Bull vs. Bear is a weekly feature where the VettaFi writers’ room takes opposite sides for a debate on controversial stocks, strategies, or market ideas — with plenty of discussion of ETF ideas to play either angle. For this edition of Bull vs. Bear, Elle Caruso and Karrie Gordon debate if investors should use low volatility ETFs to navigate high volatility in the market.

Elle Caruso, staff writer, VettaFi: Hi, Karrie! I’m looking forward to discussing low volatility ETFs with you. Volatility eased slightly in U.S. equities in September after increasing a bit the month prior. However, October has historically been the most volatile month for the S&P 500, and investors are bracing for this year to be no exception.

With great uncertainty in the market surrounding inflation, interest rate hikes, a potential recession, geopolitical factors, and upcoming third-quarter earnings reports, advisors need to be mindful of the risks they are taking.

Experts anticipate volatility may spike this month and remain elevated, making it important to prepare client portfolios. Many investors have trouble stomaching volatility and will divest at the worst times, hurting their total return.

Advisors can help clients stomach volatility and maintain target equity exposure during choppy markets by using low volatility ETFs. Low volatility ETFs are a great solution, allowing investors to participate in the upside while minimizing downside risk.

Some ETFs that focus on low volatility stocks include the Invesco S&P 500 Low Volatility ETF (SPLV), the iShares MSCI USA Min Vol Factor ETF (USMV), and the Fidelity Low Volatility Factor ETF (FDLO).

Harnessing Volatility for Gains

Karrie Gordon, staff writer, VettaFi: Elle, I’m happy to be back discussing volatility with you. It’s a hot-button topic and a word I tend to see frequently across media and market analyses this year. So let me jump right in.

Volatility became a word with a boogeyman vibe for markets in the last couple of years — and for good reason. Investors, and therefore markets, have become accustomed to a low-volatility environment in the last decade. Portfolios are built largely around more predictable forward-looking trajectories than what we’re experiencing currently.

As uncertainty has spiked, so too has market volatility. While it can be painful for portfolios, volatility in itself isn’t an inherently bad thing. In these times of increased volatility, there is opportunity in a number of funds that invest in the Cboe Volatility Index (VIX) via futures.

It’s important to understand that the VIX doesn’t measure daily price fluctuations in markets. Instead, it captures what the market thinks of volatility in the next 30 days. It does so by measuring S&P 500 Index options prices. It’s a short-term, forward-looking gauge. As such, exposures to the VIX via futures should also be short-term.

