The energy sector continues to light the major indices on fire, assets like the Invesco S&P SmallCap Energy ETF (PSCE) and Invesco Dynamic Energy Exploration & Production ETF (PXE) leading the way for Invesco funds the past week.

Rising oil prices have been fueling the energy rally since late last year, and that trend could persist through the summer.

“The energy sector has been the best performer in the U.S. stock market this year, but it isn’t too late to jump in, as the setup is still attractive for the reopening of the economy,” a MarketWatch article said. “On June 1, oil prices rose to a two-year high. And an analysis by GasBuddy showed gasoline demand in the U.S. at close to normal levels, possibly poised to hit record levels this summer.”

PSCE seeks to track the investment results of the S&P SmallCap 600® Capped Energy Index. The fund generally will invest at least 90% of its total assets in the securities of small-capitalization U.S. energy companies that comprise the underlying index.

These companies are principally engaged in the business of producing, distributing, or servicing energy-related products, including oil and gas exploration and production, refining, oil services, and pipelines. The fund has been an extraordinary performer this year, gaining 74%.

PXE seeks to track the investment results of the Dynamic Energy Exploration & Production Intellidex Index. The fund invests at least 90% of its total assets in the securities that comprise the underlying Intellidex.

The Intellidex is composed of common stocks of U.S. companies involved in the exploration and production of natural resources used to produce energy. These companies are engaged principally in the exploration, extraction, and production of crude oil and natural gas from land-based or offshore wells.

Like PSCE, PXE has been a strong performer this year, gaining 77%. Unlike the broad-based PSCE, PXE focuses specifically on the exploration aspects of energy.

Leading the S&P 500

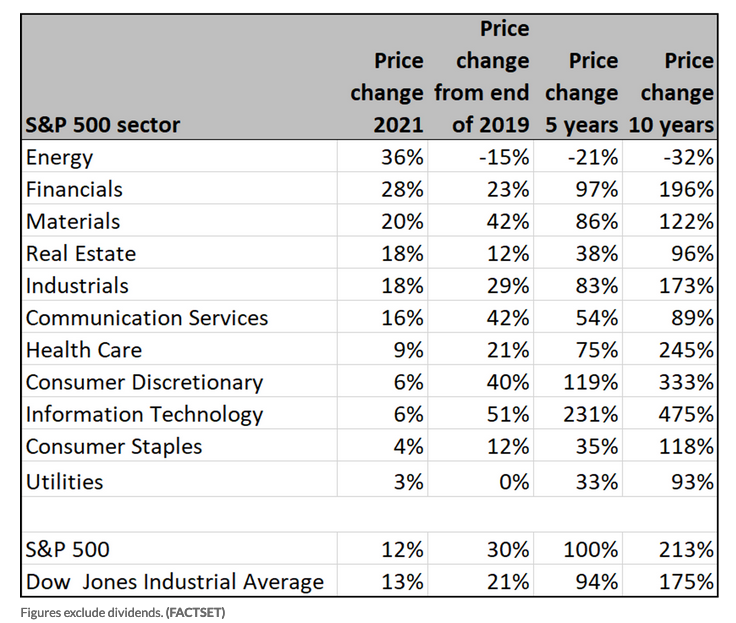

As mentioned, the energy sector has been a stellar performer thus far this year. That outperformance is also apparent when looking specifically at the S&P 500.

“The S&P 500 energy sector was up 36% for 2021 through the end of May,” the MarketWatch article said. “That’s the best sector performance in the benchmark index so far this year.”

For more news and information, visit the Innovative ETFs Channel.