“Artists often have no idea what they’re going to create. They make art in order to know what they are planning. Buchman quotes Picasso: ‘To know what you’re going to draw, you have to begin drawing.’”

Russ Roberts Wild Problems

The View from 30,000 feet

Last week was a relatively light week in economic data in the US, with a heavy focus on global central banks. The dispersion is widening in global central bank policy. Global central banks have been united in their use of policy to target lower inflation. Sentiment indicators have been universal in communicating consumers and companies are very uncomfortable with policy pressures, which have amounted to providing a feeling of stomping on the brakes down a steep mountain road filled with potholes, without passenger’s wearing seatbelts. As people have been flung about the vehicle, some are relatively unscathed, while others are bruised and banged up. When anyone onboard is asked how they feel about the ride, and the answer is pretty much the same – it’s terrifying. This is shown in sentiment data. The bad news is, the ride may not be over, and depending on who’s driving each country’s bus, there might still be a long way to the bottom. The good new is, at this point, the injuries seem relatively minor, and some of the buses are nearing the bottom.

- Central banks around the world are having varying levels of success in the battle against inflation

- Optimism around earnings in second half of the year weighted heavily towards mega cap winners of 2023

- China is facing structural headwinds that could challenge Emerging Market index performance

- The most Frequently Asked Question from client’s this week: Why are macro strategists so bearish?

Central banks around the world are having varying levels of success in the battle against inflation

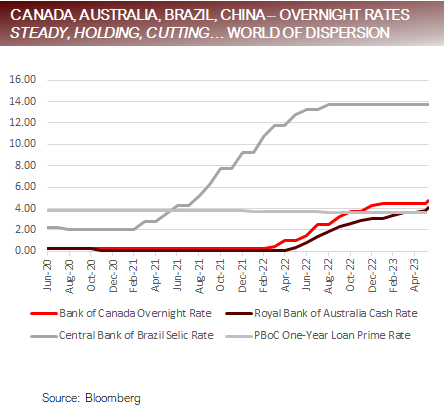

- In the bumpy road towards central policy normalization, countries are separating into three buckets: Not there yet, Don’t know how close we are, Might be there.

-

- Not there yet: Surprise hikes last week from Bank of Canada and Royal Bank of Australia highlight their battle against inflation may be far from over.

-

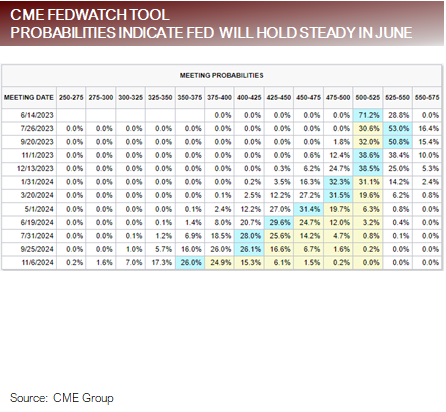

- Don’t know how close we are: Implied volatility probabilities indicate that US Federal Reserve will pause in June and with a coinflip on if on if they stay on hold or hike again in July.

-

- Might be there: Brazil showing signs that inflation is slowing faster than expected and beginning to talk about easing.

- Bottomline

- Over the last year global central bank policy has been mostly uniform, but due to the unique dynamics of each economy the impacts of higher rates has had varying effects for each country and the lingering causes and impacts of inflation are slightly different for each country. As a result, countries will exit their respective hiking cycles at different times, which will have major investment and FX considerations.

Entering a world of dispersion of central banks policy rates – economy specific policy

Optimism around earnings in second half of the year weighted towards mega cap winners of 2023

- Earnings for the S&P500 are expected to fall in Q2 2023 by -6.4% If this happens, Q2 will be the worst quarter for earnings since Q2 2020. To put this in context, the 5-year average growth rate of S&P500 earnings is +13.4% and the 10- year average is +8.7%. 7 out of 11 sectors are expected to have negative earnings growth in Q2 2023.

- After Q2, analyst projections are that earnings health will rebound, with Q3 projected grow 8% and Q4 projected to grow by 8.2%. By Q4 2023, the expectation is that 9 out of 11 sectors will be reporting positive earnings growth, with 5 sectors having double digit earnings growth.

