Economic indicators provide insight into the overall health and performance of an economy. They are essential tools for policymakers, advisors, investors, and businesses because they allow them to make informed decisions regarding business strategies and financial markets. In the week ending on April 11, the SPDR S&P 500 ETF Trust (SPY) fell 0.08%, while the Invesco S&P 500 Equal Weight ETF (RSP) was down 1.08%.

Inflation continues to be a hot topic of conversation because of its role in the Fed’s interest rate policy. The Fed has been cautious about making any changes to monetary policy, emphasizing the need for inflation to continue to move towards their 2% target. This article will summarize three important economic indicators from the past week to provide insight into the latest inflation trends, consumer attitudes, and potential implications.

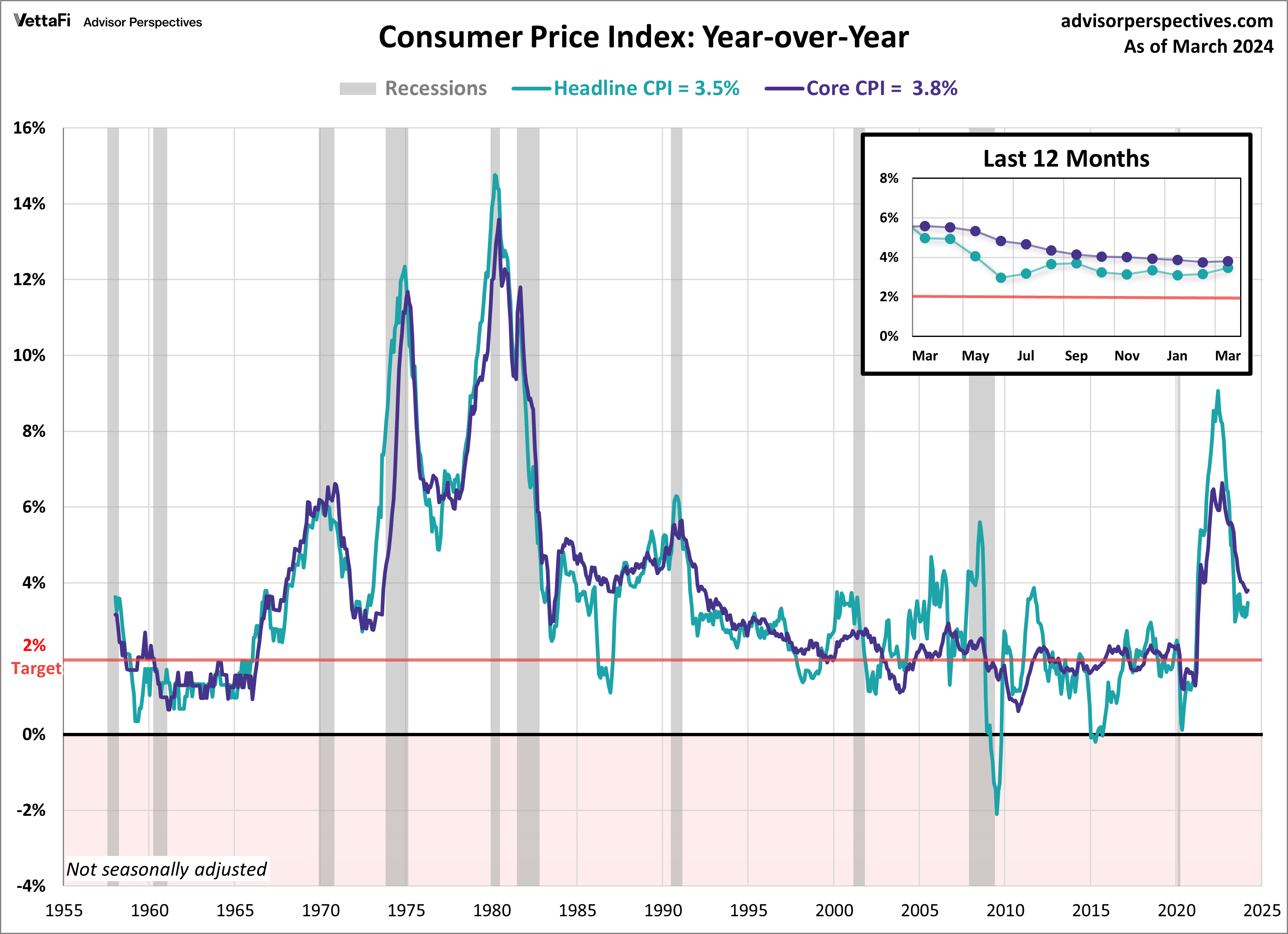

Economic Indicators: Consumer Price Index

Consumer prices rose more than expected for the third straight month as inflation remains stubborn. The Consumer Price Index (CPI) rose 3.5% in March, up from 3.2% in February and more than the expected 3.4% growth. On a monthly basis, consumer prices rose 0.4% which was higher than the forecasted 0.3% growth. The primary driver for the monthly increase was the continued rise in shelter and gasoline costs. When combined, these two contributed to over half of the headline increase.

Core inflation, which excludes food and energy prices, accelerated for the first time in 12 months. On an annual basis, core CPI inched up from 3.75% in February to 3.80% in March, just above the expected 3.7% growth. Additionally, core prices increased 0.4% from February, more than the anticipated 0.3% growth.

The question remains as to when the Fed will begin to cut rates, with some now questioning if it’ll even happen this year. The latest CPI numbers show inflation heating back up and moving opposite the Fed’s 2% target rate. The Fed is expected to continue to hold rates steady over their next few meetings with the CME Fed Watch Tool currently forecasting the first rate cut to take place in September.

