Last week was once again packed with several key economic releases that helped provide insight into the overall state of the U.S. economy. Policymakers, advisors, and analysts closely monitor these indicators to gauge recession risk and understand the direction of interest rates because the data can ultimately impact business decisions and financial markets. In the week ending on September 28, the SPDR S&P 500 ETF Trust (SPY) fell 0.44% while the Invesco S&P 500 Equal Weight ETF (RSP) was down 0.43%. In this article, we take a deeper look at three pivotal economic releases from the past week: personal consumption expenditures (PCE), gross domestic product (GDP), and consumer confidence.

These interconnected indicators provide invaluable insights into the nation’s economic climate, with a particular focus on consumption and consumer sentiment. Understanding consumers’ perceptions of the economy enables us to gauge consumer spending patterns, a crucial driver of overall economic growth.

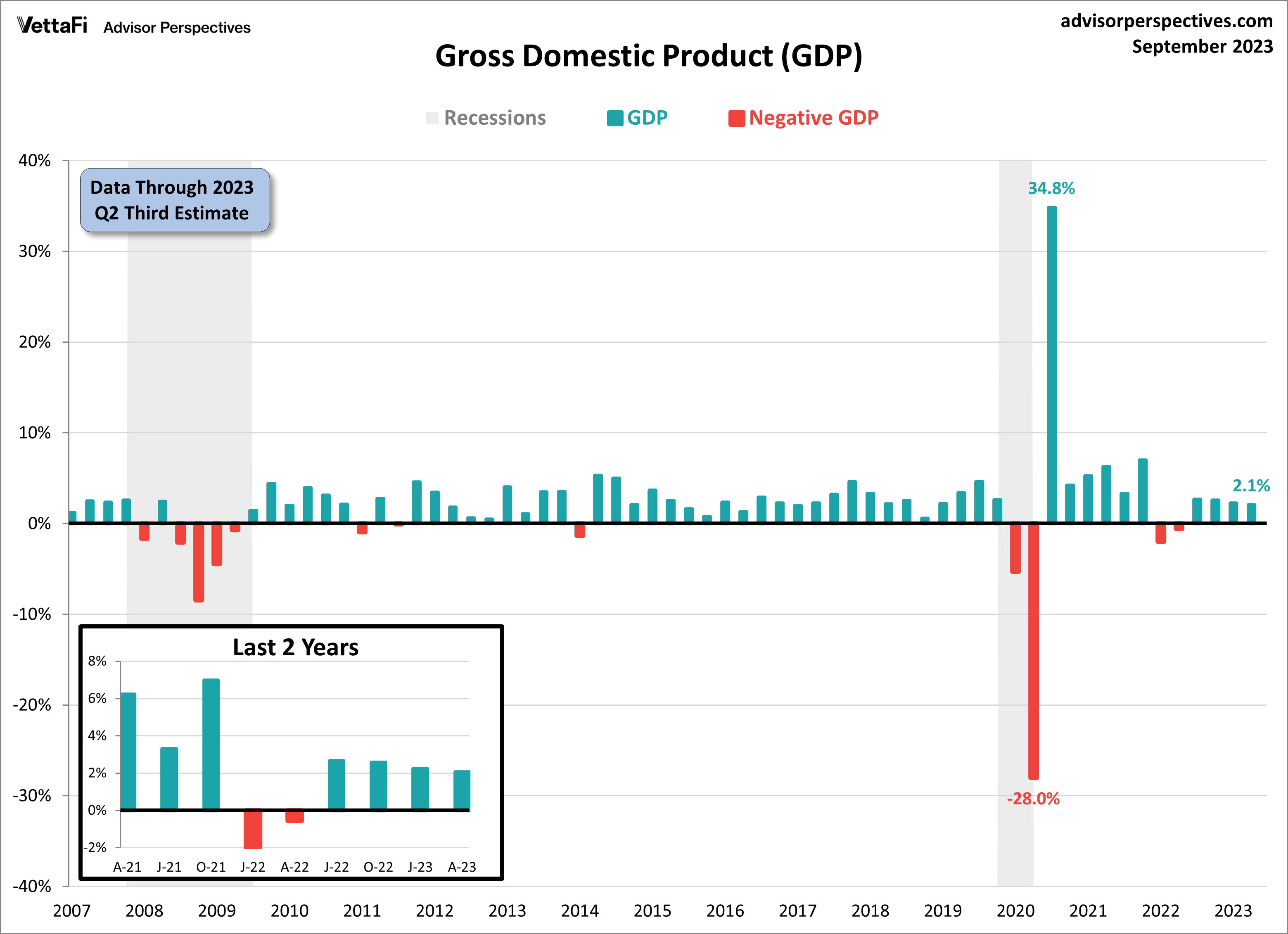

Gross Domestic Product (GDP)

The third estimate for Q2 2023 Gross Domestic Product (GDP) revealed that the economy expanded at an annual rate of 2.1%, unchanged from the second estimate. However, this final reading for Q2 represents a slight slowdown compared to the revised 2.2% growth recorded in the first quarter. Over the past year, concerns about an economic slowdown and the possibility of a recession have been prevalent. Despite the GDP slowing down in each of the past three quarters, it’s important to note that GDP has remained positive over the past year, highlighting the resilience of the economy and providing confidence that a recession may be avoided after all.

While the headline figure remained unchanged from the second estimate to the final estimate, there were notable revisions in the four individual components of GDP. Federal government and consumer spending both saw downward revisions, with the personal consumption expenditure component cut in half. This suggests that consumers weren’t spending as much as initially thought. These downward revisions, however, were counterbalanced by a substantial upward revision in business investment and exports. Notably, all four components made positive contributions to overall real GDP, with business investment being the largest contributor.

