Economic indicators are released every week to help provide insight into the overall state of the U.S. economy. Policymakers and advisors closely monitor economic indicators to understand recession risk and the direction of interest rates because the data can ultimately impact business decisions and financial markets. In the week ending on September 7th, the SPDR S&P 500 ETF Trust (SPY) fell 1.22% while the Invesco S&P 500® Equal Weight ETF (RSP) was down 1.56%.

Although the economic calendar was relatively quiet last week, there were still important releases that warrant attention. In this article, we explore three of those important economic releases from the past week: the S&P Global Services PMI, the ISM Services PMI, and the trade balance. By examining these data points, we gain a better understanding of the strength of the country’s services sector as well as the latest foreign trade activity, both of which impact overall economic growth.

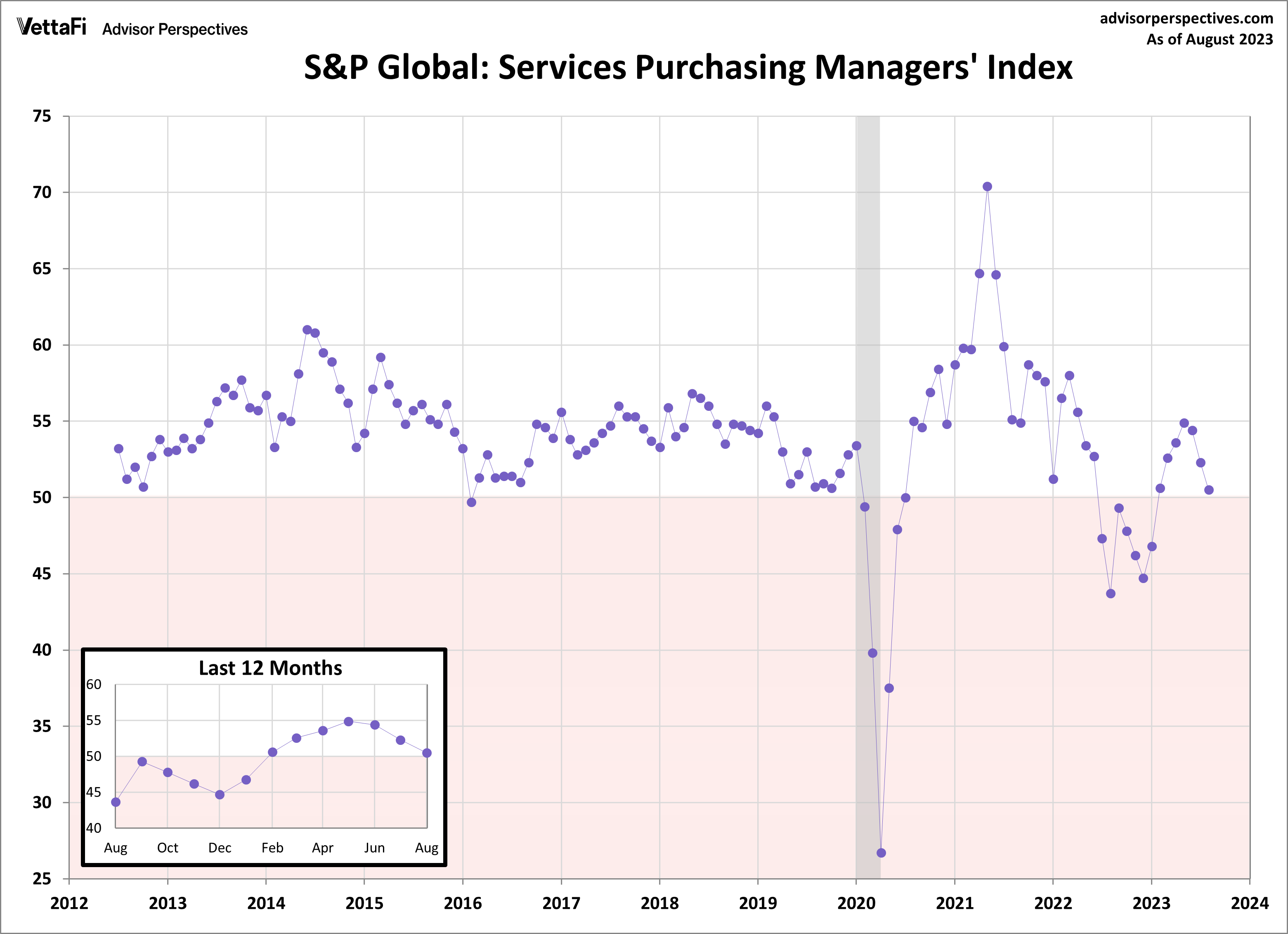

S&P Global Services PMI

Growth for the U.S.’s services sector continued to slowdown as the S&P Global Services PMI declined for a third straight month. The index fell sharply from 52.3 in July to 50.5 in August, which was just below the 51.0 forecast. The latest reading keeps the index in expansion territory for the seventh straight month but represents the weakest growth over that time.

The deceleration in the services sector can largely be attributed to inflationary pressures and high interest rates. Businesses faced higher wage bills and rising input charge inflation due to increasing energy, fuel, and material prices. Firms were hesitant to pass along the full extent of these costs to the consumers, as they were already seeing the impact of interest rates and elevated inflation on consumer spending. These pressures led to fewer new orders, causing a contraction in new business and only fractional gains in employment to meet the lessening demands. Despite these challenges, the U.S. service sector still experienced growth this month, fueled by efforts to work through existing orders and continued gains in foreign client demand. Service provides maintain an optimistic outlook for the coming year despite the current muted demand but still remain cautious about further interest rate hikes.

