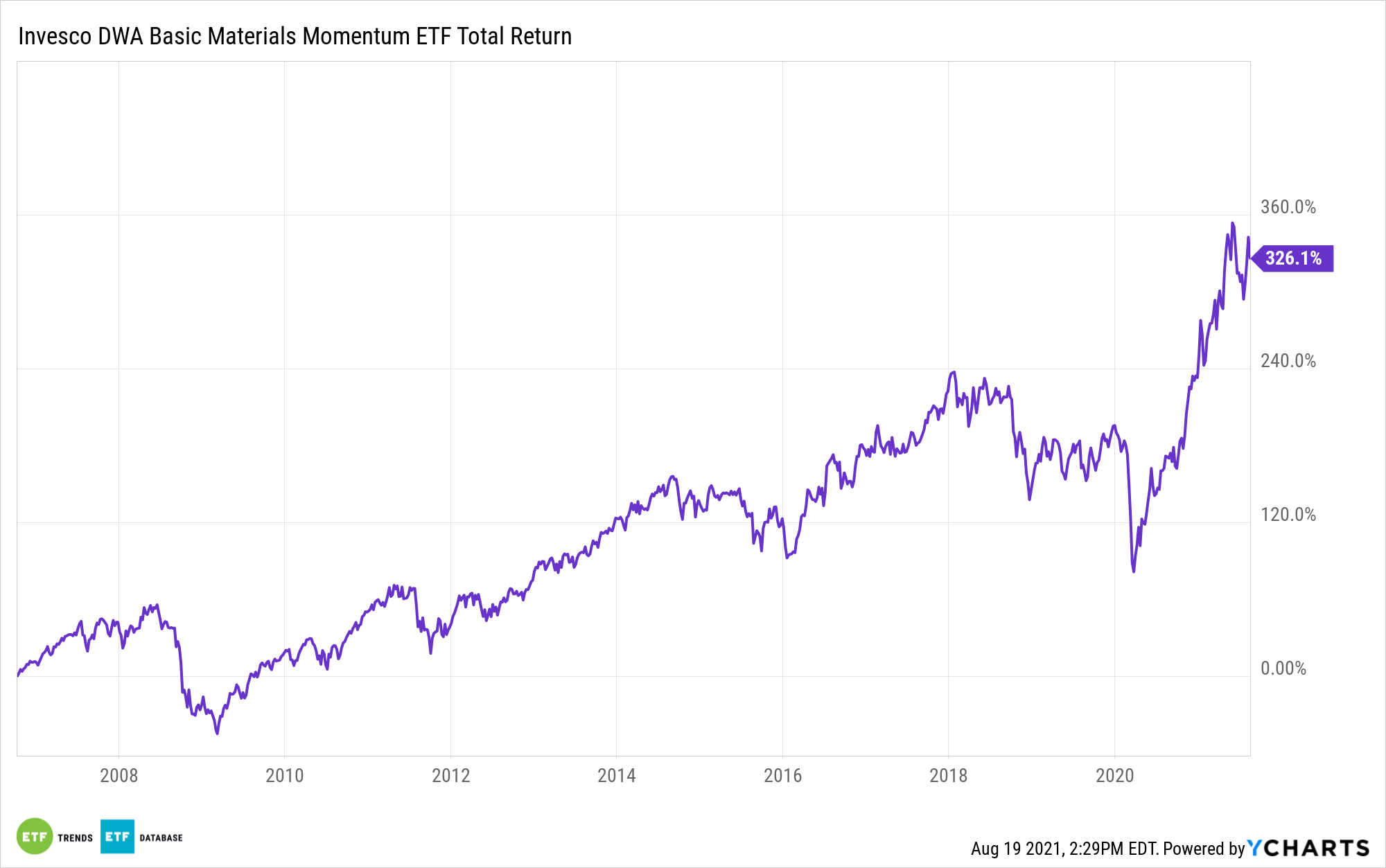

Basic materials might be a no frills play in the ETF world, but add momentum to the mix, and one gets a dynamic fund in the Invesco DWA Basic Materials Momentum ETF (PYZ).

The basic materials sector could also provide a counterbalance to inflation. As everyday consumer prices inflate, PYZ could hedge other investments that may be hurt by inflation, such as bonds.

“This ETF offers exposure to the U.S. materials sector, a corner of the domestic economy that includes companies engaged in the extraction and production of various natural resources (and therefore potentially useful as a means of establishing ‘indirect’ commodity exposure through commodity-intensive companies),” an ETF Database analysis noted.

PYZ follows the Dorsey Wright® Basic Materials Technical Leaders Index, which is comprised of 30 materials stocks from the NASDAQ US Benchmark Index. The benchmark is rooted in the famed Dorsey Wright relative strength methodology. PYZ currently holds 32 stocks.

“Given the sector-specific focus, PYZ likely doesn’t deserve a core allocation, but may be useful as a means of implementing a tactical tilt towards the materials sector,” the analysis added. “PYZ is unique within this category due to the nature of the underlying index; this fund is part of the PowerShares Intellidex suite, seeking to replicate an index that employs quant-based screening techniques to identify companies deemed to maintain the greatest potential for capital appreciation.”

A Greener America Could Benefit Basic Materials

With a focus on momentum, PYZ certainly has it with the current U.S. presidential administration. With an emphasis on cleaning up the environment, the current administration is lending a big boost to the materials sector.

“The basic materials sector is one that is typically considered to be less exciting or gripping than others, like say the technology sector,” an article on the financial website Insider Monkey said. “However, it is a sector that can be considered among the winners of the market in 2021.”

“There are a couple of reasons for this, most notably the fact that President Biden’s administration and its focus on a greener and more environmentally friendly America would lead to a greater focus on the production of green technology, and electric vehicles (EVs) in particular,” the article added. “How this may affect the basic materials sector is the next, and most natural question, and is easily answered when one considers that metals produced and refined by this sector, such as copper, lithium, and others, are among the few most vital elements required in the production of EVs and green electricity.”

For more news and information, visit the Innovative ETFs Channel.