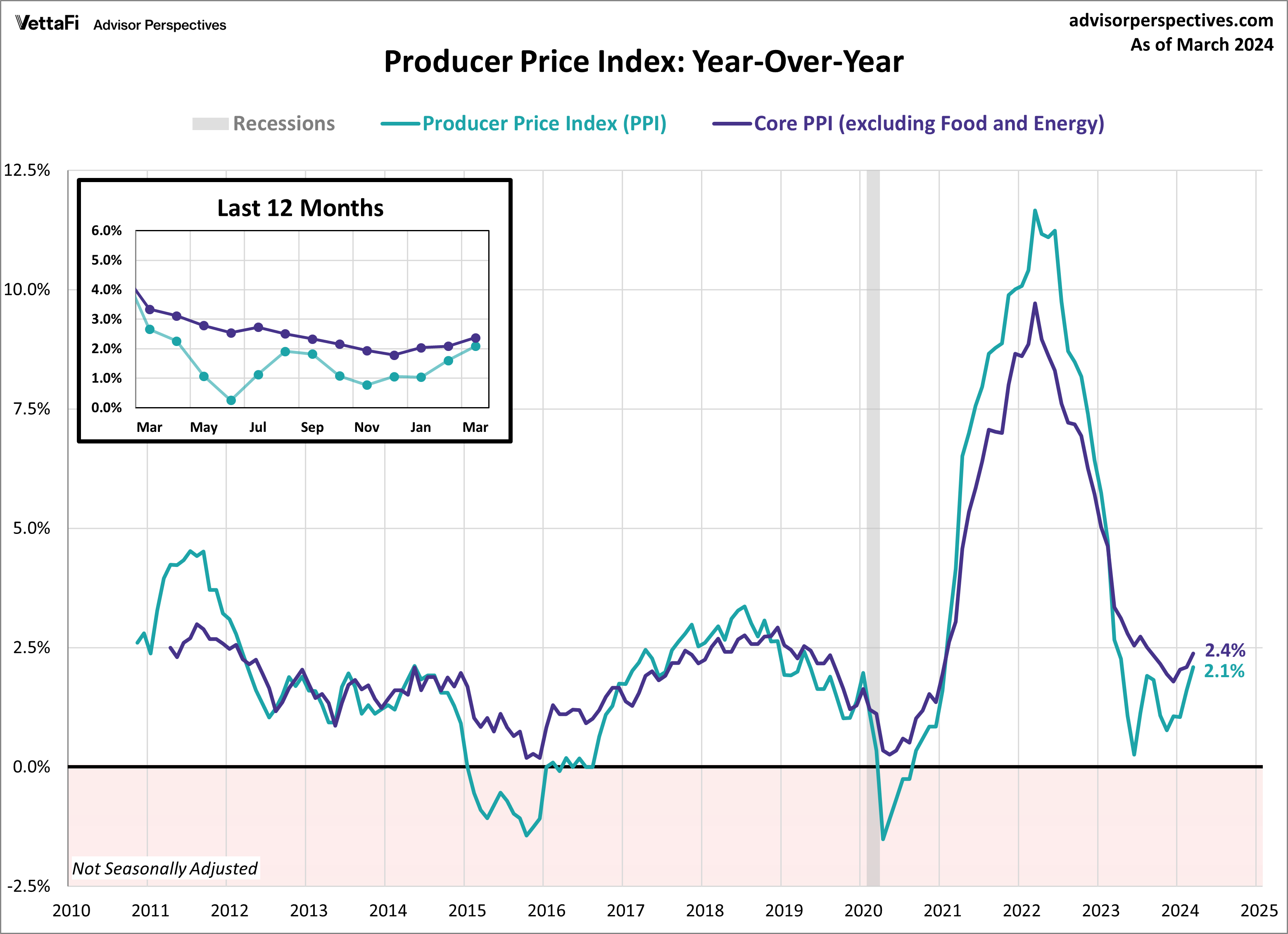

Economic Indicators: Producer Price Index

Wholesale prices rose for a third consecutive month, although the increase was less than economists expected. In March, the Producer Price Index (PPI) was up 0.2% from the previous month, less than the projected 0.3% growth from February. On an annual basis, the PPI rose 2.1%, a pickup from February’s 1.6% growth and below the expected 2.2% increase. The latest figure is the highest level for the headline index since April 2023. Additionally, the Core Producer Price Index (PPI), which excludes food and energy, rose 0.2% on a monthly basis as expected. Core PPI was up 2.4% from one year ago, an acceleration from the previous month’s 2.1% rise in wholesale prices and higher than the projected 2.3% increase. The latest figure is the highest level for the core index since August 2023.

The producer price index is widely considered a leading indicator of consumer inflation, as shifts in producer-level prices often trickle down to consumers. The past few PPI reports have shown wholesale inflation slowly heating up which could signal future consumer prices hikes. However, with the latest report coming in slightly better than expected, it should provide some relief.

