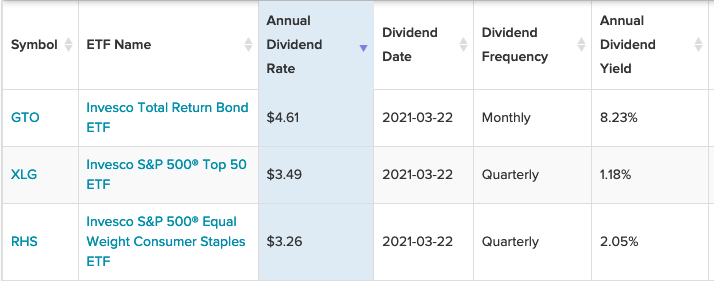

Even with Treasury yields ticking higher, fixed income investors still have to look elsewhere for more yield. One way is via income-producing ETFs and Invesco has investors covered with three funds that currently offer the highest annual dividend rates.

- Invesco Total Return Bond ETF (GTO): seeks maximum total return, comprised of income and capital appreciation. The fund will normally invest in a portfolio of fixed income instruments of varying maturities and of any credit quality. It will normally invest at least 80% of its net assets (plus any borrowings for investment purposes) in fixed income instruments, which may be represented by certain derivative instruments, and also include ETFs and closed-end funds (“CEFs”) that invest substantially all of their assets in fixed income instruments (which may include ETFs and CEFs affiliated with the fund).

- Invesco S&P 500 Top 50 ETF (XLG): seeks to track the investment results of the S&P 500® Top 50 Index. The fund generally will invest at least 90% of its total assets in the securities that comprise the underlying index. The index provider compiles, maintains and calculates the underlying index, which consists of the 50 largest members of the S&P 500® Index by float-adjusted market capitalization. The underlying index’s components are weighted by float-adjusted market capitalization.

- Invesco S&P 500 Equal Weight Consumer Staples ETF (RHS): seeks to track the investment results of the S&P 500® Equal Weight Consumer Staples Index. The fund generally will invest at least 90% of its total assets in the securities that comprise the underlying index. The underlying index is composed of all of the components of the S&P 500® Consumer Staples Index, an index that contains the common stocks of all companies included in the S&P 500® Index that are classified as members of the consumer staples sector, as defined according to the Global Industry Classification Standard (GICS).

Rumblings of More Stimulus Push Yields Higher

The current fixed income environment is seeing safe haven government debt yields push higher thanks to rumblings of more stimulus measures ahead. This time around, the focus is on giving business sectors a nudge forward to get the economy back to pre-pandemic normalcy.

“The move in yields comes a day ahead of President Joe Biden revealing details of his infrastructure plan,” a CNBC report said. “The recovery package is expected to include up to $3 trillion in spending across a swathe of sectors in an effort to bolster the U.S. economy.”

“HSBC strategists said in a note published Monday that ‘stimulus and any infrastructure plan are likely to prove to be a sugar rush for the economy given the secular headwinds,'” the report added.

For more news and information, visit the Innovative ETFs Channel.