Each week economic indicators are released to provide better understanding into the health and performance of the U.S. economy. Policymakers, advisors, and analysts closely monitor these indicators because they allow them to make informed decisions regarding business strategies and financial markets. In the week ending November 30, the SPDR S&P 500 ETF Trust (SPY) rose 0.30%. The Invesco S&P 500 Equal Weight ETF (RSP) was up 1.24%.

In this article, we take a deeper look at three pivotal economic releases from the past week: personal consumption expenditures (PCE), gross domestic product (GDP), and consumer confidence. These interconnected indicators provide insights into the nation’s economic landscape. They particularly focus on consumption and consumer attitudes. Understanding consumers’ perceptions of the economy enables us to gauge consumer spending patterns, a crucial driver of overall economic growth.

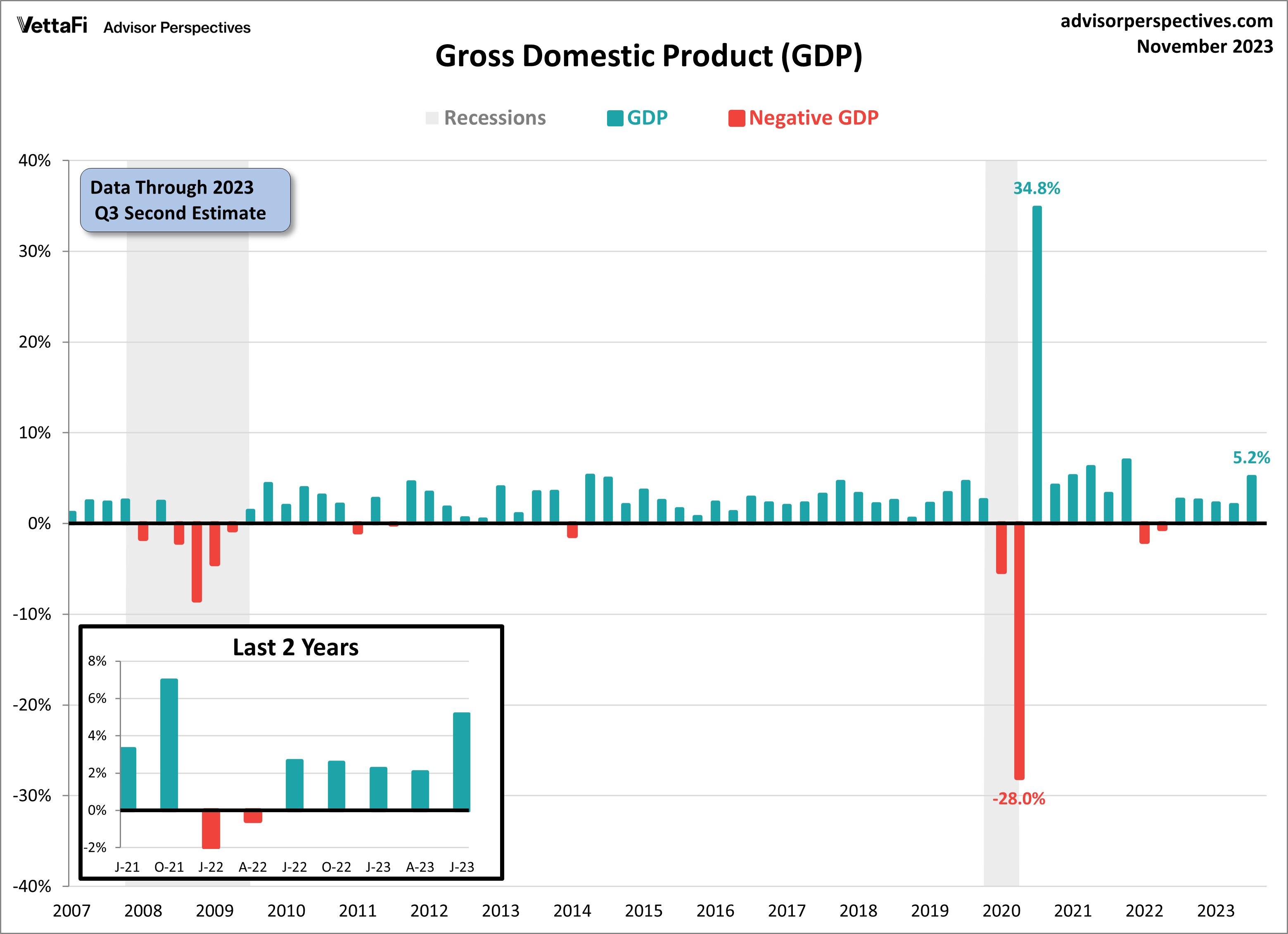

Gross Domestic Product

In the third quarter of 2023, the U.S. economy grew at a faster pace than initially thought, highlighting the economy’s resilience. The second estimate for Q3 2023 GDP revealed the economy expanded at an annual rate of 5.2%. That was a slight adjustment from the initial estimate of 4.9% growth reported last month. It was also more than double the 2.1% pace in the second quarter. The latest figure marks the fifth consecutive quarter of growth. That defies the numerous predictions made over the past year of an impending economic slowdown and possible recession. The U.S. economy is widely expected to slow down in the final quarter of the year. That is due to consumers continuing to face various challenges. Those include high interest rates, the resumption of student loan payments, and dwindling savings.

Consumer spending, although revised lower this month, remains the catalyst behind last quarter’s economic growth emerging as the largest contributor to real GDP growth out of the four subcomponents. Additionally, business investments and government spending made positive contributions. Net exports of goods and services was the sole negative contributor in Q3. All three of these components saw upward revisions from last month.which ultimately led to the overall upward revision in GDP growth this month.