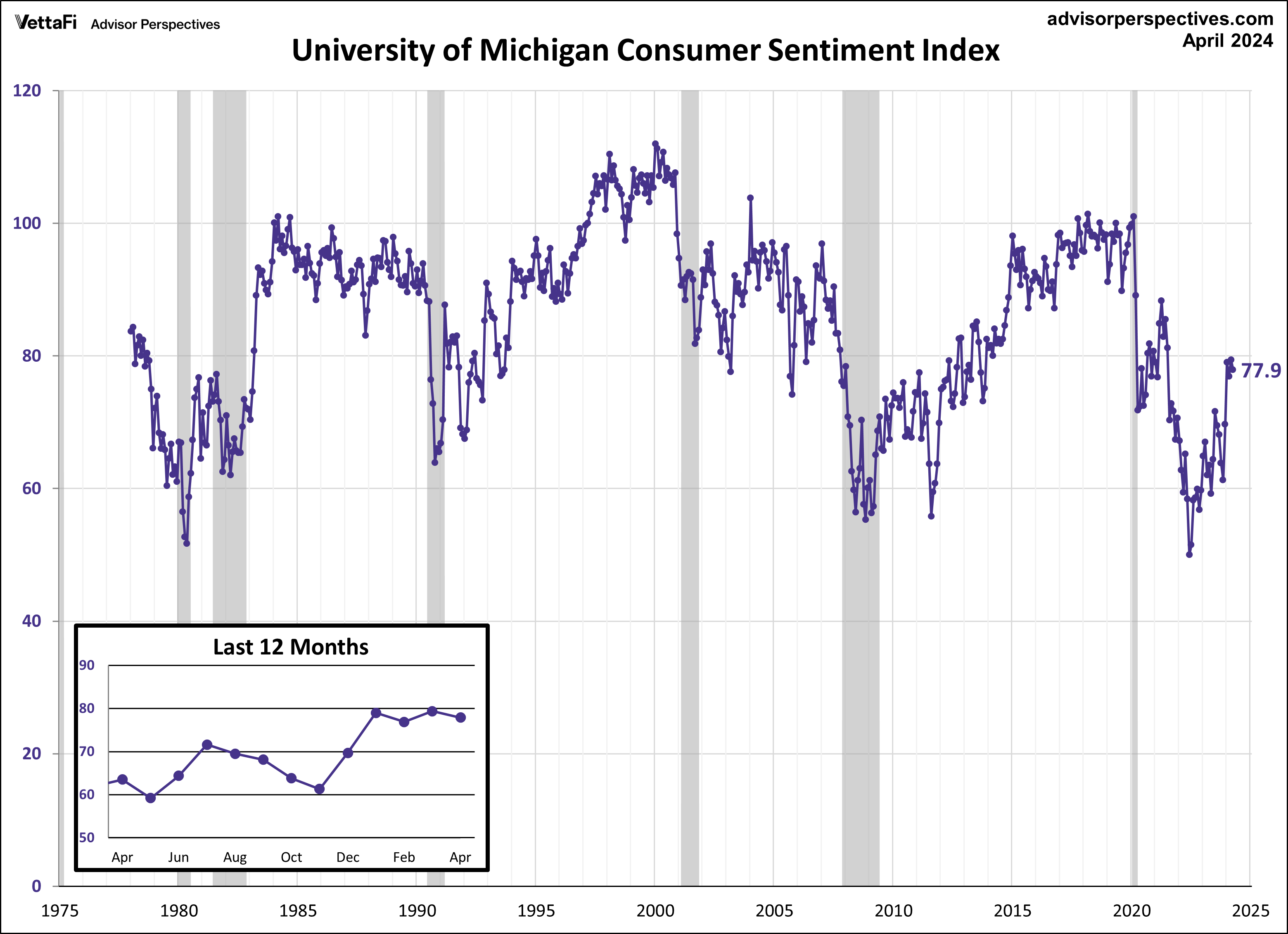

Economic Indicators: Michigan Consumer Sentiment

Consumer attitudes were little changed, according to this month’s preliminary report for the Michigan Consumer Sentiment Index. The April preliminary report came in at 77.9, marking a 1.9% decrease from March’s final reading and just below the forecasted value of 79.0. Sentiment has moved sideways for the past four months within a narrow 2.5 point range, underscoring consumers’ steady perceptions of the state of the economy since the start of the year.

The Michigan Consumer Sentiment Index is a monthly survey measuring consumers’ opinions with regards to the economy, personal finances, business conditions, and buying conditions. While consumers have shown stable expectations regarding personal finances, business conditions, and labor markets over the past several months, the latest report revealed a slight uptick in inflation expectations. Additionally, the November presidential election remains a significant factor in consumer’s attitudes and future perceptions for the economy’s trajectory.

Consumer attitudes are closely monitored as their confidence levels tend to impact their spending behavior. Given that consumer spending accounts for approximately 70% of the economy, consumer spending has a major impact on economic growth.

The Consumer Discretionary Select Sector SPDR ETF (XLY) is tied to consumer sentiment.

The Week Ahead

The upcoming week will unveil key economic data, featuring the latest figures on retail sales, industrial production, and the Conference Board’s Leading Economic Index. These individual metrics offer valuable insights into distinct aspects of economic activity: retail sales reflect consumer spending, industrial production measures manufacturing strength, and the Leading Economic Index provides guidance on future economic trends. Taken together, they create a more holistic view of the economy’s overall health.

The retail sales data could impact interests in the SPDR S&P Retail ETF (XRT) while the industrial production data could impact interests in the Industrial Select Sector SPDR Fund (XLI).

For more news, information, and analysis, visit the Innovative ETFs Channel.