Initial public offerings (IPOs) like Uber and Lyft may have had investors wishing they never took those rides in 2019, but what could be in store for 2020?

“This was not quite the banner year for tech initial public offerings that private investors had hoped for. All told, 49 tech companies went public in 2019, raising $25.7 billion,” an article in The Information noted. “That compared with 54 IPOs raising a total of $20.8 billion last year, according to Dealogic. But while the overall amount raised was higher, several high-profile IPOs haven’t performed anywhere near as well as expected.”

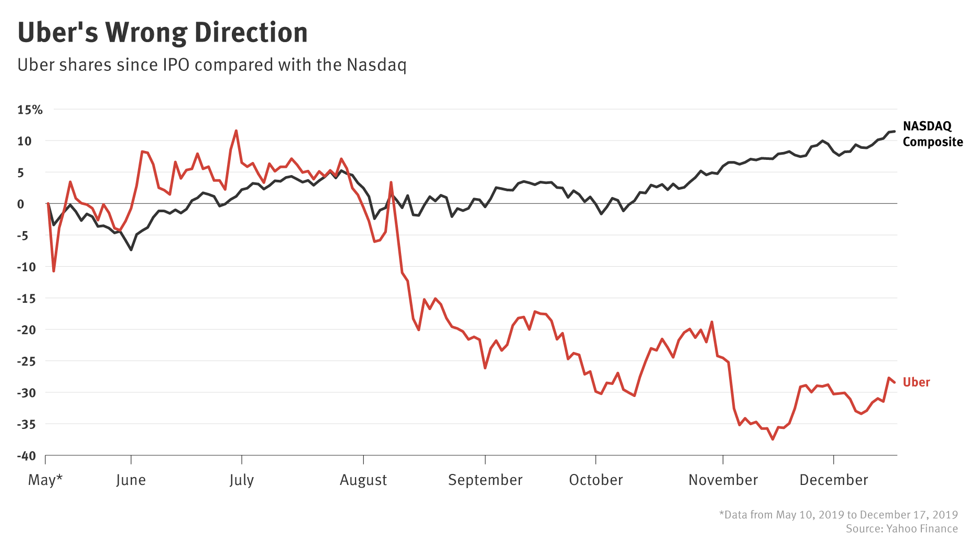

“Both Uber and Lyft are trading about 34% below their IPO prices, while Pinterest stock has fallen to 4% below its IPO price after initially trading much higher,” the article added. “There were a few bright spots in 2019, notably enterprise software firms Zoom Video, still trading 83% above its IPO price, and CrowdStrike, trading 42% above its IPO price, even though both have fallen from their highs. Their performance reflects investor confidence in the enterprise software business.”

White Elephant IPOs

It hasn’t been all coal in Christmas stockings for IPOs, however. While IPOs have been akin to a “white elephant” Christmas gift in an investor’s portfolio—something they’d like to give away, but some IPOs have been the gifts that keep on giving as in the case of three specific companies—Beyond Meat, Zoom Video and Palomar Holdings.

Investors can get broad exposure to IPOs via the Renaissance IPO ETF (NYSEArca: IPO). IPO seeks to replicate the price and yield performance of the Renaissance IPO Index, which is a portfolio of companies that have recently completed an initial public offering (“IPO”) and are listed on a U.S. exchange.

Another fund worth looking at is the First Trust US Equity Opportunities ETF (NYSEArca: FPX). FPX seeks investment results that correspond generally to the price and yield of an equity index called the IPOX®-100 U.S. Index, which seeks to measure the performance of the equity securities of the 100 largest and typically most liquid IPOs, including spin-offs and equity carve-outs of U.S. companies.

For investors seeking IPO opportunities around the globe, the Renaissance International IPO ETF (NYSEArca: IPOS) adds an international spin to the IPO market. IPOS tracks the rules-based Renaissance International IPO Index, which adds sizeable new companies on a fast-entry basis with the rest upon scheduled quarterly reviews. Current IPOS holdings include SoftBank Corp, Xiaomi and China Tower Corp.

For more market trends, visit ETF Trends.