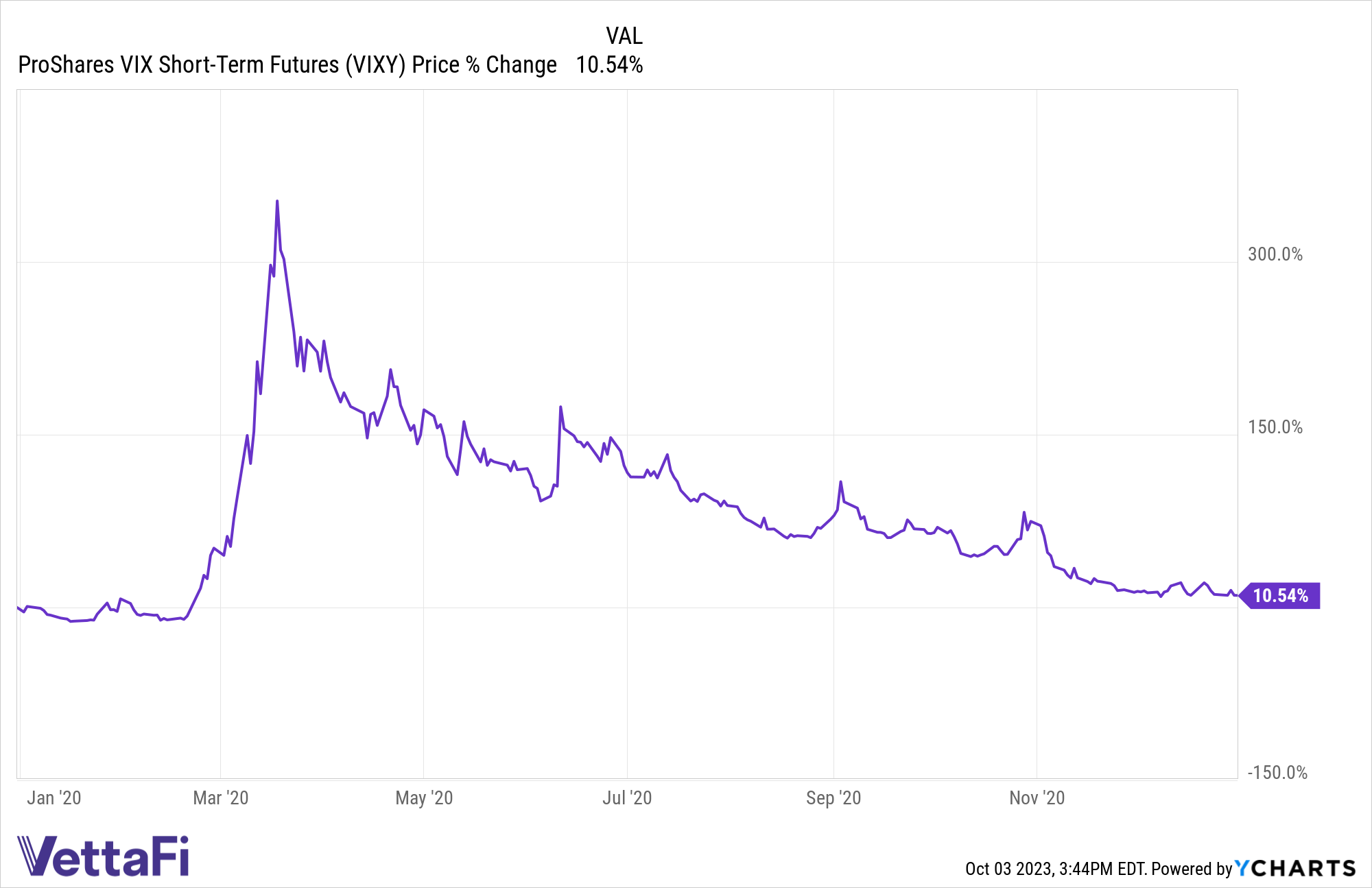

The great thing about the VIX is that, historically, it carries a negative correlation to stocks. This means that when stocks drop precipitously, the VIX typically rises sharply. In an environment when recession threatens, having short-term exposure to the VIX could prove beneficial. Investors back in 2020 certainly benefited from short-term VIX futures exposure.

You need look no further than the performance of the ProShares VIX Short-Term Futures (VIXY) in 2020. As the COVID-19 pandemic took hold in February, VIXY climbed. By March 18, 2020, the fund peaked at a 352% gain compared to January 1 levels.

There is value in short-term VIX futures exposure, particularly when market gyrations intensify.

Last Month Could Be a Sign of What’s to Come

Caruso: Equities across the cap spectrum fell last month, ending the third quarter in the red. The S&P 500 posted its second consecutive month of broad declines, falling 4.9% in September. Notably, this marked the first time the benchmark had fallen in two consecutive months this year.

Even as the third quarter erased some of the S&P 500’s gains, the index is still up 13.1% for the year as of the end of September. Investors can position their portfolios more defensively to safeguard the gains achieved.

Adding a defensive strategy such as the Invesco S&P 500 Low Volatility ETF (SPLV) could help investors protect returns if volatility increases. The fund is a useful tool for achieving more stability in portfolios to avoid big daily moves.

A single-factor low volatility ETF like SPLV can keep investors exposed to large-cap stocks while limiting risk by focusing on more defensive stocks. Lower volatility stocks might not climb as high if gains continue; however, they can provide protection if a pullback occurs.

Last month, SPLV’s underlying index outperformed the S&P 500 by 100 basis points, highlighting the value that a low volatility ETF can add to portfolios.

You Can Benefit From Reduced Volatility Too

Gordon: There is definite value in volatility mitigation strategies, I won’t argue that. For investors seeking to boost returns in a challenging market environment, however, I think the inclusion of volatility-capture strategies is worth consideration.

Gordon: There is definite value in volatility mitigation strategies, I won’t argue that. For investors seeking to boost returns in a challenging market environment, however, I think the inclusion of volatility-capture strategies is worth consideration.

Though I may be a bear, I’m not proposing investors bloat their portfolios with VIX futures strategies by any means. The only fat bears we need around here are those in Katmai National Park. What I am saying is that there is potential value in educated, short-term exposure to VIX futures and derivatives.

