Economic indicators are released every week to provide insight into the overall health and performance of an economy. They are essential tools for policymakers, advisors, investors, and businesses. That is because they allow them to make informed decisions regarding business strategies and financial markets. In the week ending February 15, the SPDR S&P 500 ETF Trust (SPY) rose 0.74% while the Invesco S&P 500 Equal Weight ETF (RSP) was up 1.27%.

Inflation has been an ongoing topic of conversation for the past few years. That is because of its central role in the Fed’s interest rate policy. This article highlights three important indicators from the past week – consumer price index, retail sales, and consumer sentiment. An examination of these data points provides valuable information about the latest trends in inflation, consumers’ response to it, and its potential implications.

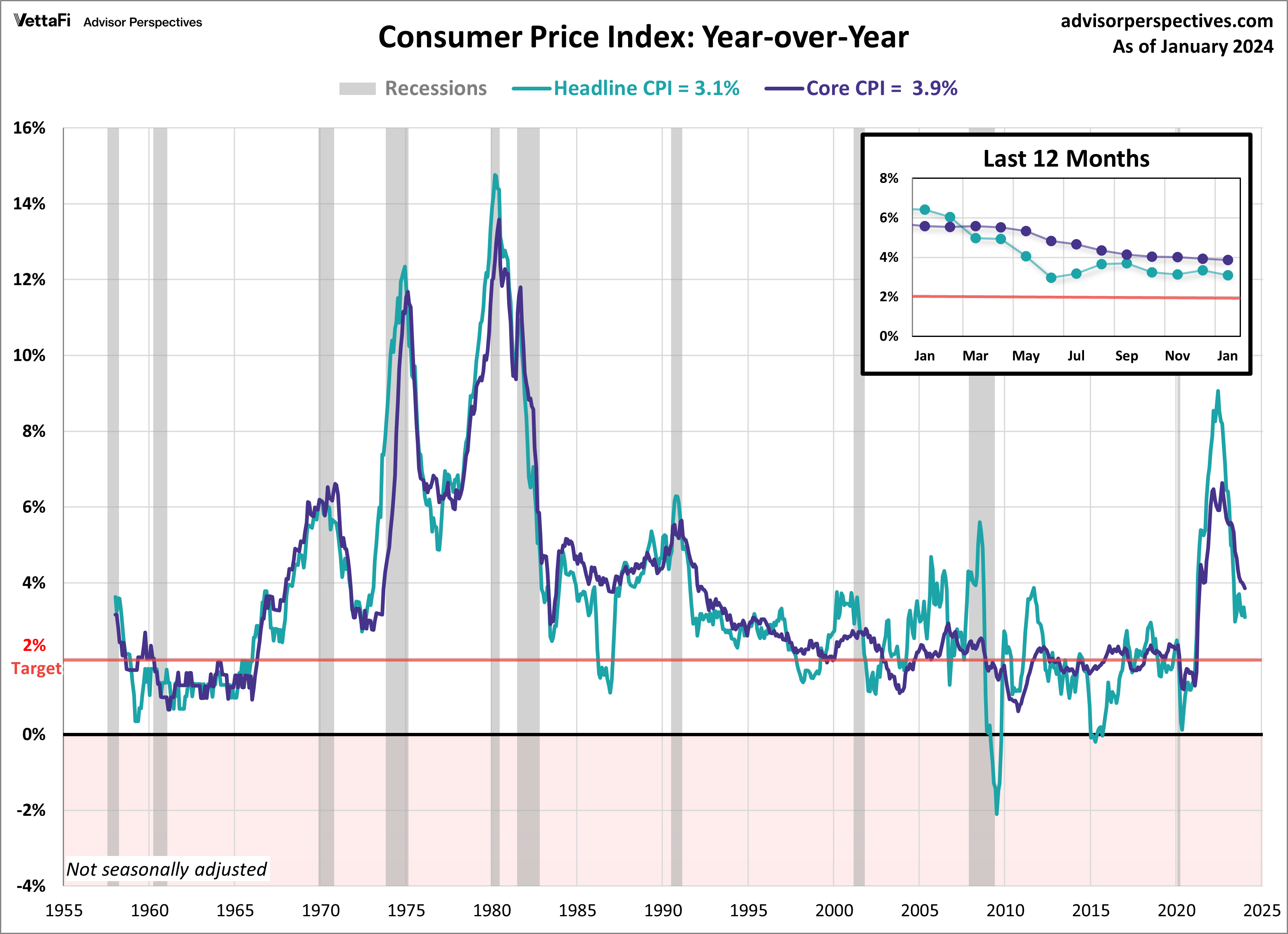

Consumer Price Index

Consumer prices rose more than expected as the inflation battle has rolled over into 2024. The Consumer Price Index (CPI) rose 3.1% in January. That’s down from 3.4% in December but more than the expected 2.9% growth. Compared to the previous month, consumer prices rose 0.3%.That’s higher than the expected 0.2% increase. The primary driver for the monthly increase was the continued rise in shelter costs. That contributed more than two-thirds of the headline increase.

Core inflation, which excludes food and energy prices, was practically flat in January, remaining at its lowest level since May 2021. Core CPI fell was unchanged at 3.9% on an annual basis, higher than the expected 3.7% growth. Additionally, core prices increased 0.4% from the previous month. That was more than the anticipated 0.3% growth.

The question remains as to when the Fed will begin to cut rates. The latest CPI report gives cause for the Fed to hold rates steady over their next few meetings. The Fed will receive another inflation report and several other key economic reports before their next meeting. However, with inflation still above the Fed’s 2% target rate, it’s very likely that they will continue to delay their first rate cut. At the time of writing, the CME Fed Watch Tool indicates a 90% likelihood for rate stability at the March meeting, with a 63% probability for the May meeting. The CME Fed Watch Tool is currently showing a 53% probability that the first rate cut will take place in June.

