Policymakers, advisors, and analysts closely monitor economic indicators because they provide information on the health and performance of the U.S. economy. This information enables them to make informed decisions regarding business strategies and financial markets. In the week ending April 25, the SPDR S&P 500 ETF Trust (SPY) rose 0.79% while the Invesco S&P 500 Equal Weight ETF (RSP) was up 1.97%. The Fed is scheduled to meet this week, where it is expected to hold rates steady between 5.25% and 5.50% for a sixth straight meeting.

This article takes a deeper look at three important economic releases from the past week: personal consumption expenditures (PCE), gross domestic product (GDP), and consumer sentiment. These indicators provide insights into the country’s economic landscape, with a particular focus on consumption and consumer attitudes. By understanding consumers’ attitudes toward the economy, we can gauge their spending patterns, which significantly drive overall economic growth.

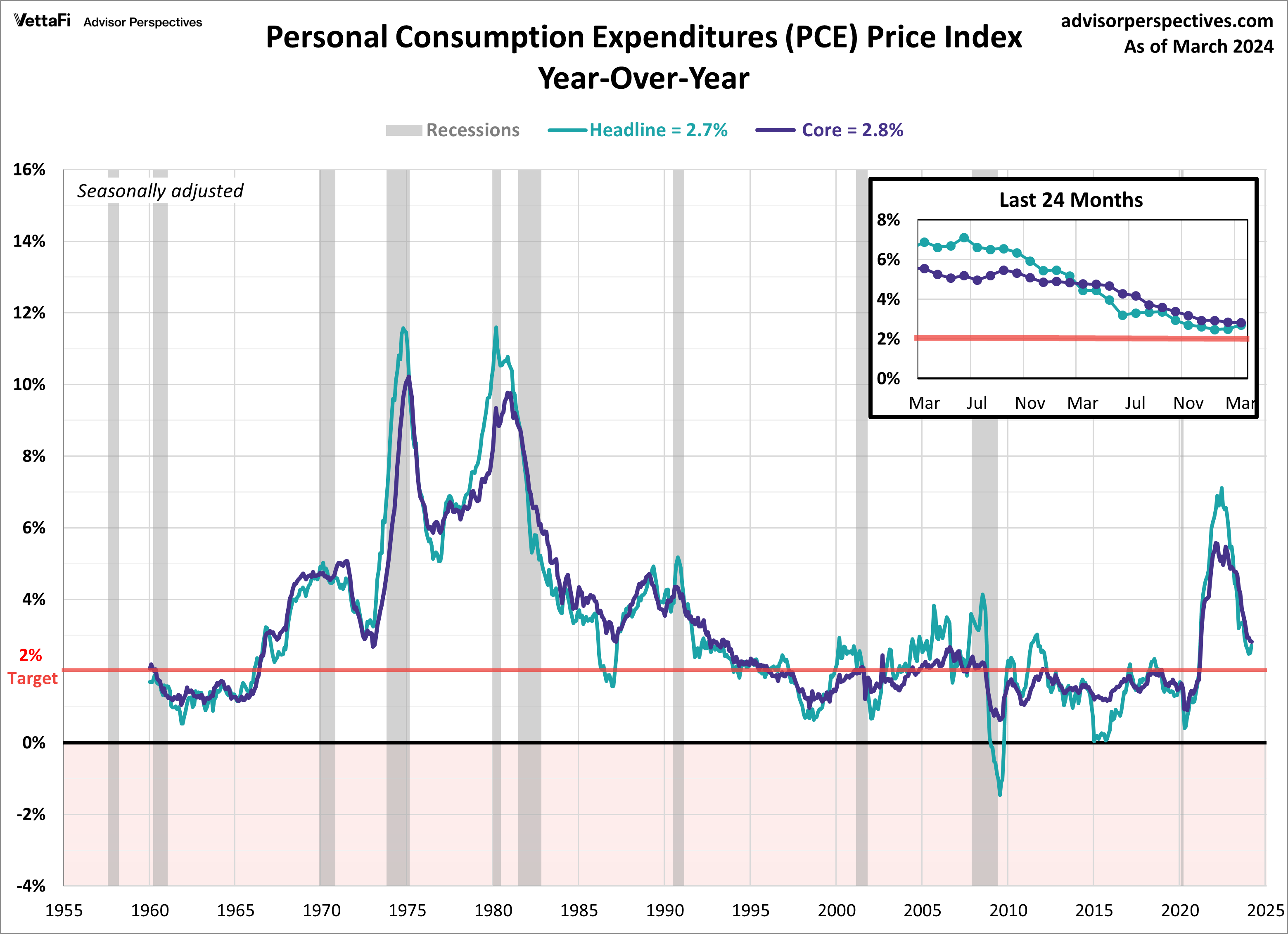

Personal Consumption Expenditures (PCE)

The Fed’s preferred inflation gauge rose more than expected in March. The Core PCE Price Index, which measures inflation excluding volatile food and energy prices, rose by 2.8% compared to the previous year, unchanged from February. Inflation was expected to decelerate at its steady pace as it has been over the past year to 2.6% last month.

Despite the higher-than-anticipated reading, core PCE still sits at its lowest level in the past three years. Additionally, headline PCE accelerated for a second straight month from 2.5% in February to 2.7% in March. That was higher than the anticipated 2.6% growth. On a monthly basis, both headline and core PCE rose 0.3% from February as predicted. Overall, the latest PCE numbers were surprising but not alarming. The Fed will most likely remain patient with its first rate cut as it needs clearer signs of where inflation is heading.