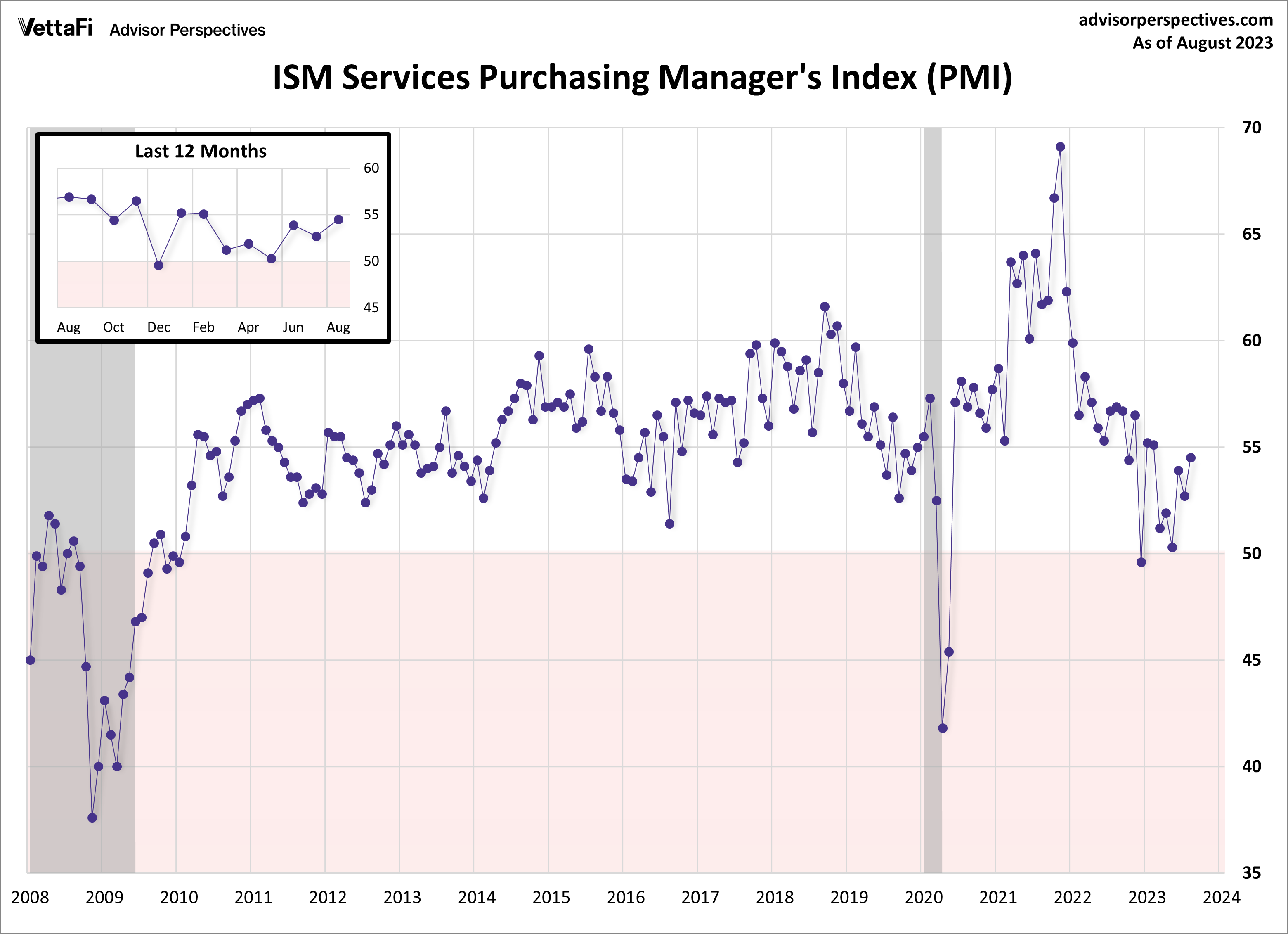

ISM Services PMI

Economic activity expanded in the services sector for the eighth straight month. The ISM Services PMI reached its highest level in the past six months, coming in at 54.5 in August. The latest reading was better than the expected 52.5 forecast. Nearly all subcomponents of the index improved in August, with backlog of orders being the sole component that contracted. Additionally, 13 service industries reported growth while 5 industries reported a decline. Overall, the business conditions in the services sector are currently stable as the sector has now grown in 38 of the last 39 months, with the lone contraction in December 2022.