I cannot underscore enough the importance of understanding the complexity of these products. They’re never meant to be held for anything other than short-term. They’re only for very experienced investors and require an enormous amount of due diligence to understand. Add in funds that offer leveraged and inverse options on the VIX, and you can see the layers of complexity.

That said, let’s talk about another core benefit. Because these strategies provide exposure to the VIX through futures, there are both long and short VIX futures ETFs. Investors can hedge against, or speculate, on volatility increasing or decreasing respectively. Funds like VIXY offer long exposure on short-term VIX futures and generally benefit when volatility soars.

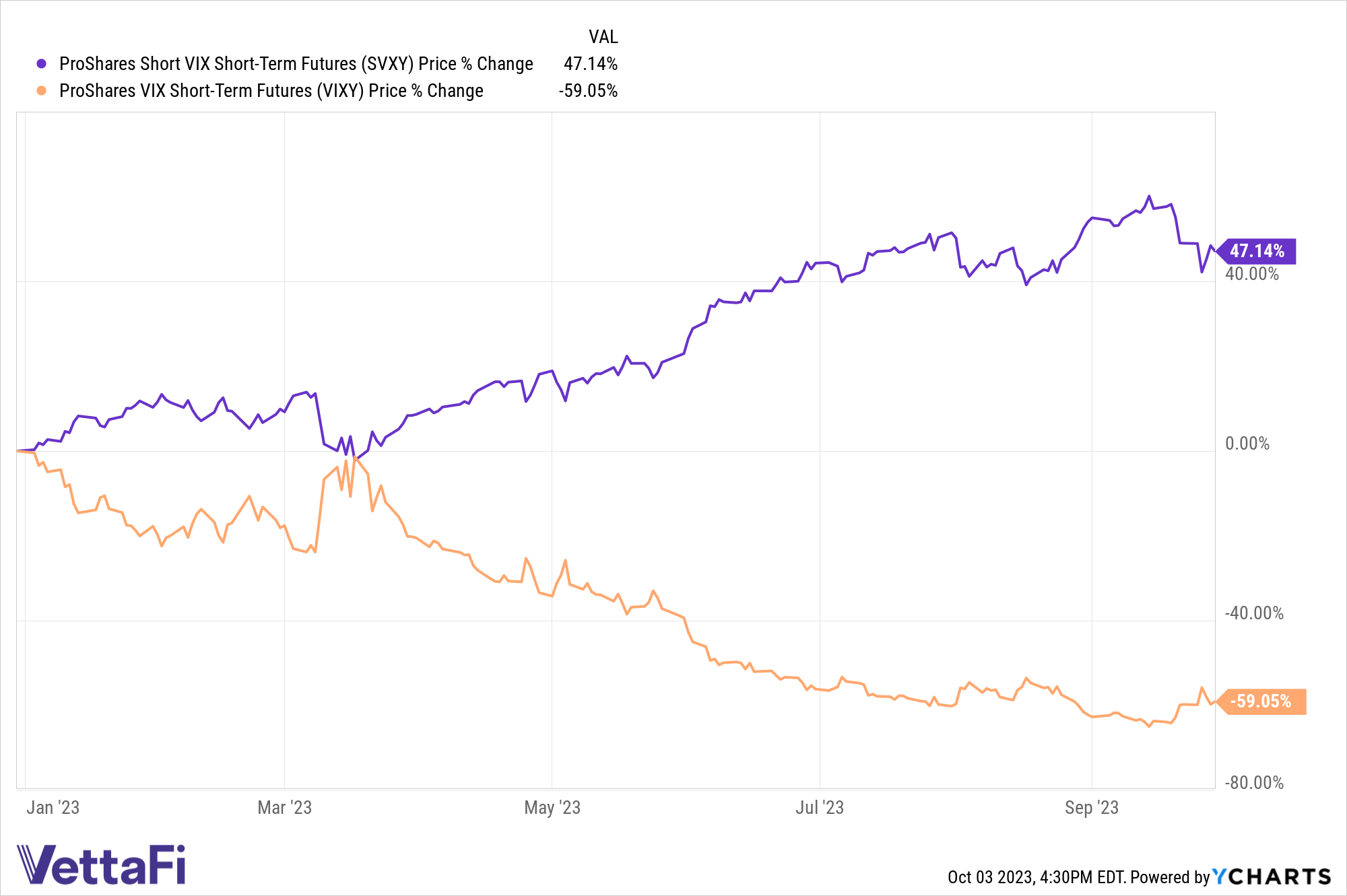

However, in times of marginal or reduced volatility, short VIX futures ETFs provide the opportunity for investors to capitalize on the lack of sharp volatility spikes. A short futures position benefits when the security or index tracked drops. Given the relatively solid equity performance of the first three quarters this year, short VIX short-term futures exposures did well over the same period.

