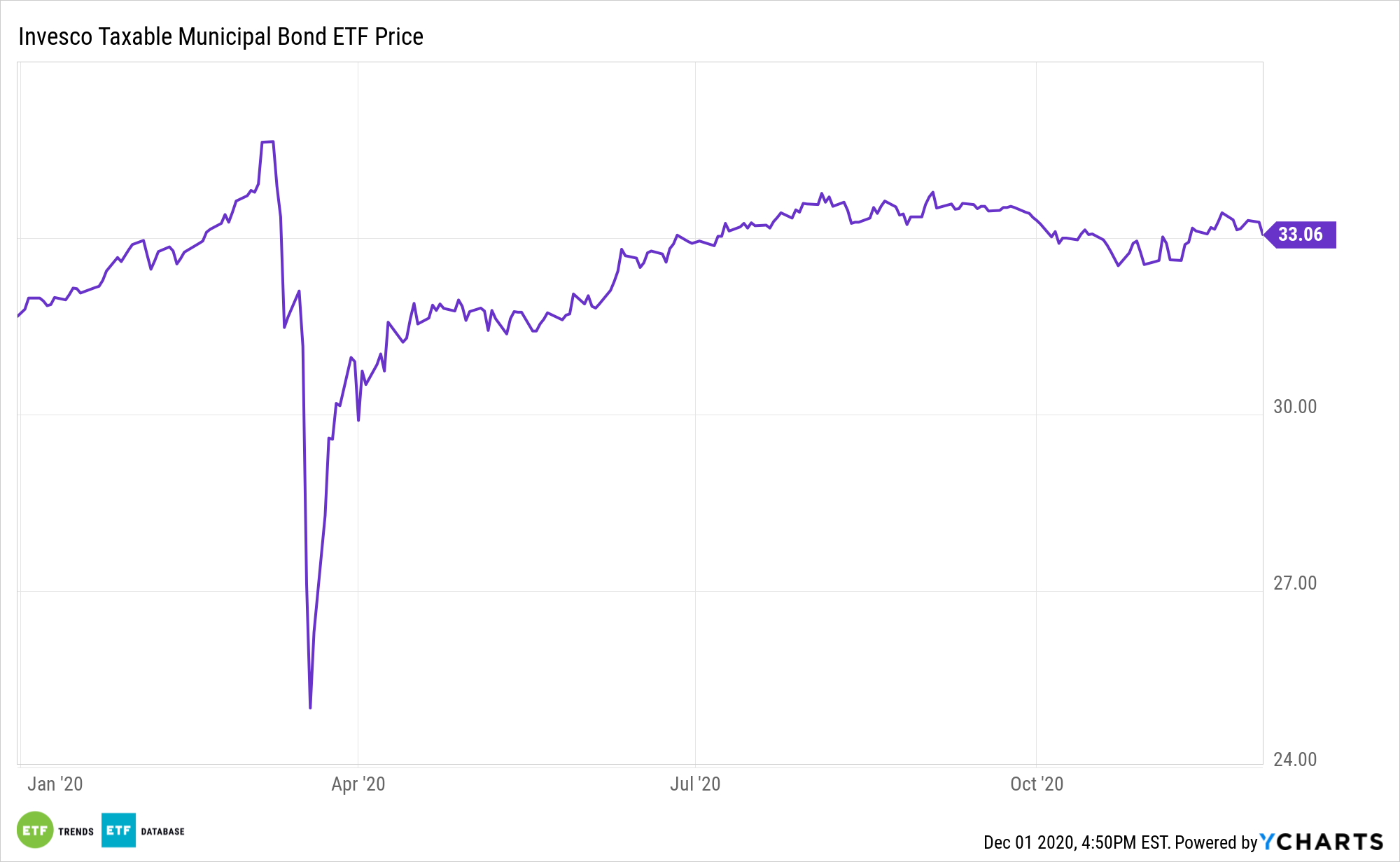

With a Joe Biden administration looming, municipal bonds have been in play for fixed income investors. One pertinent idea is a taxable municipal bond, the focus of the Invesco Taxable Municipal Bond ETF (BAB).

BAB seeks to track the investment results of the ICE BofAML US Taxable Municipal Securities Plus Index. The underlying index is designed to track the performance of U.S. dollar-denominated taxable municipal debt publicly issued by U.S. states and territories, and their political subdivisions, in the U.S. market.

According to Investopedia, taxable municipal bonds are “issued by a local government, such as a city, county, or related agency, to finance projects that the federal government will not subsidize, and it is not tax exempt.”

As its namesake suggests, the BAB ETF hearkens to Build America Bonds (BAB), which, courtesy again of Investopedia, “were created under the American Recovery and Reinvestment Act (ARRA) of 2009 and, although taxable, have special tax credits and federal subsidies for either the bond issuer or holder. Taxable municipal bonds are popular among institutional investors and mutual funds that cannot take advantage of other tax breaks.”

Taxable munis are one area that ETF investors can leverage, with a fast-growing space in the municipal debt or bond markets.

“Municipal bonds and tax-exempt debt are no longer synonymous,” a Barron’s article said. “Taxable municipal bonds are the fastest-growing sector in U.S. fixed income. This year, issuance has totaled more than $170 billion, double the $85 billion sold in all of 2019. The total market has grown to $700 billion—sizable but still below the $3.7 trillion tax-exempt muni market.”

Taxable munis also “offer an attractive alternative to corporate bonds, with higher yields and lower historical default rates.”

Betting on a Muni Recovery

BAB also sets investors up for a 2021 recovery to build off the current vaccine rally. New vaccine candidates and a new administration should provide some tangible tailwinds for the fund.

“Investors in the $3.9 trillion municipal-bond market are starting to bet on the nation’s recovery from the coronavirus pandemic,” a Bloomberg article said.

“The best news muni credit has heard in a long time is this vaccine news the last couple of weeks,” said Thomas Graff, head of fixed-income for Brown Advisory.

For more news and information, visit the Innovative ETFs Channel.