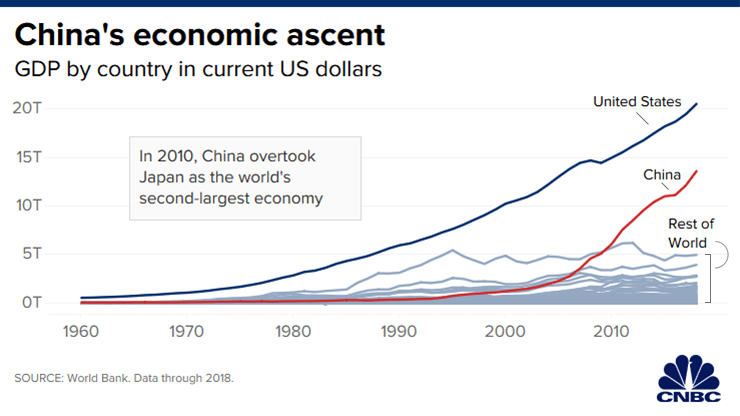

China had a goal of doubling its GDP as well as its income in a 10-year period, and not only is it on path to meet that, the world’s second largest economy is looking to overtake the U.S. for the top spot.

China’s GDP currently stands at $13.1 trillion and forecasters expect that to increase by another 6% in 2020.

“Going forward, China is going to continue to be very competitive,” said Michael Yoshikami, founder of Destination Wealth Management. “China is still going to be a global player. But it’s a matter of managing expectations relative to what you think is going to happen.”

“The Chinese economy is targeted to grow at 7%. It was growing at 14%. If it grows at 6%, that’s still a lot, but you’re going to see a lot of negative sentiment,” Yoshikami added. “If you talk to people in China, the average person is not as optimistic as they were two years ago or four years ago or six years ago.”

Here are three funds to consider as China eyes the top spot:

- Xtrackers CSI 300 China A-Shares ETF (NYSEArca: ASHR): seeks investment results that correspond generally to the performance, before fees and expenses, of the CSI 300 Index. The fund will normally invest at least 80% of its total assets in securities of issuers that comprise the underlying index. The underlying index is designed to reflect the price fluctuation and performance of the China A-Share market and is composed of the 300 largest and most liquid stocks in the China A-Share market. The underlying index includes small-cap, mid-cap, and large-cap stocks.

- Xtrackers CSI 500 China A-Shares Small Cap ETF (NYSEArca: ASHS): seeks investment results that correspond generally to the performance, before fees and expenses, of the CSI 500 Index. The index is designed to reflect the price fluctuation and performance of small-cap companies in the China A-Share market and is composed of the 500 smallest and most liquid stocks in the China A-Share market. Under normal circumstances, the fund invests at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in A-Shares of Chinese small-cap issuers or in derivative instruments and other securities that provide investment exposure to A-Shares of Chinese small-cap issuers.

- Xtrackers MSCI China A Inclusion Equity ETF (NYSEArca: ASHX): The investment seeks investment results that correspond generally to the performance, before fees and expenses, of the MSCI China A Inclusion Index. The fund will normally invest at least 80% of its total assets in securities (including depositary receipts in respect of such securities) of issuers that comprise the underlying index. The underlying index is designed to track the equity market performance of China A-Shares that are accessible through the Shanghai-Hong Kong Stock Connect program or the Shenzhen-Hong Kong Stock Connect program.

For more investing trends, visit ETFtrends.com.