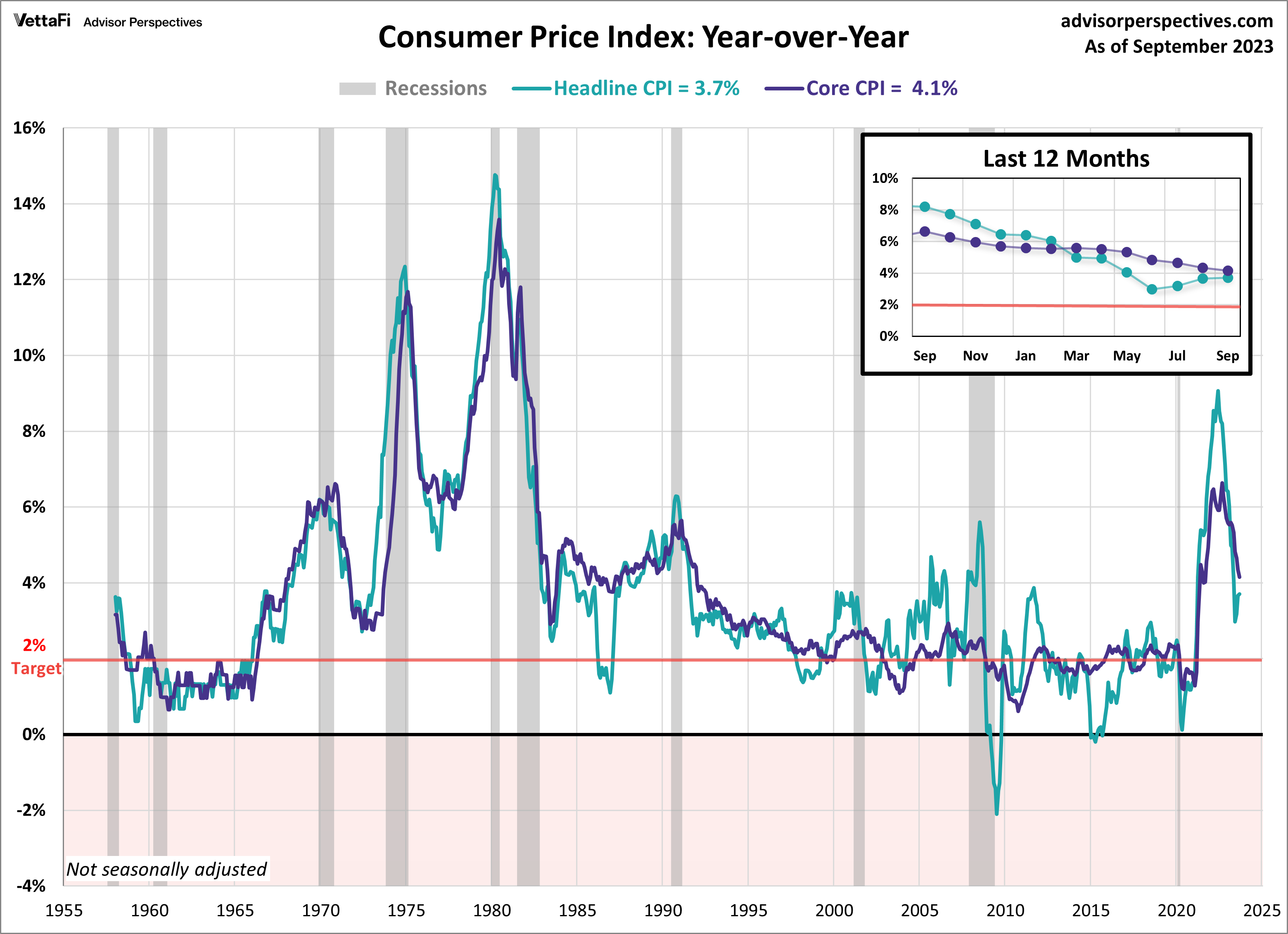

Consumer Price Index (CPI)

The battle against inflation continues as consumer prices saw a slightly stronger-than-anticipated increase last month. In September, the Consumer Price Index (CPI) rose 0.4% from the previous month and 3.7% from one year ago, unchanged from August. The latest data was just above the expected 0.3% monthly increase and 3.6% annual increase. The primary driver of this month’s uptick can be attributed to shelter costs, which accounted for more than half of this month’s overall increase.