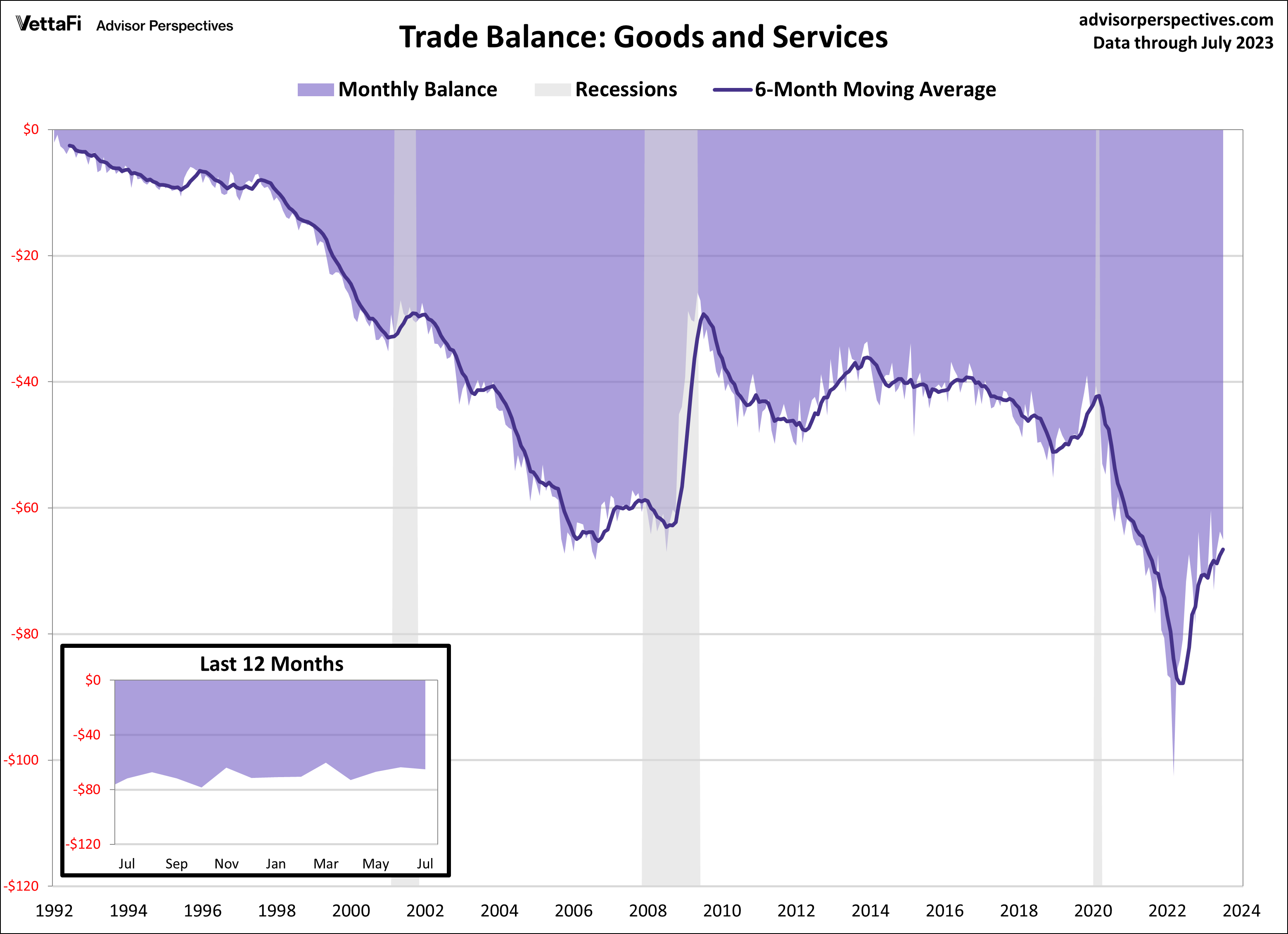

Trade Balance

The U.S. international trade deficit widened for the first time in three months. The trade deficit expanded by 2.0% in July to $65.0 billion due to a larger increase in imports than exports. The trade balance, which reports on the country’s imports and exports of goods and services, provides insights into foreign trade dynamics, serving as a gauge for the overall growth or contraction of the economy. Notably, the goods deficit increased by $2.0 billion during this time while the services surplus increased by $0.7 billion.

The monthly data points for the U.S. trade balance can be highly volatile and therefore it is best to look at the six-month moving average to get a clearer sense of the overall trend. In 2020, because of the COVID-19 pandemic, the trade deficit rapidly expanded to never-before-seen levels. However, over the past year, the deficit has shrunk significantly and currently sits at its lowest level since June 2021.

Economic Indicators and the Week Ahead

The upcoming week will feature key economic indicators focused on inflation and sentiment within the economy. On Wednesday, the Bureau of Labor Statistics will release August’s Consumer Price Index (CPI) followed by August’s Producer Price Index (PPI) on Thursday. Last month, both CPI and PPI ticked up for the first time in 13 months to 3.2% and 0.80%, respectively, proving the battle against inflation is not over yet. Additionally, the Michigan Consumer Sentiment and the NFIB Small Business Optimism surveys will be released this week to provide the latest insight into prevailing sentiments among consumers and small business owners. Over the past year, consumer attitudes have gradually improved despite hitting a small setback last month while concerns among small business owners have remained prevalent.

For more news, information, and analysis visit the Innovative ETFs Channel.