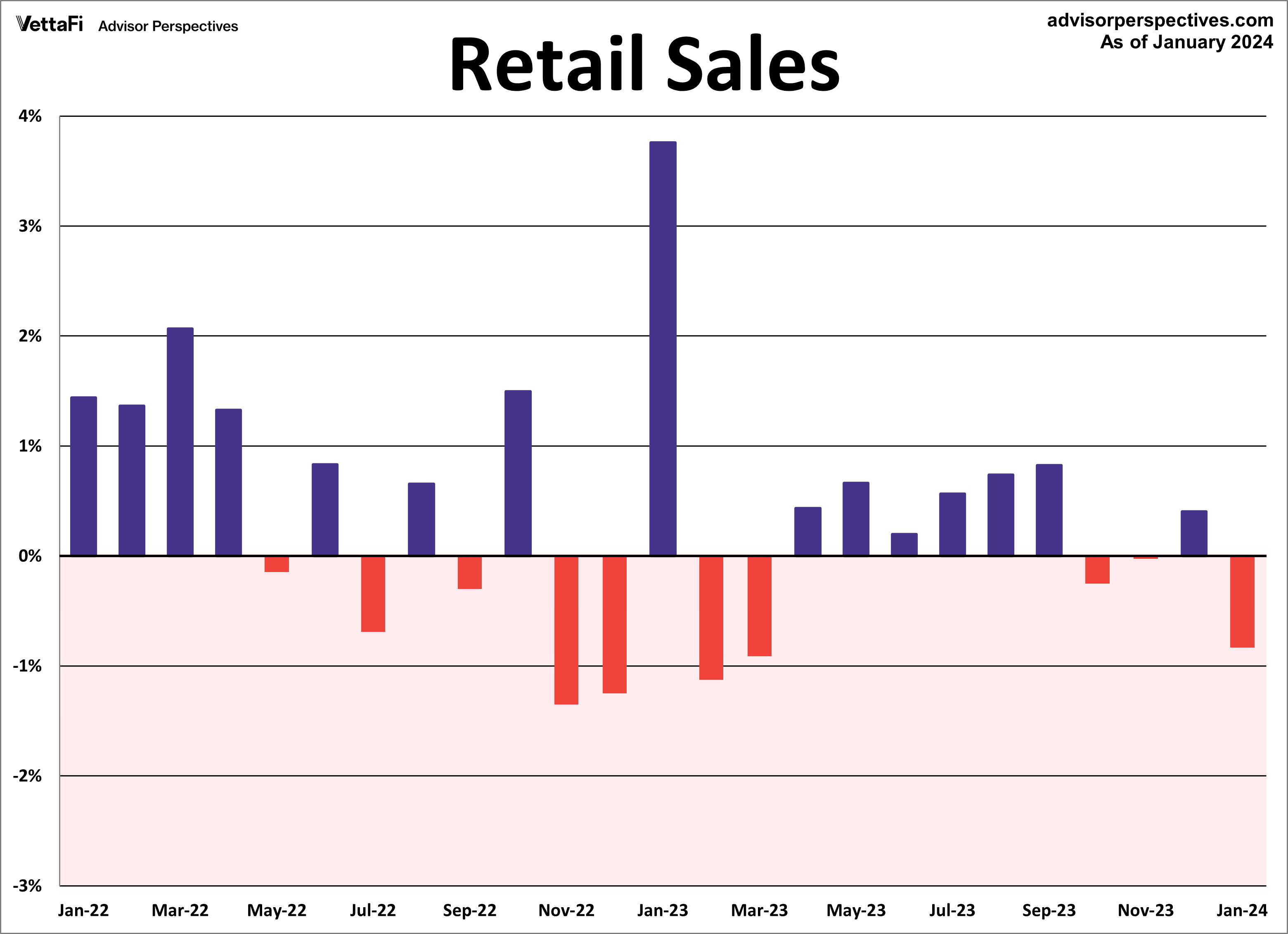

Retail Sales

American consumers reduced their spending last month by the largest amount since March after a strong holiday shopping season. Retail sales fell 0.8% in January, much more than the anticipated 0.2% decline. Core retail sales (excluding automobiles) were down 0.6% from December. That unexpectedly fell short of the forecasted 0.2% growth. Lastly, control purchases, which is thought to be an even more “core” view of retail sales, were down 0.4% from last month.

While this series typically does not garner as much attention as the headline and core figures, control purchases are a more consistent and reliable reading of the economy. That’s because it strips out many volatile components. Several reports have attributed the cold weather conditions from January to the latest decline. While that may be part of it, consumers are still facing higher interest rates and higher-than-expected inflation. In general, the most recent figures indicate a sharp deceleration in consumer spending. That points to the Fed possibly cutting rates, if the trend continues, sooner rather than later.

Retail sales will have an impact on the interest in the SPDR S&P Retail ETF (XRT), VanEck Retail ETF (RTH), Amplify Online Retail ETF (IBUY), and ProShares Online Retail ETF (ONLN).