Despite the recent heating up of headline CPI, Core CPI, which excludes food and energy prices, exhibited a slowdown in September, dropping from 4.3% to 4.1% on an annual basis. This marks the sixth consecutive month of deceleration and the lowest level since September 2021. On a monthly basis, core prices increased by 0.3% compared to August. Both readings were consistent with their respective forecasts.

All eyes remain fixed on the Federal Reserve and what they’ll do next. At the time of writing, the CME Fed Watch tool indicates an 88% probability that the Fed will maintain rates at their current level during their next meeting on November 1st. With that being said, it’s still too early to completely rule out another rate hike this year.

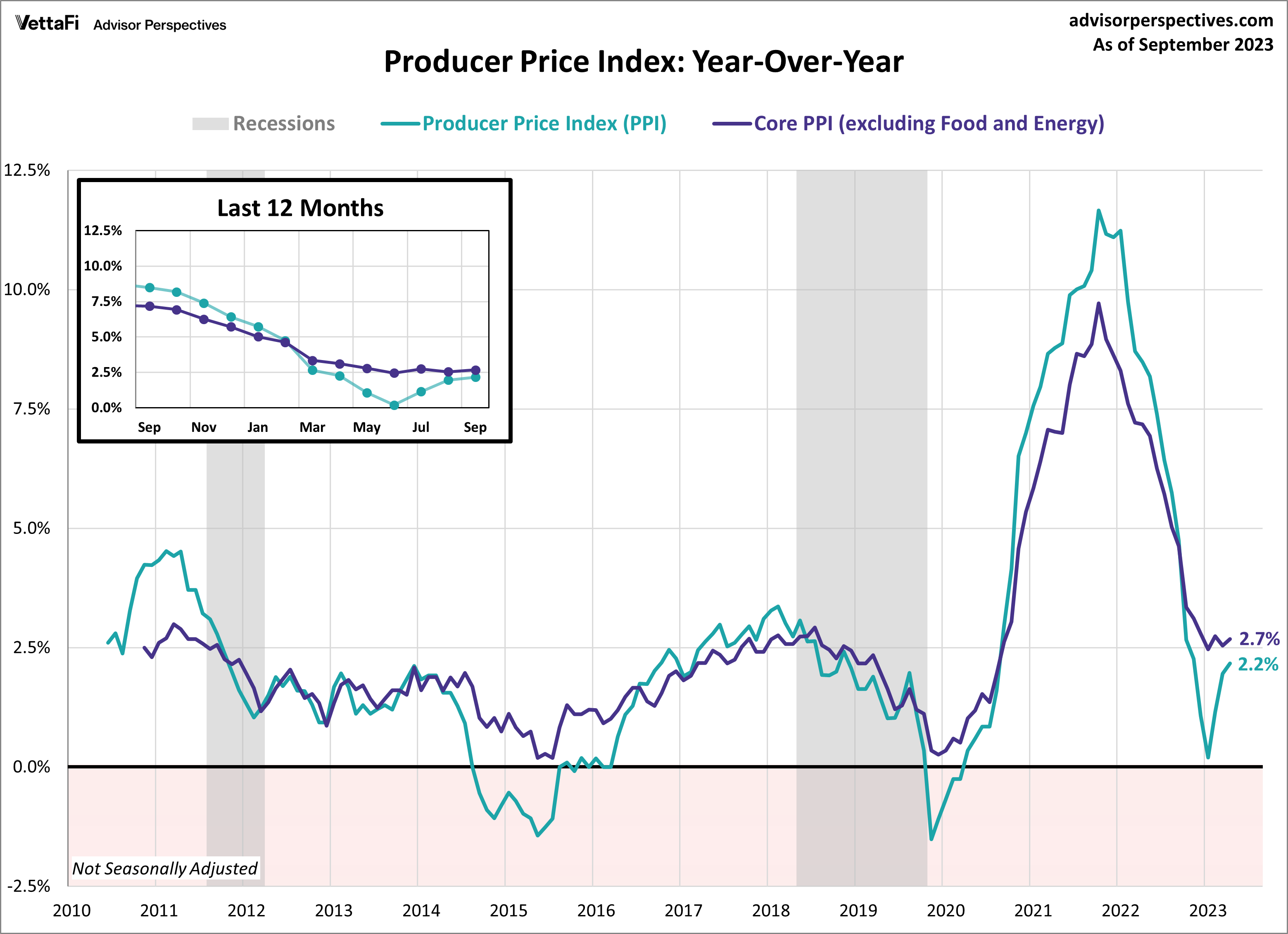

Producer Price Index (PPI)

