A volatile Thanksgiving holiday trading week showed how an equal-weight strategy can help tamp down volatility with a fund like the Invesco S&P 500 Equal Weight Energy ETF (RYE).

Oil prices have had a strong run in 2021, but they weren’t immune to the post-Thanksgiving rout that saw the Dow Jones Industrial Average fall by 900 points. The energy sector took a hit as news of the COVID-19 variant spread like wildfire.

“South Africa’s warning of a new and fast-spreading strain of coronavirus walloped the energy sector on Friday, leading to the sharpest declines in oil prices since the global economy locked down early last year to slow the spread of the deadly virus,” the Wall Street Journal reports. “Oil prices fell more than 11%. Gasoline and diesel futures each dropped more than 12%. Tumbling energy stocks gave the strongest pull to plunging stock indexes Friday.”

Nonetheless, oil prices took their punches and rolled with them. Monday brought value-seeking investors into the energy sector, but with an abundance of caution given that the new COVID-19 variant still leaves a lot of unanswered questions.

“Oil prices rebounded on Monday as investors looked for bargains after Friday’s slump and on speculation that OPEC+ may pause an output increase in response to the spread of Omicron, but the mood remained cautious with little known about the new variant,” Reuters reports.

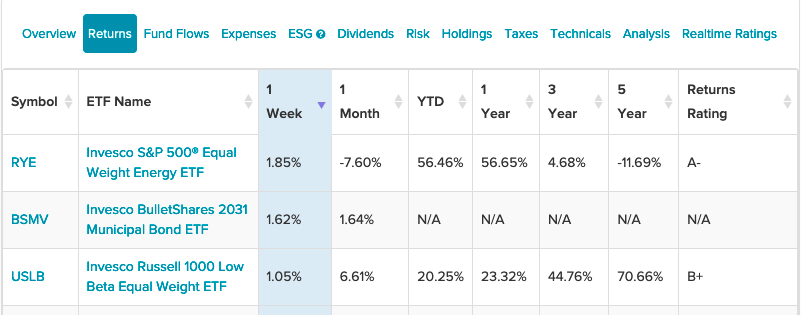

RYE was able to eke a 2% gain out of the Invesco ETFs, followed by funds focusing on municipal bonds and a low beta strategy. Piggybacking off the overall strength seen in the energy sector this year, RYE is up close to 60% year-to-date.

Minimizing Concentration Risk

An equal-weight strategy can help minimize concentration risk so investors are not too heavy with one stock. The energy sector in particular can experience strong momentous moves, so a built-in volatility management strategy is almost necessary when the markets are swinging wildly.

“Like many Rydex ETFs, RYE is equal-weighted, meaning that exposure is spread evenly across portfolio components,” an ETF Database analysis suggests. “This methodology may be particularly appealing in the top-heavy energy industry, where traditional cap-weighting can result in significant concentration issues.” For more news, information, and strategy, visit our Portfolio Strategies Channel.

For more news, information, and strategy, visit our Portfolio Strategies Channel.