Investors may be looking to add exposure to semiconductor ETFs ahead of Taiwan Semiconductor Manufacturing (TSM)‘s earnings this week.

On Thursday, Taiwan Semiconductor Manufacturing will report its March quarter results and offer its near-term outlook. Investors looking forward to the report can gain industry exposure with the Invesco PHLX Semiconductor ETF (SOXQ) and the Invesco Dynamic Semiconductors ETF (PSI).

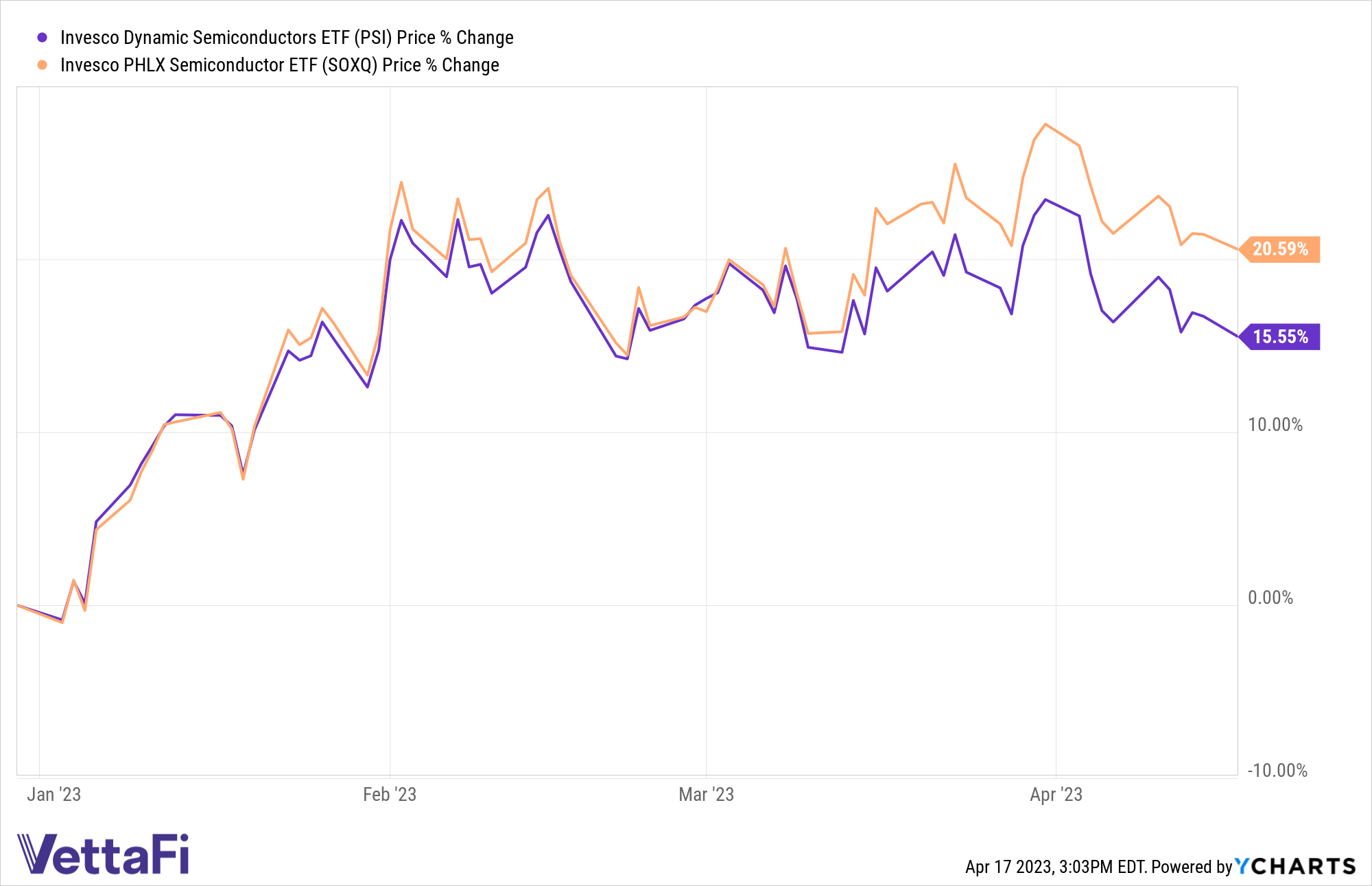

SOXQ and PSI are each outpacing broader markets this year. SOXQ has climbed 20.6%, while PSI has increased 15.6% year to date as of April 14.

Notably, four of the 10 top-performing ETFs by five-year returns are focused on semiconductors. PSI is 15thon the list, returning 17.71% annualized over a five-year period, according to ETF Database. SOXQ was incepted in 2021 and has not yet amassed a five-year track record.

SOXQ is based on the PHLX Semiconductor Sector Index, which measures the performance of the 30 largest U.S.-listed securities of companies engaged in the semiconductor business. Semiconductors include products such as memory chips, microprocessors, integrated circuits, and related equipment that serve a wide variety of purposes in various types of electronics, including personal household products, automobiles, and computers, among others.

SOXQ charges 19 basis points and has $104 million in assets under management.

PSI is based on the Dynamic Semiconductor Intellidex℠ Index, which is designed to provide capital appreciation by thoroughly evaluating companies based on a variety of investment merit criteria, including price momentum, earnings momentum, quality, management action, and value. The index is comprised of common stocks of 30 U.S. semiconductors companies.

PSI has attracted $537 million in assets since its inception in 2005. PSI charges 56 basis points.

For more news, information, and analysis, visit the Innovative ETFs Channel.