Wholesale prices continued to accelerate for the third consecutive month, primarily driven by increased gas and energy costs. In September, Producer Price Index (PPI) rose by 2.2% compared to the previous year, surpassing last month’s 2.0% increase and exceeding the anticipated 1.6% rise. On a monthly basis, the headline PPI exhibited a 0.5% increase in wholesale prices, which outpaced expectations of a 0.3% monthly rise. Additionally, the Core Producer Price Index (PPI), which excludes food and energy, also showed a higher-than-expected 2.7% annual increase, up from last month’s 2.5% rise and surpassing the projected 2.3% increase. On a monthly basis, core PPI increased by 0.3%, exceeding the expected 0.2% rise.

The producer price index is a widely regarded leading indicator of consumer inflation, as price shifts at the producer level often trickle down to consumers. While both the PPI and the Consumer Price Index (CPI) have retreated from their peak levels in early 2022, recent months have seen a resurgence in the headline figures, which suggests that inflation may not have reached its end, potentially signaling the persistence of higher interest rates.

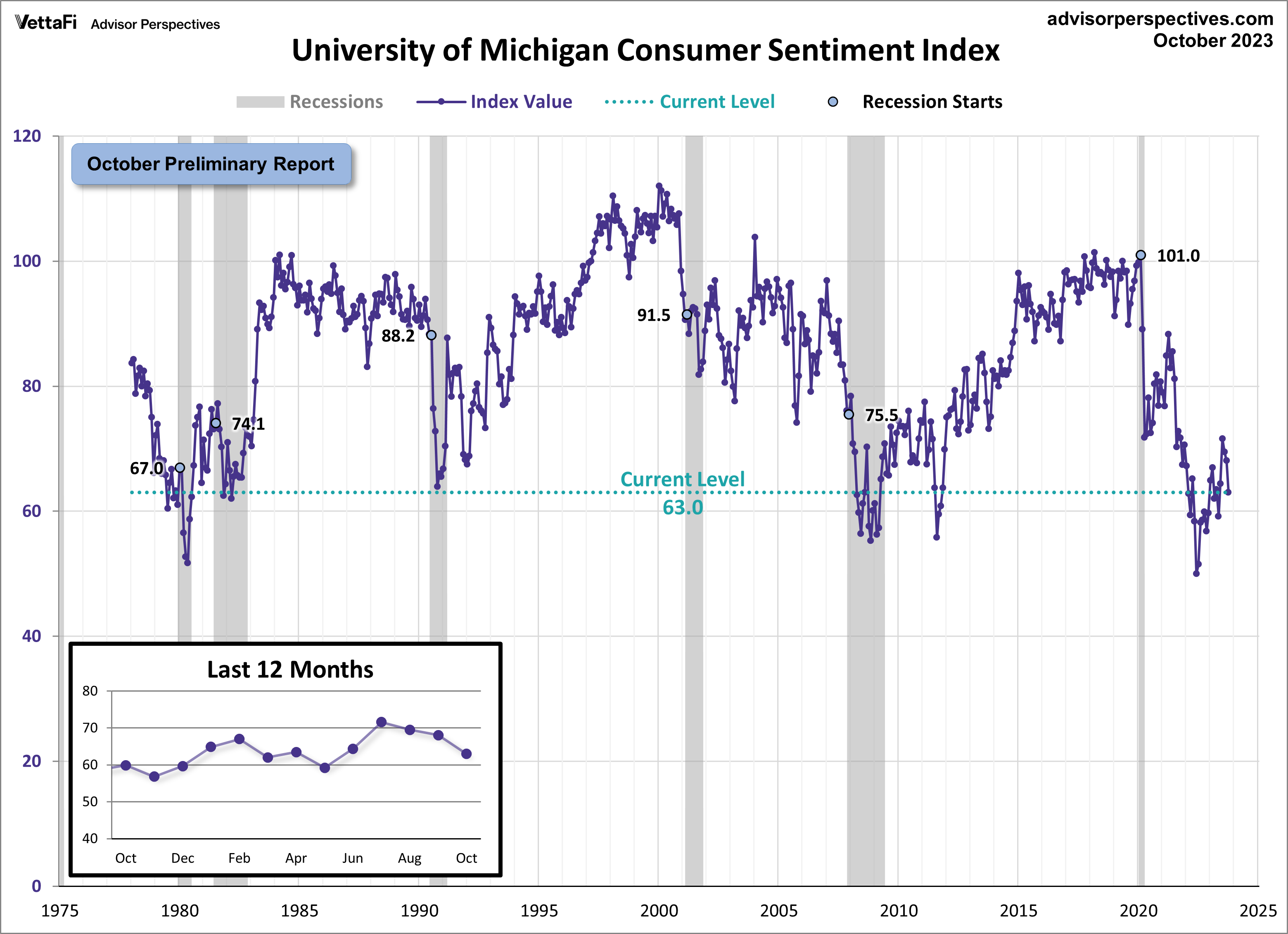

Michigan Consumer Sentiment

Consumer sentiment regarding the economy continued to deteriorate, as the Michigan Consumer Sentiment Index recorded its third consecutive monthly decline. According to the October preliminary report, the index fell sharply to 63.0, reflecting a 7.5% decline from September’s final reading and well below the forecasted value of 67.2. While consumer attitudes have shown some improvement since the historical lows of last year, this latest reading marks the lowest reading since May and pushes the index to the 6th percentile of its historical series.

The Michigan Consumer Sentiment Index is a monthly survey measuring consumers’ opinions with regards to the economy, personal finances, business conditions, and buying conditions. In the latest report, consumers expressed increased concerns over inflation as they grapple with the ongoing burden of high prices. Additionally, short-term business expectations detioriated considerably in the latest report while long term expectations reamined relatively stable, indicating that consumers don’t anticipate current economic conditions to persist. Given that consumer spending drives approximately 70% of the economy, consumer attitudes are closely monitored, as their confidence levels directly influence their spending behavior and, consequently, economic growth.

The Consumer Discretionary Select Sector SPDR ETF (XLY) is tied to consumer sentiment.