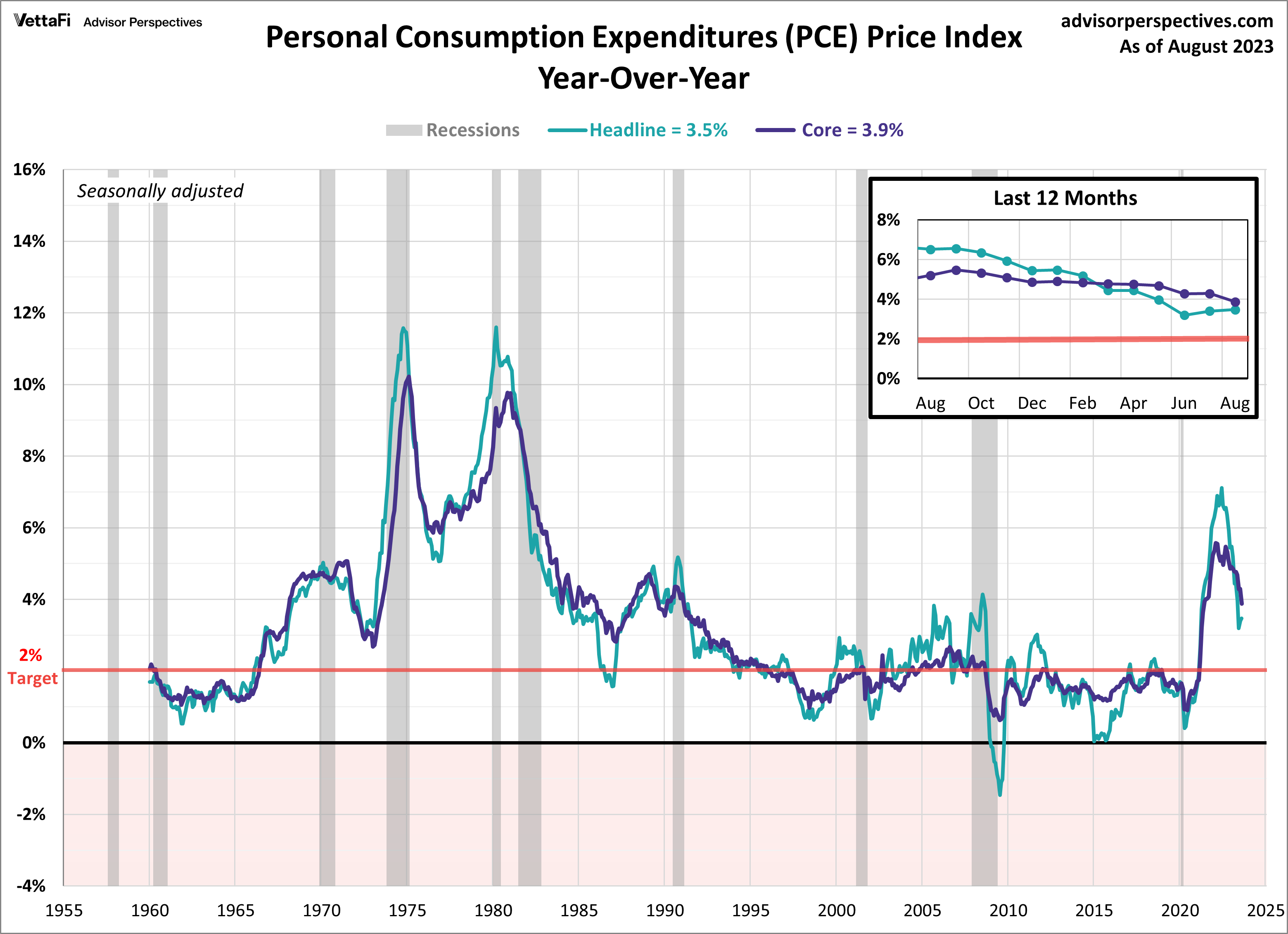

Personal Consumption Expenditures (PCE)

The Fed’s preferred inflation gauge showed signs of cooling in August. This has sparked hopes that the central bank may be nearing the end of its rate hikes. The Core PCE Price Index, which measures inflation excluding volatile food and energy prices, rose by 3.9% compared to the previous year, a slowdown from the 4.3% recorded in the prior month. Core PCE inflation is now at its lowest level in over two years. But it remains above the Fed’s 2% target rate. On a monthly basis, the core PCE inched up by just 0.1% from July.

While the core measure shifted down this month, headline PCE accelerated from 3.4% in July to 3.5% in August. Additionally, headline PCE increased 0.4% month-over-month. The increase seen this month in headline prices was in large part from elevated gas prices seen in August. Both annual readings were consistent with their respective forecasts while the monthly changes were smaller than anticipated. Overall, the latest PCE numbers should offer some relief to the Fed, but the inflation battle remains far from over.