The ProShares Short VIX Short-Term Futures ETF (SVXY) rose 47.14% in the first three quarters, while VIXY fell 59.05%. You can see the effect of the mini-banking crisis in March on both funds. The subsequent volatility spike was reflected in both funds’ temporary reversals.

With a challenged near-term forecast, investors have the ability to express their outlook on volatility through short or long VIX futures ETFs.

Multifactor Strategies Targeting Low Volatility Stock Have a Compelling Track Record

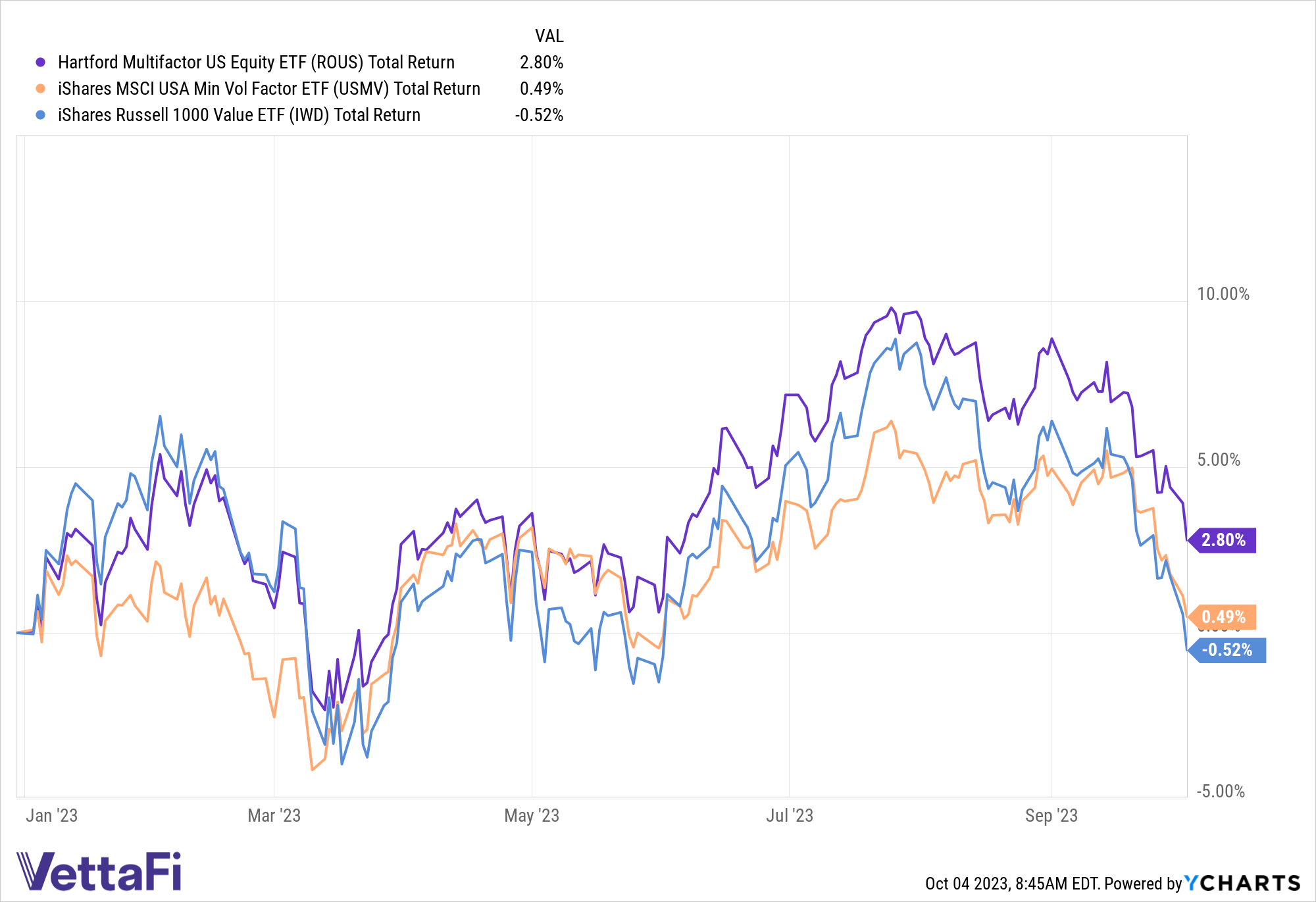

Caruso: I’ve focused on single-factor low volatility ETFs so far, but it’s important to also consider multifactor ETFs that target low volatility stocks. These strategies may be better positioned to behave defensively and have a strong track record of outperforming peers.

The Hartford Multifactor US Equity ETF (ROUS), which targets value stocks exhibiting lower volatility, has gained 2.8% year to date, while the iShares Russell 1000 Value ETF (IWD) has lost 0.5%, and the iShares MSCI USA Min Vol Factor ETF (USMV) has climbed just 0.5%. Performance suggests layering defensive factors, as a multifactor strategy does, could generate outperformance.

Multifactor ETFs like ROUS seek to target desired return-enhancing factors and reduce exposure to unrewarded risk exposures. ROUS is a defensive value ETF, aiming to provide more balanced exposure to U.S. large-caps while also dampening volatility compared to benchmarks.

The ETF is designed to offer 15% less volatility than traditional cap-weighted indexes over a full market cycle. Notably, about 75% of ROUS’ holdings demonstrate lower volatility than the Russell 1000 Index.

Targeting individual factors often leads to undesired qualities, something that might draw investors to multifactor strategies. For example, targeting the low volatility factor also introduces a tilt away from quality and momentum.

However, multifactor ETFs using an integrated approach have demonstrated their ability to enhance returns and mitigate volatility and other risks. This is a compelling opportunity for investors, particularly in the current market environment.

Plus, unlike VIXY and SVXY, which charge 105 and 95 basis points, respectively, multifactor ETFs cost around as much as other equity funds, enabling them to be a core holding in portfolios.

An Alternative Play on Volatility as Correlations Rise

