Explaining consumer spending involves a lot of contradictions. Consumer spending is strong. But consumers are stretched. Consumers are shifting spending to services like restaurants, travel, and concerts and away from goods. But certain goods like consumer staples should remain strong in economic downturns. E-commerce has been resilient relative to total retail sales. But only for certain segments. This note discusses those contradictions along with retail trends for 2024.

1 – Discretionary vs. Staples Means Less in This Environment

There have been lots of discussion about the consumer. However, there are significant differences between spending on consumer discretionary and consumer staples. Consumer staples are products that are less sensitive to economic cycles. Consumers will purchase these products whether they have more or less money in their wallets. This includes necessities like groceries, household goods, and personal products. Additionally, this also includes certain types of products and brands that are highly valued by consumers like tobacco products or Coca-Cola (KO). Consumer discretionary products are sensitive to economic cycles. Consumers will cut back on spending when they have less money. This includes autos, leisure, and apparel. These products either are not necessities or purchases that can be put off until a later date.

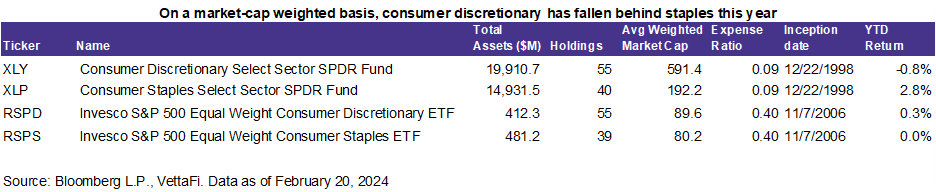

Many analysts, myself included, think consumer staples are cheap relative to consumer discretionary. However, that comes with a caveat. Consumer discretionary has remained strong because consumers now have a subjective definition of what endures during economic cycles. And in this current economic cycle, consumers haven’t yet decided to give up experiences like restaurants, travel, and concerts. On a market-cap-weighted basis, ETFs like the Consumer Discretionary Select Sector SPDR ETF (XLY) have fallen behind the Consumer Staples Select Sector SPDR ETF (XLP). But on an equal-weighted basis, staples and discretionary are about in line (and both flat) as discretionary remains resilient due to changing consumer habits.

2 – Retailers have fewer inventory issues, so there may be fewer discounts for consumers this year.

2 – Retailers have fewer inventory issues, so there may be fewer discounts for consumers this year.

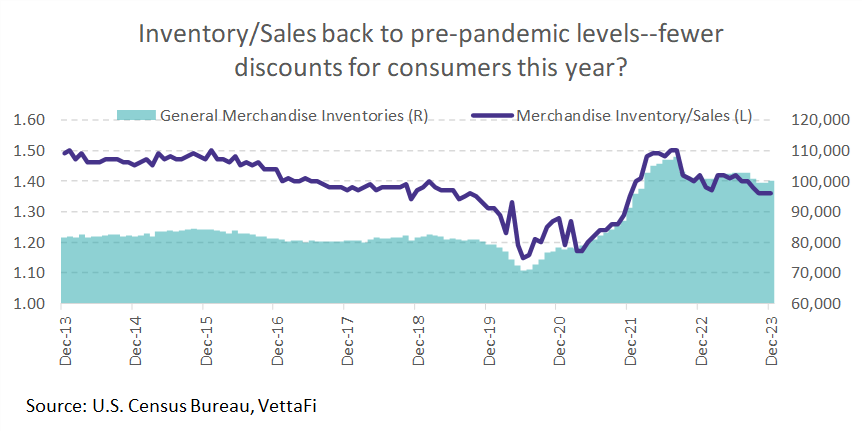

During the peak of the pandemic, retailers were overwhelmed by rising consumer demand for goods. They were not able to stock up on items quickly enough due to disruptions in the supply chain. Retailers ended up stockpiling and turning to a “just-in-case” model. That means keeping large inventories on hand to reduce the risk of running out of stock instead of a “just-in-time” model where inventory arrives just as it is needed. Those inventories accumulated (see chart above) as both consumer demand and supply chains normalized and retailers were stuck with massive amounts of inventory. This led to sales and deep discounts, which helped retain consumer demand strong despite higher inflation.

Currently, inventories are still higher than normal, but the general merchandise retail inventory/sales ratio has returned to pre-pandemic levels. This means retailers have enough inventory on hand to meet normal demand. So, they will likely have fewer discounts going forward. This may eat into consumer demand, but revenue may be balanced out by increased pricing.