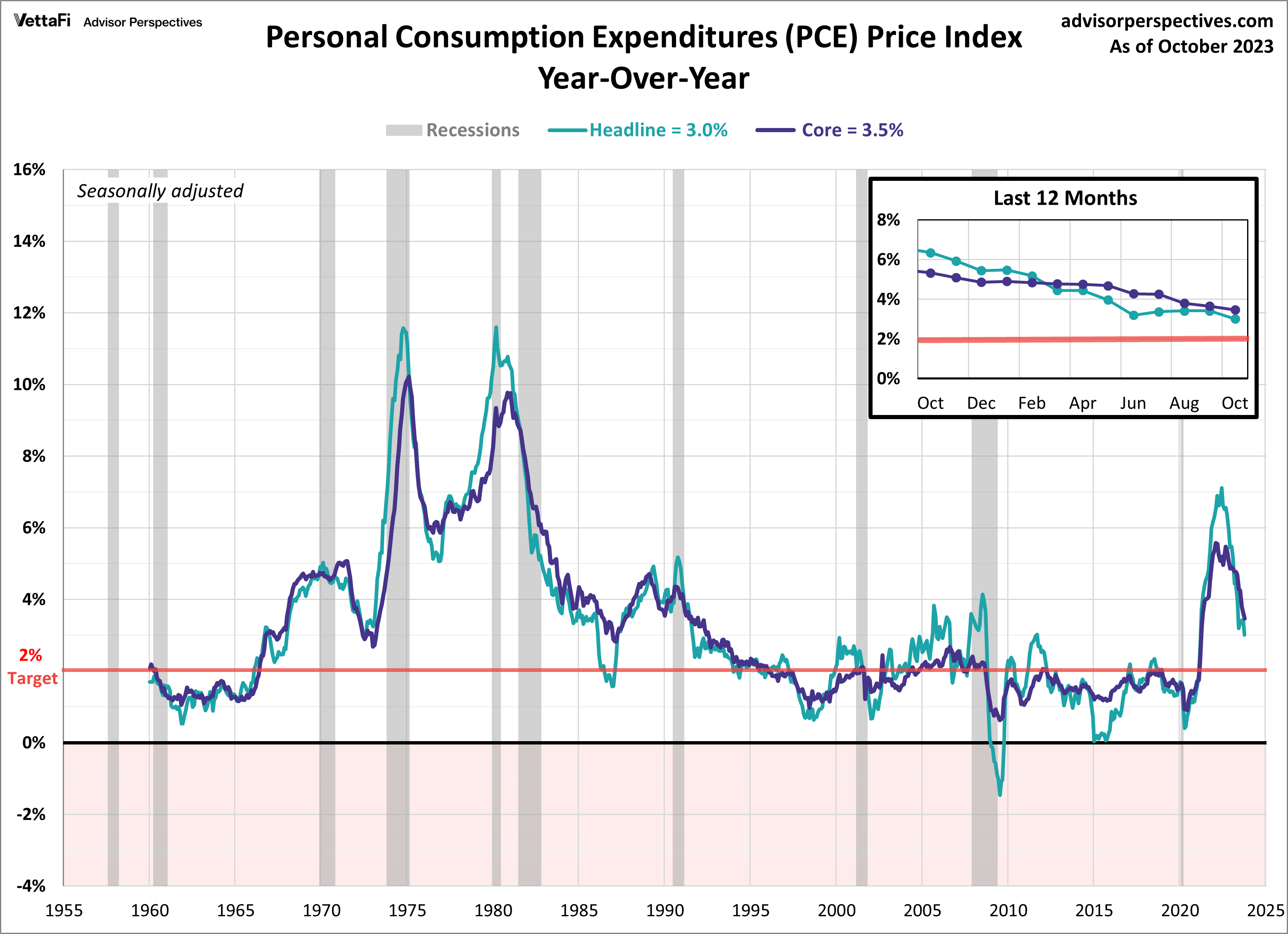

Personal Consumption Expenditures

The Fed’s preferred inflation gauge cooled further in October, giving hope that the Fed is done hiking rates. The Core PCE Price Index, which measures inflation excluding volatile food and energy prices, rose by 3.5% compared to the previous year, a slowdown from the 3.7% recorded in September. Core PCE inflation is now at its lowest level in two and a half years. However, it remains above the Fed’s 2% target rate.

Additionally, headline PCE shifted down from 3.4% in September to 3.0% in October. That was its lowest level since March 2021. Both annual readings were consistent with their respective forecasts. On a monthly basis, the core PCE rose 0.2% from September as expected. Headline PCE fell short of expectations by remaining flat in October compared to the 0.1% expected growth. Overall, the latest PCE numbers should offer some relief to the Fed in regard to their battle against inflation, even signaling that rate cuts could be on the horizon.

