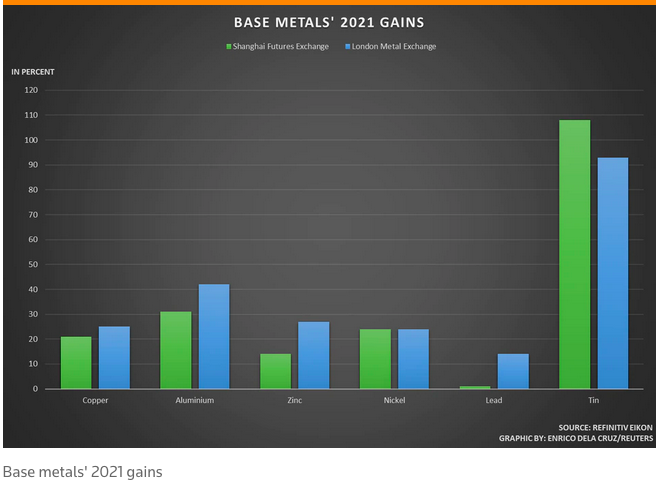

Chinese demand drove base metals in 2021 as the country’s economy improved despite headwinds like the Evergrande crisis and the ongoing effects of the COVID-19 pandemic.

Even as the global economy continues to recover from COVID-19, some analysts are cautious moving forward.

“China has been a primary source of demand for base metals since 2003, but we think this trend has started to come to an end,” said Justin Smirk, senior economist at Westpac in Australia.

“With the decline of investment and production as key growth drivers, this will see diminishing incremental economic growth and a reduction in materials demand as a share of output,” Smirk said.

Factory activity in China accelerated during the month of December, but it could be a temporary tick higher. A downturn in real estate development and other factors could continue to drag down the economy heading deeper into 2022.

“Looking to January, we expect the manufacturing PMI to fall to 50.0, weighed on by the stricter-than-usual anti-pollution measures to ensure blue skies for the upcoming Winter Olympics that will start in early February and contracting demand as result of the property downturn and slowing export growth,” Nomura economists explain in a note.

It’s not all doom and gloom, however. The Chinese central bank said that it would keep monetary policy flexible to allow for growth stabilization and provide businesses with lower financing costs.

“In our view, 2022 should bring more targeted easing to engineer a soft landing and support SMEs, high-tech and innovation firms, advanced manufacturing and green industries,” said Bruce Pang, head of macro and strategy research at China Renaissance Securities.

An ETF to Get Base Metals Exposure

Investors looking to get exposure to base metals without having to pick and choose which metal to focus on can have it all with the Invesco DB Base Metals Fund (DBB). The fund seeks to track changes, whether positive or negative, in the level of the DBIQ Optimum Yield Industrial Metals Index Excess Return™ plus the interest income from the fund’s holdings of primarily U.S. Treasury securities and money market income less the fund’s expenses.

“This ETF offers exposure to a basket of base metals, including copper, zinc, and aluminum,” an ETF Database analysis says. “As such, DBB can be a tactical tool for investors with a bullish outlook on this corner of the commodities market.”

For more news, information, and strategy, visit the Innovative ETFs Channel.