What started as an book retailer has now turned into a global retail powerhouse as Amazon could be the most important company to watch in 2020. As such, investors should be keen on watching ETFs that have the heaviest holdings of Amazon.

It wasn’t an overnight success for Amazon–it took years in the making. The success highlights the notion that good things take time.

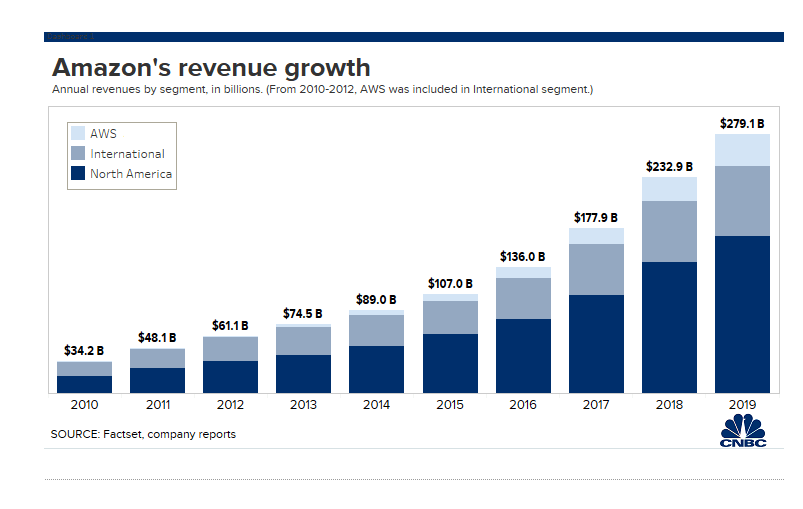

“What a difference a decade makes,” wrote Matt Rosoff in CNBC. “Over the last 10 years, Amazon has become one of the most powerful, respected and feared companies in tech, and well beyond. Revenue in its core business, e-commerce, has increased sevenfold from an already massive base of $34.2 billion. Yet Amazon still has only 40% of the overall e-commerce market in the U.S., according to eMarketer, and far less worldwide, leaving plenty more upside.”

One of the areas that will continue to help propel Amazon in 2020 will be cloud computing via its Amazon Web Services (AWS) platform.

“AWS has turned from an asterisk to the third-largest enterprise software business in the world, with an estimated $35 billion in sales this year, according to FactSet, trailing only Microsoft and Oracle,” wrote Rosoff. “Analysts project it will surpass Oracle in 2020. Cloud computing turned out to be one of the defining tech business trends of the decade, spurring Microsoft into reaction and saving what’s now considered “the other Seattle company” from its slow slide to irrelevance.”

3 ETFs to consider with heavy Amazon holdings:

- Fidelity MSCI Consumer Discretionary Index ETF (FDIS): seeks to provide investment returns that correspond generally to the performance of the MSCI USA IMI Consumer Discretionary Index. The index represents the performance of the consumer discretionary sector in the U.S. equity market.

- Consumer Discret Sel Sect SPDR ETF (NYSEArca: XLY): seeks investment results that correspond to the price and yield performance of publicly traded equity securities of companies in the Consumer Discretionary Select Sector Index. The index includes securities of companies from the following industries: retail; hotels, restaurants and leisure; textiles, apparel and luxury goods; household durables; automobiles; auto components; distributors; leisure products; and diversified consumer services.

- ProShares Online Retail ETF (NYSEArca: ONLN): seeks investment results, before fees and expenses, that track the performance of the ProShares Online Retail Index. The index tracks retailers that principally sell online or through other non-store channels. The index uses a modified market-capitalization weighted approach, is rebalanced monthly and is reconstituted annually. Retailers may include U.S. and non-U.S. companies. To be eligible, retailers must: be classified as an online retailer, an e-commerce retailer, or an internet or direct marketing retailer, according to standard industry classification systems; have a market capitalization of at least $500 million; have a six-month daily average value traded of at least $1 million; and meet other requirements.

For more market trends, visit ETF Trends.