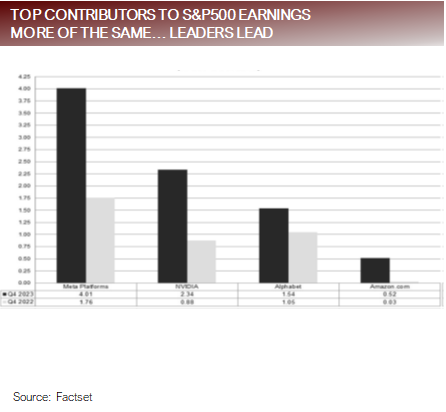

- At the company level, it’s expected to be more of the same from the first half of 2023, with Amazon, Meta, Alphabet and Nvidia being the largest contributors to earnings growth, each expected to grow earnings over 100% over the previous year. Excluding these companies, the S&P500 earnings estimate for Q4 would fall roughly in half.

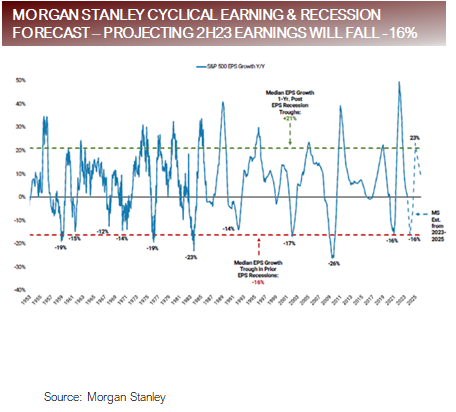

- Mike Wilson of Morgan Stanley commented last week that bullish investors have two key risks to their assumptions:

- The impact of rate hikes is behind us

- That expansion in earnings in consumer cyclicals and tech may face challenges due to weakness in other areas of the economy.

- Goldman Sachs and Bank of America have landed on the other side of the Goldman’s Kostin noting that there have been 9 episodes since 1980 where there was a bubble in leadership which broadened out, and Bank of America’s Subramanian noting that 92% of the time once a bull market has started, the index was higher 12 months later.

- Bottom Line

- Analysts’ projections for higher earnings have been battling macro strategists calls for headwinds all year and winning. This dynamic along with having an alternative that provides income (cash) has kept manager exposures lean all year. Deutsch Bank published a piece late last week indicating that 90% of active managers have missed the 2023 rally

Bears predicting earnings will contract in 2H23; Bulls relying on mega caps to pull markets higher

China is facing structural headwinds that could challenge Emerging Market index performance

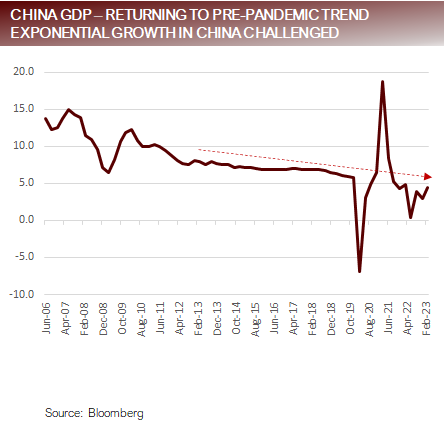

- China’s economy has been on a steady trajectory of lower growth since 2010, falling from a peak annualized rate of +12.2% in 2010 to +5.8% at the end of To put this in context, from the beginning for 2000 to the end of 2006, China’s GDP grew at an average rate of +10.0%.

- Internally, the quality of China’s growth has been diminished for the last decade, with large parts of GDP growth driven by infrastructure spending and expansive real estate projects that are in shambles and have led to the creation of entire “ghost cities”.

