Biotechnology sector-related exchange traded funds strengthened after Illumina (NasdaqGS: ILMN) announced better-than-expected quarterly earnings and an optimistic 2021 outlook.

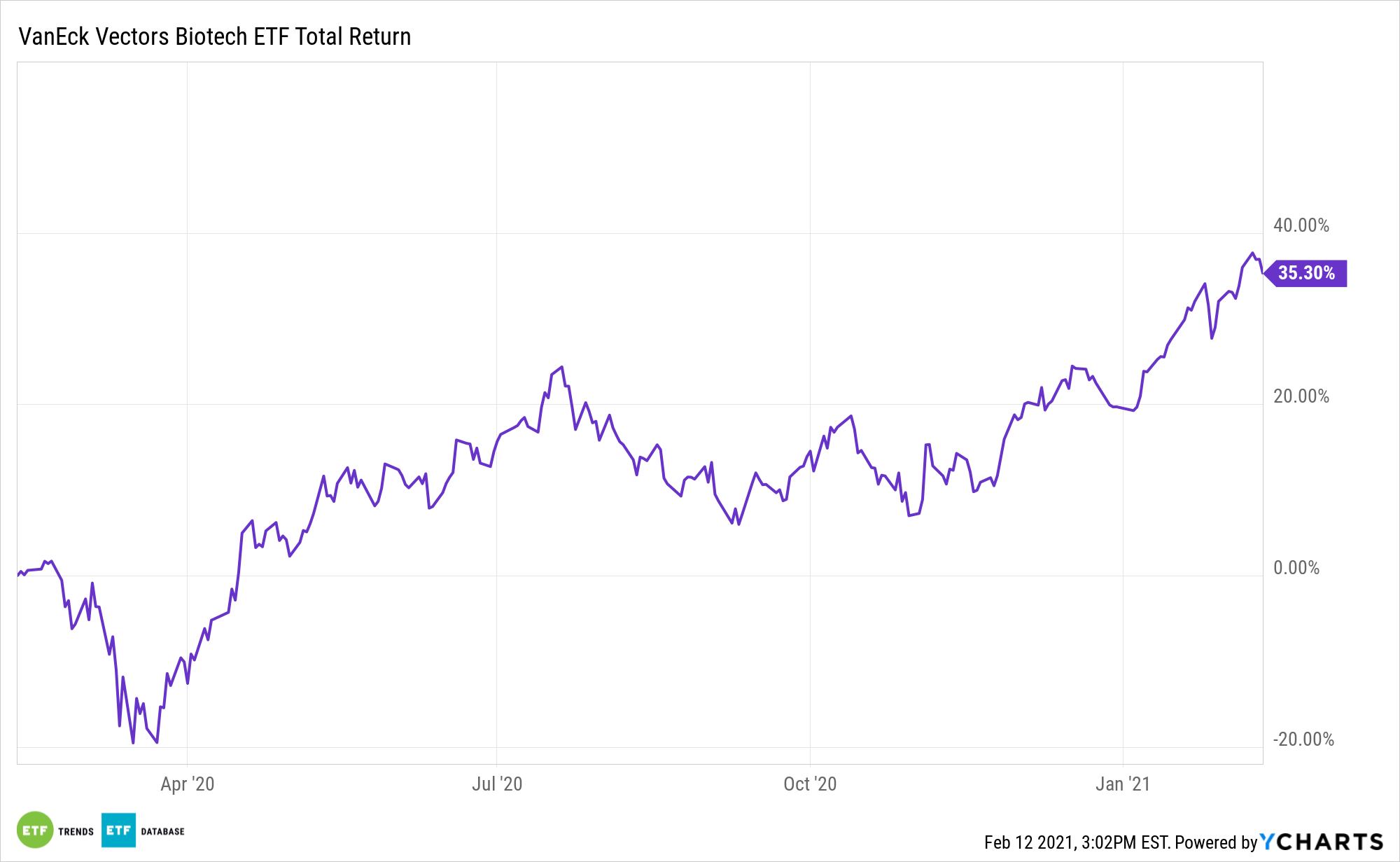

On Friday, the VanEck Vectors Biotech ETF (BBH) rose 2.0% and iShares Nasdaq Biotechnology ETF (IBB) gained 0.5%.

Meanwhile, Illumina shares jumped 13.4%. ILMN makes up 5.9% of BBH and 4.7% of IBB.

Illumina revealed a record fourth quarter revenue of $953 million, an increase of 20% compared to the third quarter of 2020 and $0.5 million higher than the prior year period, the Wall Street Journal reports.

“Illumina delivered a strong finish to 2020 with record fourth quarter revenue exceeding our expectations,” Francis deSouza, Chief Executive Officer, said. “We also had record orders in the quarter, including record sequencing instrument orders and the second highest quarter for NovaSeq instrument orders. Our business delivered strong sequential growth in the second half of 2020 and we expect continued recovery from the pandemic in 2021.”

Further bolstering the company’s shares, the genomic sequencer projected year-over-year revenue growth in the range of 17% to 20%.

The company will also benefit from the U.S. government’s push toward better coronavirus surveillance. The proposed U.S. budget package for Covid-19 includes $1.75 billion for genomic sequencing, Investor’s Business Daily reports. The sequencing will help track mutations and the effectiveness of vaccines.

“As this global infrastructure settles in, Illumina expects the instrumentation to be used to identify future outbreaks, to better understand antimicrobial resistance and to combat bioterrorism,” Canaccord Genuity analyst Max Masucci said in a note to clients.

The surveillance opportunity for Covid-19 is potentially bigger than for the seasonal flu, according to Masucci. Illumina’s coronavirus offerings contributed to its second quarter and ‘incrementally so’ in the third and fourth quarters.

Looking ahead, the company expects to close its acquisition of the biotech GRAIL in the second half of 2021. Furthermore, its partnerships with several drug makers, such as Bristol Myers Squibb and Merck, should begin to pay dividends.

For more news, information, and strategy, visit the Innovative ETFs Channel.