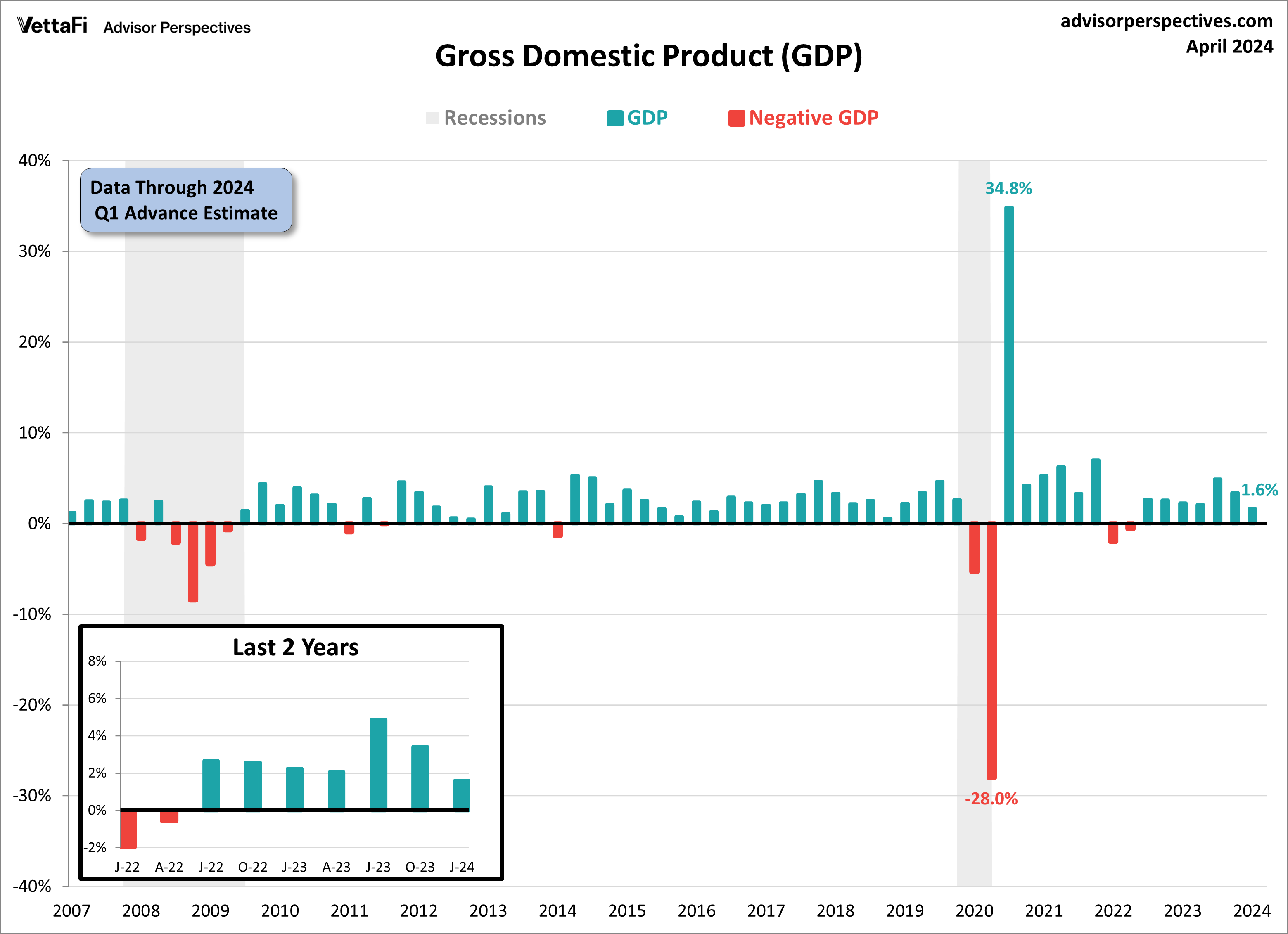

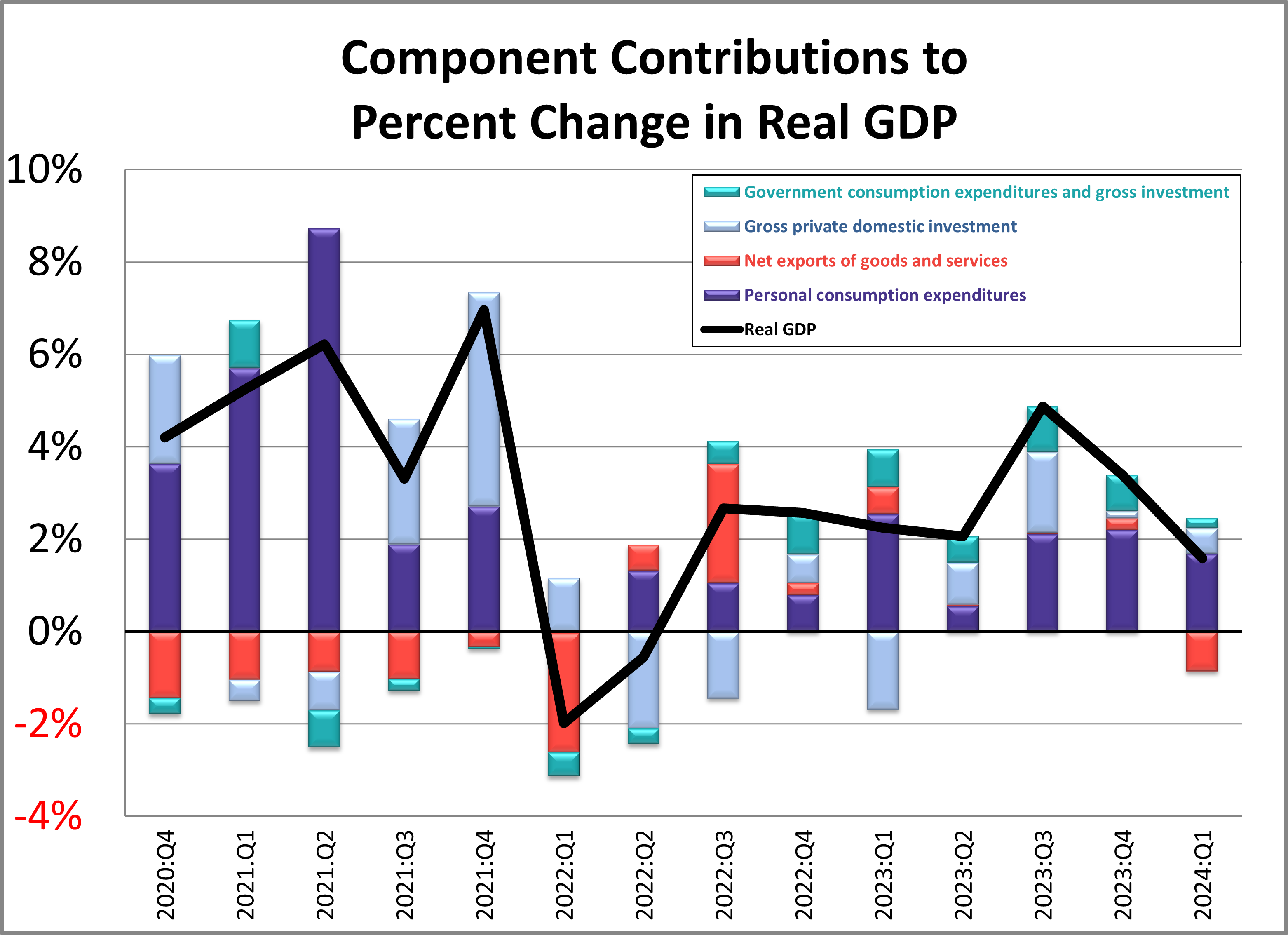

Gross Domestic Product (GDP)

The U.S. economy grew at its slowest pace in almost two years, according to the advance estimate for Q1 2024 Gross Domestic Product (GDP). The economy expanded at a rate of 1.6%. That’s a significant slowdown from 3.4% in Q4 of last year and less than the expected 2.5% pace. The latest figure marks the seventh consecutive quarter of growth. It also marks the slowest growth of any quarter over that period.

Last quarter, three out of the four subcomponents contributed positively to real GDP. That breaks a three-quarter streak where all four subcomponents had done so. Consumer spending once again emerged as the largest contributor to last quarter’s economic growth. Business investment and government spending also made positive contributions. Net exports were the sole negative contributor last quarter as imports, which are a subtraction in the calculation of GDP, increased.