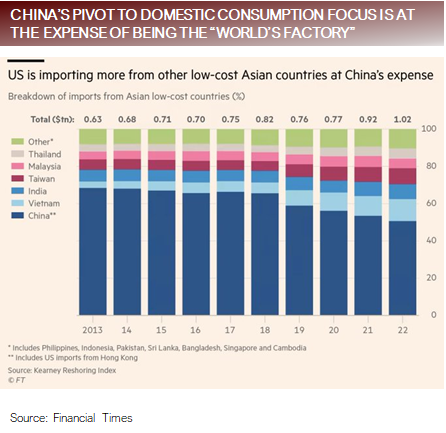

- Xi has abandoned his predecessor’s policies of adopting western ideals to become the “world’s factory”, and attempting to replace the driver of demand from international to domestic to create and environment where Chinese brands compete with Western brands for dominance.

- China is facing a demographic After peaking with 1.4b people, the Chinese population is projected to collapse by 50% to 75% by the turn of the century.

- With China representing 27% of the Emerging Market Index, persistent weakness in China could represent a headwind for index appreciation, the opposite of what the S&P500 is experiencing, where the largest weight could be a drag on index performance and instead of lifting it higher.

China’s transformation to a domestic led economy will mean structurally lower growth rates

FAQ: Why are macro strategists so bearish?

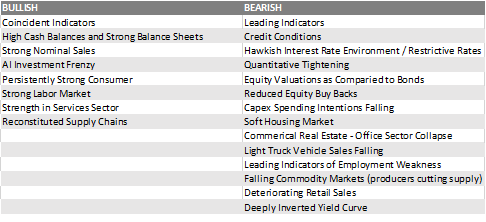

- The BULL / BEAR SCORECARD leans firmly in favor of the bears from a macro perspective.

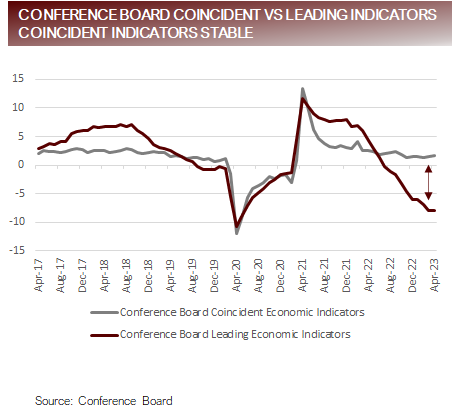

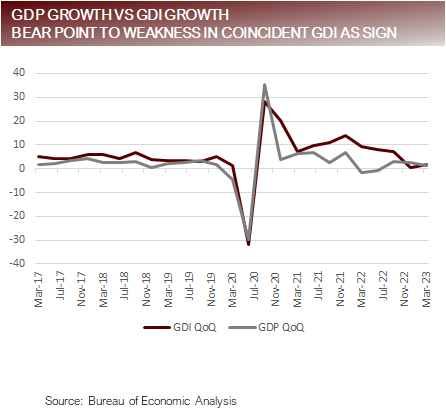

- The major issue that bears face is that much of the bearish data is attached to soft/sentiment indicators, as well as other leading indicators and historical relationships, while the bullish data is attached to hard data and coincident indicators.

- Ultimately, as long as the employment market holds, there are excess cash balances to burn through from the pandemic stimulus and there is inflation, which supercharges nominal earnings, the bull case may have legs.

- The bull case has been further emboldened by the AI Frenzy, which is obfuscating underlying weakness in large swaths of the market and economy.

An unusual gap has developed between leading and coincident indicators

Putting it all together

- Closing in on the June Fed decision, probabilities are indicating the Fed will pause. There is a widening dispersion between global central banks with some banks, such as Australia and Canada, struggling with persistent inflationary pressures and returning to hiking, while other’s, such as Brazil, are experiencing reduced inflationary pressures and talking about cutting rates.

- The narrow rally in the S&P500 looks set to continue, with projections for earning growth in the second half of 2023 heavily weighted towards the winners of the first part of the year. This has led some of Wall Street’s largest firms, including Goldman Sachs and Bank of America, to update their forecasts for the rally to Others on Wall Street, such as Morgan Stanley, continue to point towards historical relationships that indicate earnings will struggle.

- Much of the debate between bulls and bears is centered on the continued strength in coincident data being driven by excess savings from pandemic fueled stimulus and the strong labor market, contrasted against an overwhelming number of leading indicators that have historically shown strong relationships to recessions.

For more news, information, and analysis, visit the Innovative ETFs Channel.