When screening for ETFs solely on cost, sometimes the numbers don’t tell the whole story. The Invesco KBW High Dividend Yield Financial ETF (KBWD) is precisely one of those funds.

That’s because its 1.24% expense ratio hides the fact that it actually includes operating expenses tied to private equity holdings. It’s one example where an ETF advisor or investor can get lost in the numbers and not know the truth until they peel back the layers.

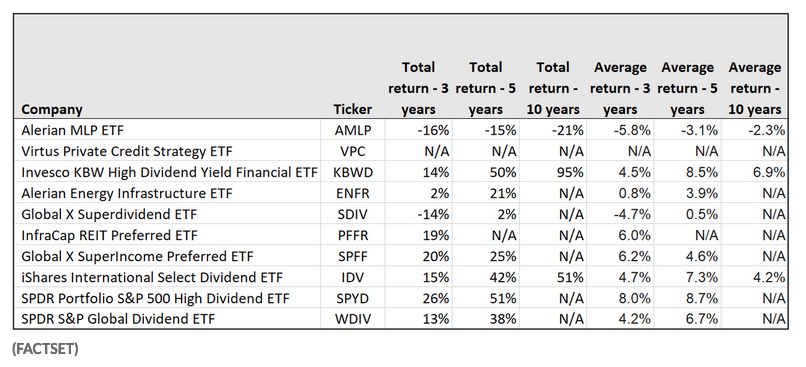

“The fund’s eye-popping fee is a regulatory illusion. It’s required to report the operating expenses of its private equity holdings as part of its expense ratio. Real-world holding costs have been consistently in line with KBWD’s very reasonable management fee” of 0.35%. The ETF focuses on real-estate investment trusts, as well as private-equity funds,” FactSet noted in a MarketWatch article that included the 10 highest-yielding dividend stock ETFs.

An Income Diversification Tool

In the current low yield environment, KBWD is the perfect opportunity for fixed income investors to diversify their portfolios and chase higher yields. However, the fund isn’t for the faint of heart.

KBWD is based on the KBW Nasdaq Financial Sector Dividend Yield Index (Index). The Fund generally will invest at least 90% of its total assets in the securities of publicly listed financial companies with competitive dividend yields, in the United States and that comprise the Index.

“This ETF is one of the more unique offerings in the financial sector, as KBWD offers a way to access banks and other institutions that pay out attractive dividend yields,” an ETF Database analysis suggested. “KBWD is definitely a risky bet, as the underlying companies generally include the less stable financial institutions that aren’t necessarily on strong fiscal footing.”

As mentioned, one needs a cast-iron stomach before investing in KBWD.

“As such, this fund probably isn’t appropriate for those with a low risk tolerance and the hyper-targeted nature diminishes the appeal to those constructing a balanced portfolio for the long run,” the analysis said further. “But for those seeking to tilt towards dividend paying stocks and enhance the current return generated from the equity side of a portfolio, KBWD can be a very attractive option, as the effective dividend yield may be in excess of 10%.”

For more news and information, visit the Innovative ETFs Channel.