Cocoa futures have skyrocketed this year due to particularly dry weather in West Africa. Per the Wall Street Journal, the most-actively traded cocoa futures have risen about 12% this year (and 11% in February alone) to $2,811 per metric ton, putting it on track for being the highest monthly level since April 2018.

If this lack of rainfall in the region persists, it could hurt the crop scheduled to be harvested in April. This could require more beans to make the same product.

“You see cocoa futures going up and your chocolate bar is going to be more expensive,” Peter Mooses, a trader at RJO Futures, told the Journal. “If we see hot temperatures with no rain, this trend of [prices] moving higher is really going to continue.”

Cocoa beans, which finished 2021 down 3.2%, are one of several commodities to see prices climb recently, including sugar, soybeans, and arabica coffee.

All of this could have a huge impact on chocolate production in the U.S., and Hershey Co. has revealed that, despite adding production lines and hiring more workers, it’s been unable to keep up with the demand for Valentine’s Day candy this year. Meanwhile, Anthony-Thomas Candy Co.’s cocoa supply contract is ending soon, and its next contract is expected to cost the chocolate maker noticeably more.

“We’ve been told that it will be a change from what we’re used to,” Nick Trifelos, a sales and marketing manager at chocolate maker Anthony-Thomas Candy Co., told the Journal. “We know that it will be a noticeable difference.”

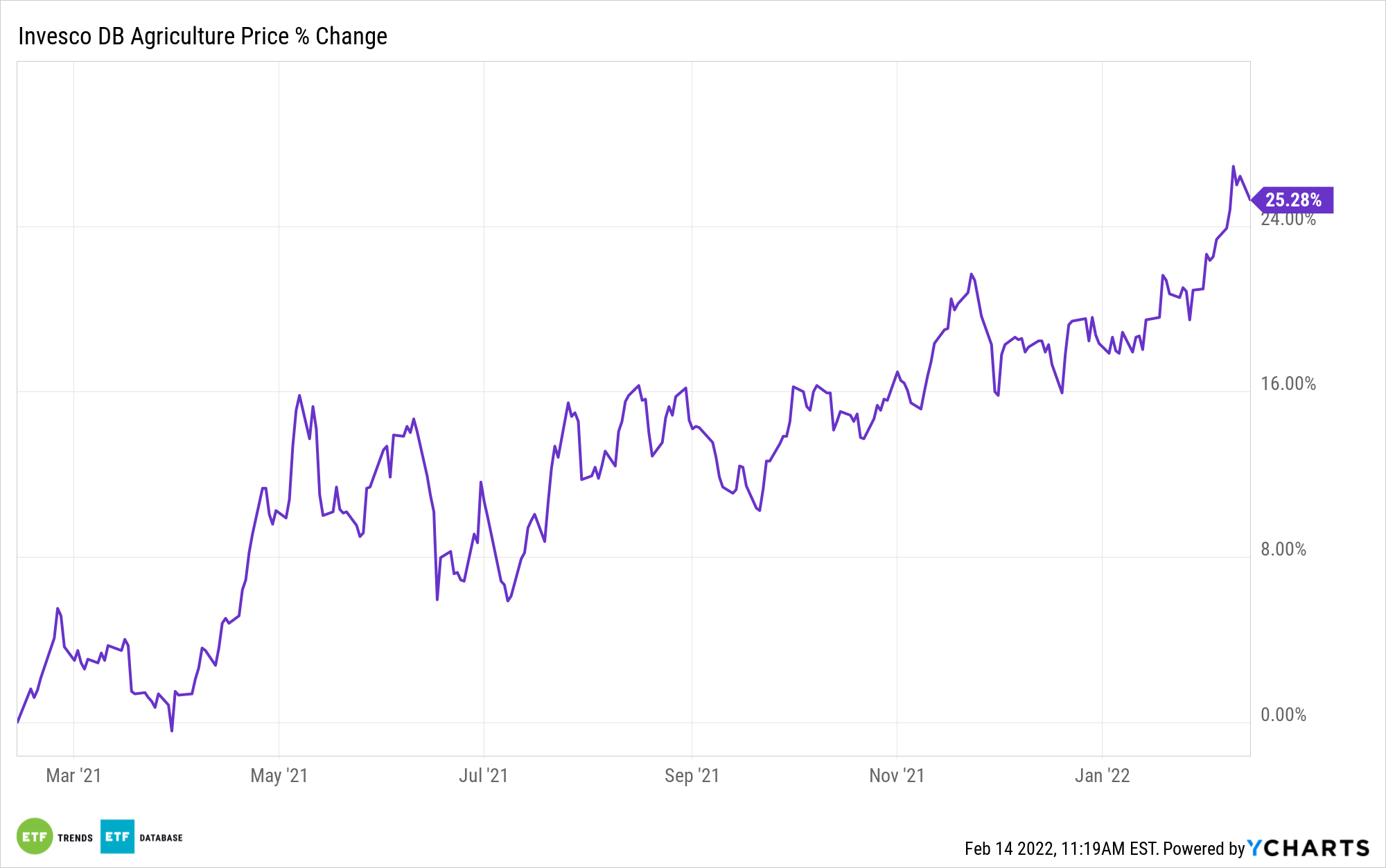

Cocoa is 11% of the Invesco DB Agriculture Fund (DBA), which makes the fund one of the few commodity funds that offers substantial access to the market.

DBA invests in a diversified basket of various agricultural natural resources. The fund seeks to track changes in the level of the DBIQ Diversified Agriculture Index Excess Return plus the interest income from its holdings of primarily U.S. Treasury securities and money market income.

The index is a rules-based index composed of futures contracts on some of the most liquid and widely traded agricultural commodities. The fund and the index are rebalanced and reconstituted annually in November.

DBA has an expense ratio of 0.93%.

For more news, information, and strategy, visit the Innovative ETFs Channel.