Gordon: Let me expand on my earlier point regarding volatility as the norm. Most traditional 60/40 portfolios are built for the environment of reduced volatility and low correlations of the last decade. It was an artificially created market environment by the Fed and has come to a conclusive and painful end. As volatility returns, and stocks and bonds move increasingly in correlation, it creates a number of pain points for traditional portfolios.

In a higher rate regime for the foreseeable future, bonds face a challenging environment. Economic uncertainty and recession risk challenge equities. Meanwhile, the removal of the Fed put led to a reversion to mean for volatility. This in turn creates a higher likelihood of periods of stock and bond correlations over any given timeline.

The addition of noncorrelated exposures allows investors the opportunity to harness the effects of increased volatility in markets. Diversification and noncorrelation become necessary complements to stocks and bonds, particularly in periods of heightened volatility.

It’s an environment that trend-following strategies generally do well in, when volatility and correlations are high. You need look no further than the performance of the iMGP DBi Managed Futures Strategy ETF (DBMF) last year to see the potential benefits. At its height, the fund was up nearly 35% and ended the year up 21.5% on a total returns basis when the S&P 500 closed down 18% for the year.

Managed futures are the ultimate trend-following strategy. They take long and short positions on four core asset classes through the futures market. Managed futures provide a noncorrelated return stream to stocks and bonds by investing in equities, rates, currencies, and commodities. While they generally hold their own in times of low volatility, when volatility spikes, they have the potential to deliver outperformance when little else does.

It’s an alternative play on harnessing the potentials of a higher volatility environment. Other funds to consider are the Simplify Managed Futures Strategy ETF (CTA), the KFA Mount Lucas Strategy ETF (KMLM), and the WisdomTree Managed Futures Strategy ETF (WTMF).

Elle, it’s been great talking volatility with you. I think there’s strong value in reducing portfolio volatility as you’ve argued. But I firmly believe there is equal value in harnessing opportunities specific to high volatility environments. Now if you’ll excuse me, this bear is off to vote since it’s fat bear week.

For more news, information, and analysis, visit the Innovative ETFs Channel.