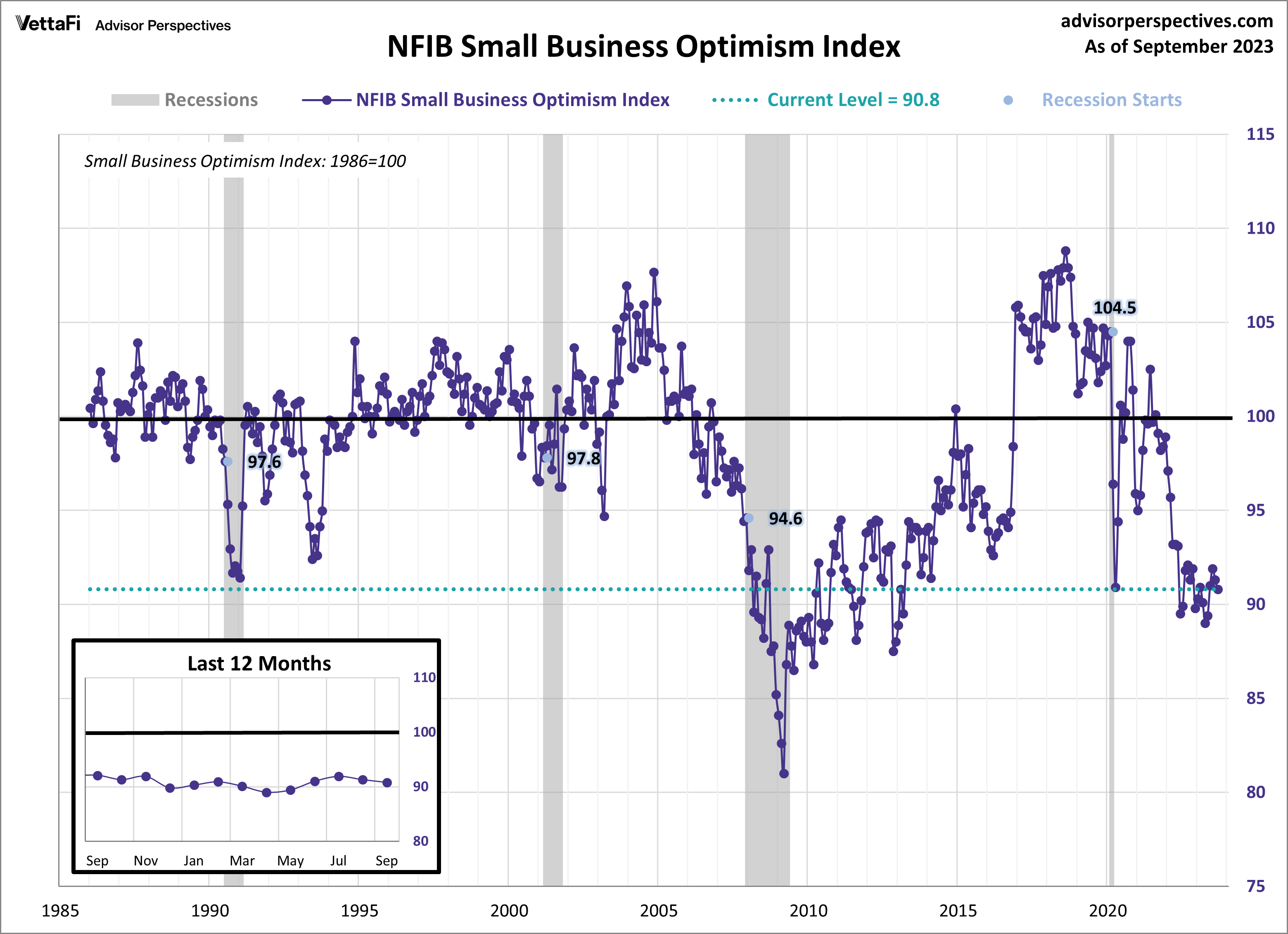

NFIB Small Business Optimism Index

In September, optimism among small business owners continued to dwindle, with the NFIB Small Business Optimism Index falling by 0.5 points to 90.8. This marks the second consecutive monthly decline and places the index in the 9th percentile within its historical series. Notably, the index has remained below its series average of 98.1 for 21 consecutive months, signaling a prolonged period of subdued optimism among small businesses.

The NFIB index serves as a composite gauge that aims to provide insight into the overall health of small businesses in the country. n the most recent report, concerns regarding inflation and labor quality remained at the forefront for small business owners. Many reported difficulties in filling job openings, primarily due to the shortage of qualified applicants. Furthermore, the survey revealed that small businesses are investing in their enterprises at historically low rates due to the burden of high borrowing costs.

Given that small businesses account for approximately 50% of the U.S. workforce, the well-being of the small business sector can significantly impact the wellbeing of the overall economy. Additionally, small businesses tend to respond more quickly to economic shifts, offering early indicators of the broader economy’s future trajectory. While the NFIB Small Business Optimism Index has been signaling a recession for over a year, the long-awaited recession has not yet materialized.

Economic Indicators and the Week Ahead

The upcoming week will unveil key economic data, featuring the latest figures on retail sales, industrial production, and the Conference Board’s Leading Economic Index. These individual metrics offer valuable insights into distinct aspects of economic activity: retail sales reflect consumer spending, industrial production measures manufacturing strength, and the Leading Economic Index provides guidance on future economic trends. Taken together, they create a more holistic view of the economy’s overall health. With the Federal Reserve’s next meeting just over two weeks away, analysts and policymakers are closely monitoring each new set of data to discern broader economic trends and potential policy implications.

Retail sales, which will impact interests in the SPDR S&P Retail ETF (XRT), are expected to increase for a 6th consecutive month, rising 0.2% from August. Meanwhile, industrial production, which could impact interests in Industrial Select Sector SPDR Fund (XLI), is projected to increase for 3rd consecutive month, rising 0.1% from August. Lastly, the Conference Board’s Leading Economic Index is forecasted to fall even further, dropping 0.3% from August which would mark the 18th consecutive monthly decline.

For more news, information, and analysis, visit the Innovative ETFs Channel.