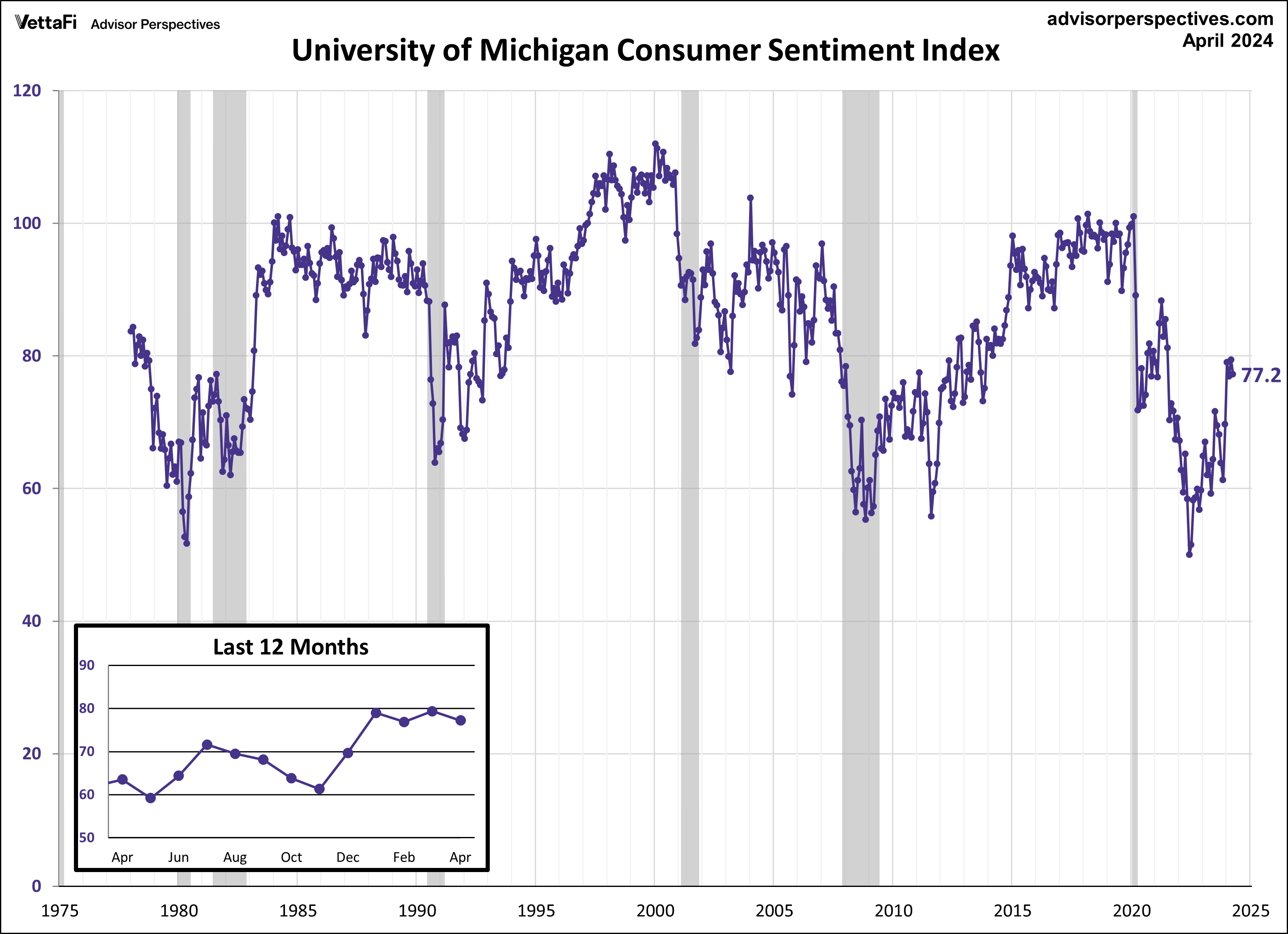

Michigan Consumer Sentiment

Consumer attitudes continued to plateau, according to this month’s final report for the Michigan Consumer Sentiment Index. The April final report came in at 77.2. That marks a 2.8% decrease from March’s final reading and is just below the forecasted value of 77.8. Since the start of the year, consumer sentiment has stayed within a narrow 2.5-point range. That underscores consumers’ stable perceptions of the economy.

The Michigan Consumer Sentiment Index is a monthly survey measuring consumers’ opinions regarding the economy, personal finances, business conditions, and buying conditions. April’s index value showed little change from March. But a closer look at the report revealed different population demographics exhibited differing outlooks that offset each other. The November presidential election remains top of mind for consumers. But ongoing geopolitical factors were not listed as a concern.

Consumer attitudes are closely monitored, as their confidence levels tend to impact their spending behavior. Consumer spending accounts for approximately 70% of the economy. As such, it has a major impact on economic growth.

The Consumer Discretionary Select Sector SPDR ETF (XLY) is tied to consumer confidence.

The Week Ahead

The labor market will take center stage this week as several key job reports will be released. The March JOLTS data and April employment reports will provide insights into the health of the labor market, a crucial component of the overall economy. The labor market has been under close watch as it is one of the key elements driving the Federal Reserve’s policy decisions. The labor market has been much stronger than expected, as job growth has been on the rise, while job openings have been flat over the past several months.

On Wednesday, the Bureau of Labor Statistics (BLS) will release the latest job openings data, while ADP will release their latest employment report that will set the stage for the more comprehensive BLS employment report due on Friday. Expectations are that 210,000 nonfarm jobs were added in April, down from 303,000 in March, and that the unemployment rate remained at 3.8%.

For more news, information, and analysis, visit the Innovative ETFs Channel.