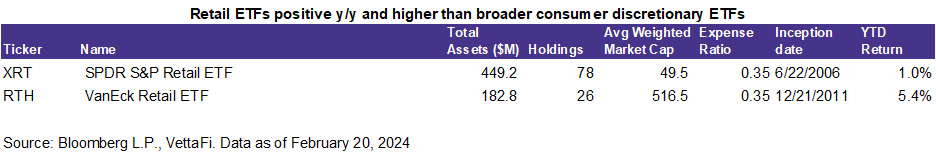

While retailers have been dampening their consumer spending outlook, much of that has already been priced in and ETFs specific to retailers like the SPDR S&P Retail ETF (XRT) and the VanEck Retail ETF (RTH) have outperformed broader consumer discretionary ETFs so far this year.

3 – E-commerce has been driving total retail sales, but not all e-commerce is created equal.

3 – E-commerce has been driving total retail sales, but not all e-commerce is created equal.

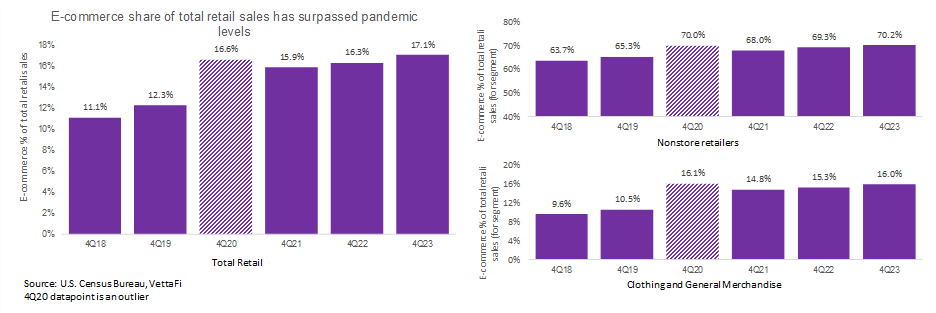

As consumers moderate spending, e-commerce as a percentage of total retail sales has remained resilient. 4Q23 U.S. e-commerce data show that e-commerce sales were 17.1% of total retail sales—now surpassing peak levels from the pandemic. The bulk of e-commerce growth is driven by small, low-value items with short replacement cycles. This includes clothing, accessories, and other general merchandise. Larger, high-value items like building products, furniture, and electronics have fallen out of favor as home buying and renovations have slowed down. Additionally, consumers are struggling to finance large purchases due to higher rates. So, consumers may be delaying large purchases while still maintaining spending on smaller purchases.

As more consumers utilize online shopping, retailers should benefit from higher profitability. First, a strong e-commerce framework can increase efficiencies in inventory management and client-facing online interfaces while supporting related channels like BOPIS (buy-online-pickup-in-store) and reverse logistics (returns). As more consumers use delivery services, it becomes easier for retailers with their own delivery fleets to fill their trucks and make several deliveries at once. Walmart (WMT), the largest retailer in the world has been growing its e-commerce sales for several years. In its most recent earnings release, the company reported that e-commerce sales increased by 17% y/y in the U.S. (while total U.S. sales grew only 3%), and e-commerce losses decreased by over 40% since last year due to some of those realized efficiencies.

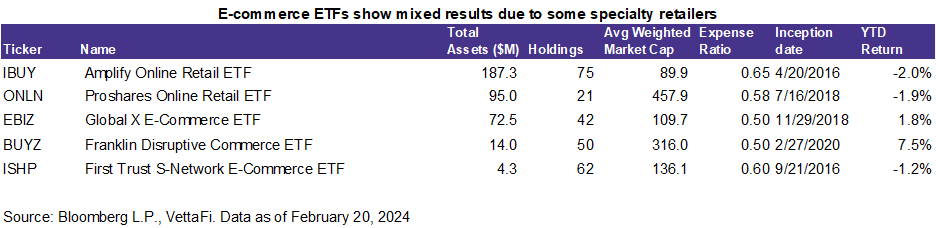

Performance for e-commerce ETFs has been mixed due to poor performance in some specialty retailers which have struggled to capture discretionary wallet share. But certain ETFs like the Global X E-commerce ETF (EBIZ) and the Franklin Disruptive Commerce ETF (BUYZ) have been positive y/y, and I expect many of these ETFs to remain resilient even when consumer discretionary spending weakens.

For more news, information, and analysis, visit the Commodities Channel.

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for ISHP and IBUY, for which it receives an index licensing fee. However, ISHP and IBUY are not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of ISHP and IBUY.