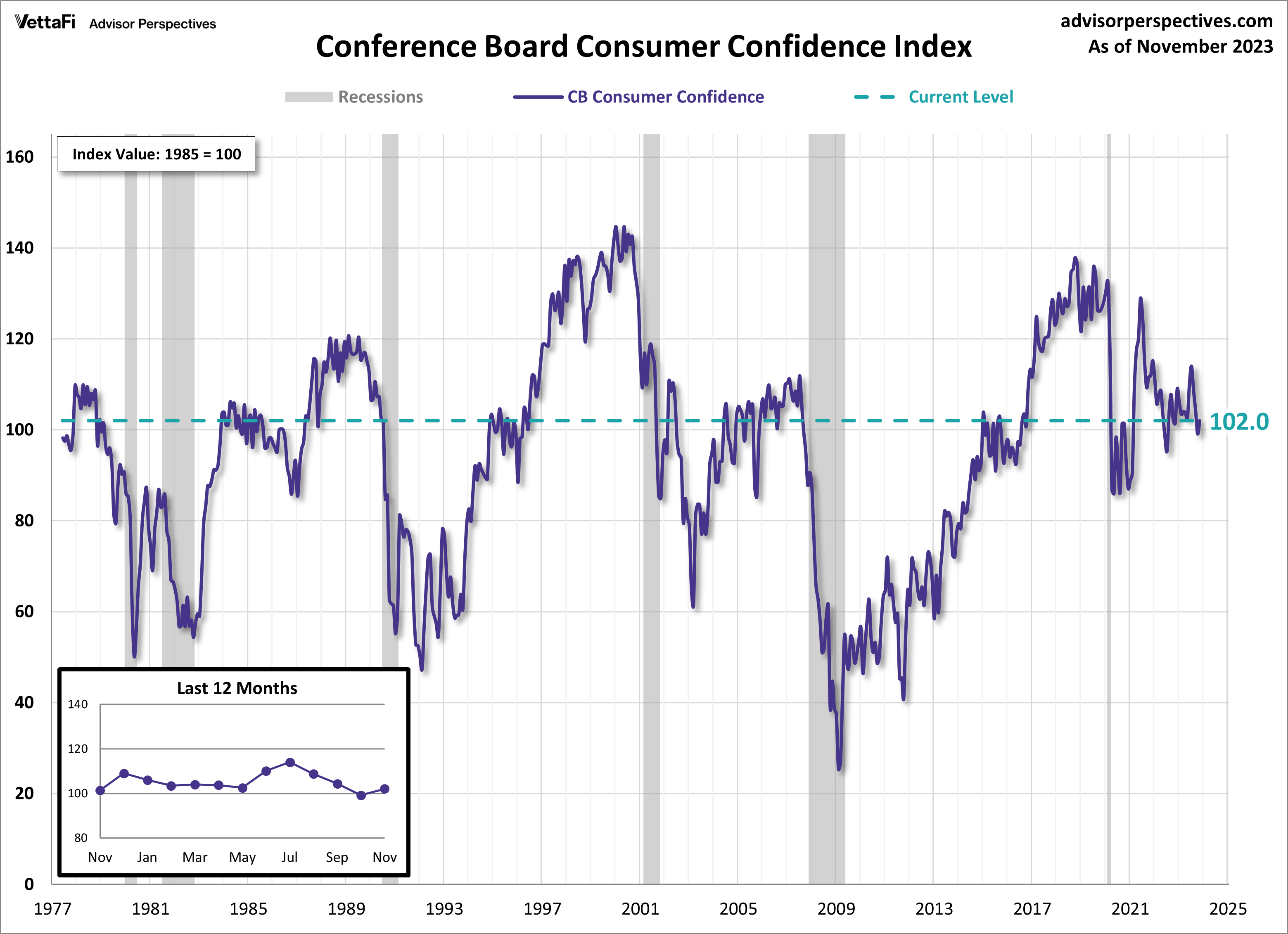

Consumer Confidence

American consumer confidence bounced back this month following three straight monthly declines. The Conference Board Consumer Confidence Index® rose to 102.0 from a downwardly revised 99.1 in October. Despite the uptick, the latest reading is the index’s second lowest level in the past year. Consumers reported rising prices remain a top concern, followed by geopolitical conflicts and higher interest rates.

The index is based on a monthly survey measuring consumer attitudes about current and future economic conditions. The index has particularly focuses on employment and labor market conditions. The overall improvement this month is largely reflected in a recovery to the expectations index. Consumers expressed increased confidence about future business conditions, future job availability, and future incomes. Additionally, consumers’ confidence levels in the present situation were largely unchanged. Fewer optimistic views on job availability were counterbalanced with improved views regarding business conditions.

The Consumer Discretionary Select Sector SPDR ETF (XLY) is tied to consumer confidence.

Economic Indicators: The Week Ahead

The focus for this week shifts to the labor market, as several key job reports will be released. The October JOLTS data and November employment reports will provide insights into the health of the labor market, a crucial component of the overall economy. The latest reports show a cooling labor market with job growth slowing and job openings trending downward.

On Tuesday, we will learn if job openings continued to rise for a third straight month in October, or if the trend resumed its downward path. Then on Wednesday, the ADP employment report will be released, which will set the stage for the more comprehensive BLS employment report released on Friday. Expectations are that 175,000 nonfarm jobs were added in November, up from 150,000 in October, and that the unemployment rate remained at 3.9%.

For more news, information, and analysis, visit the Innovative ETFs Channel.