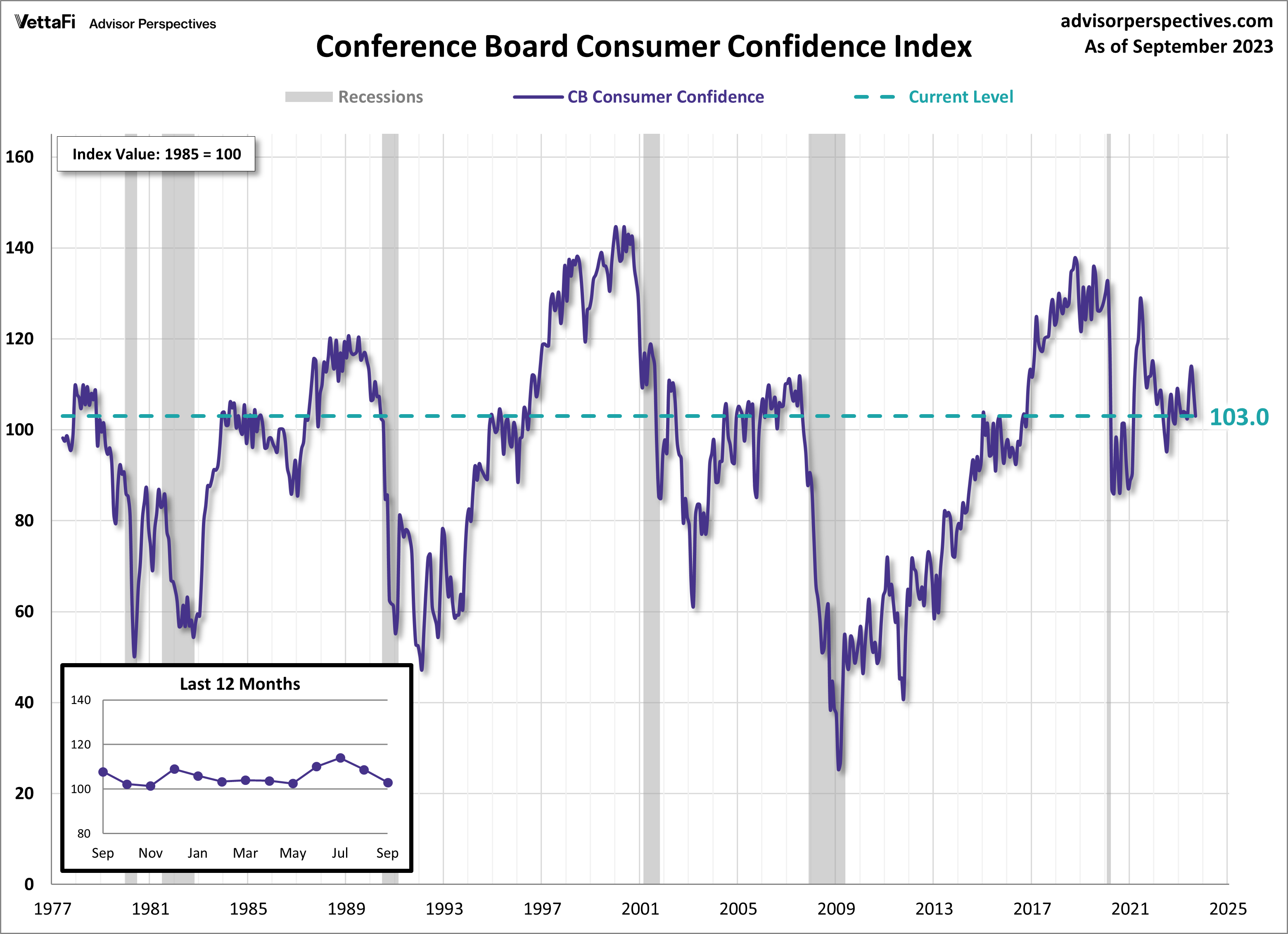

Consumer Confidence

As economic uncertainties heavily loom, American consumer confidence took a significant hit in September, reflecting growing concerns about the future. This month, Conference Board Consumer Confidence Index® fell to 103.0, down from an upwardly revised 108.7 in August. This decline in confidence marks the second consecutive month of worsening attitudes and is the index’s lowest reading since May. The index is based on a monthly survey measuring consumer attitudes about current and future economic conditions, with a particular focus on employment and labor market conditions. Interestingly, consumers’ confidence levels in the present situation were little changed. This is largely due to conflicting responses regarding business conditions and job availability. What has set off alarm bells is the expectations index, which has dipped below the level historically associated with signaling a recession within the next year. Rising prices, higher interest rates, and political tensions have sparked concern among consumers about the economic road ahead.

The Consumer Discretionary Select Sector SPDR ETF (XLY) is tied to consumer confidence.

Economic Indicators and the Week Ahead

The focus for this week shifts to employment as the market awaits the release of several key job reports. The August JOLTS data and September employment reports will provide insights into the health of the labor market, and by extension, the overall economy. Last month’s reports described a slowing yet somewhat resilient labor market. If the trend continues, the Fed may finally put a pause to their rate hiking cycle. Note that a government shutdown will cause federal statistic agencies such as the Bureau of Labor Statistics, the Census Bureau, and the Bureau of Economic Analysis to suspend operations. The Bureau of Labor Statistics provides the latest JOLTS and nonfarm payroll employment data.

For more news, information, and analysis, visit the Innovative ETFs Channel .