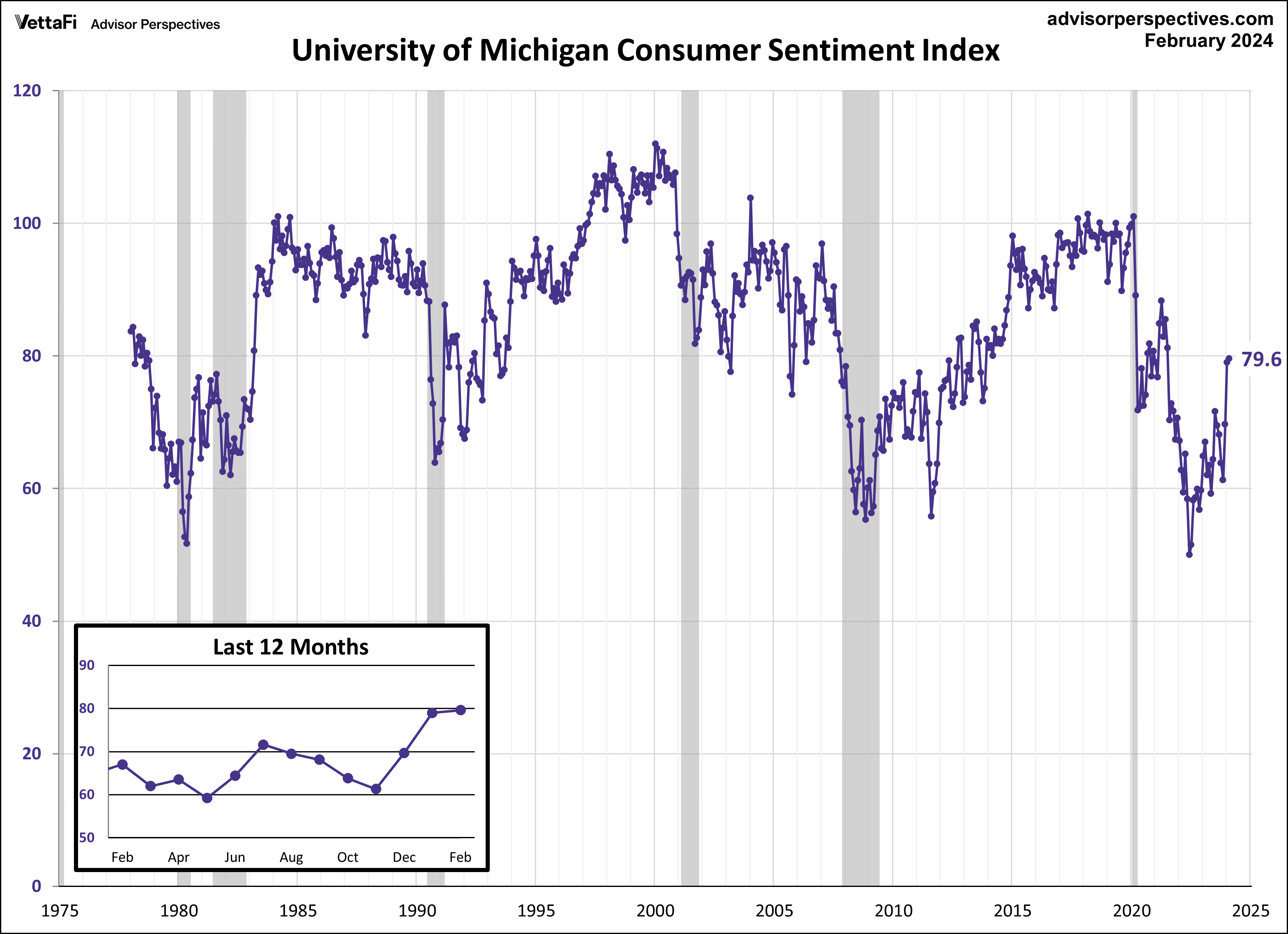

Michigan Consumer Sentiment

Consumers remain optimistic about their current and future economic conditions. That’s according to the preliminary report for the Michigan Consumer Sentiment Index. The February preliminary report came in at 79.6. That marked a 0.8% increase from January’s final reading and fell short of the forecasted value of 80.0. This is the third consecutive increase for the index and keeps the index at its highest level since April 2021.

The Michigan Consumer Sentiment Index is a monthly survey measuring consumers’ opinions with regard to the economy, personal finances, business conditions, and buying conditions. In the latest report, consumers expressed increased confidence levels that inflation would continue to slow and labor markets would continue to show strength. Consumer attitudes are closely monitored as their confidence levels tend to impact their spending behavior. Consumer spending accounts for approximately 70% of the economy. So consumer spending has a major impact on economic growth.

The Consumer Discretionary Select Sector SPDR ETF (XLY) is tied to consumer sentiment.

Economic Indicators and the Week Ahead

This week may be shortened, but there are still a few key economic reports on the calendar. On Tuesday, the Conference Board will release its January data on its Leading Economic Index (LEI), which is meant to gauge future economic trends. The LEI is forecasted to fall yet again, dropping 0.2% from December, marking the 22nd consecutive monthly decline. Then on Thursday, the National Association of Realtors will release existing home sales data for January.

Existing home sales are expected to have risen to a seasonally adjusted annual rate of 3.96 million, marking just the third monthly increase in the past 24 months. Also on Thursday, the Federal Reserve Bank of Chicago will release the January reading for their National Activity Index, which aims to gauge overall economic activity in the country.

See related video.

VettaFi LLC (“VettaFi”) is the index provider for IBUY for which it receives an index licensing fee. However, IBUY is not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of IBUY.

For more news, information, and strategy, visit the Innovative ETFs Channel.