Investing in a bank loan ETF can offer a compelling yield while helping maintain defensive portfolio positioning.

In the current environment, investors who want to generate as much yield as possible might look to bank loans instead of high yield bonds. Bank loans offer attractive income but are more conservative, adding less risk to portfolios than high yield bonds.

“With the Fed likely to slow the pace of its rate hikes advisors are likely looking for income alternatives. Senior loan ETFs incur less risk than traditional high yield bond ETFs,” Todd Rosenbluth, head of research at VettaFi, said.

The Invesco Senior Loan ETF’s (BKLN) has a 30-day SEC yield of 8.6% as of September 13. Compared to bank loan ETF category peers, BKLN takes a lower-duration, higher-quality approach.

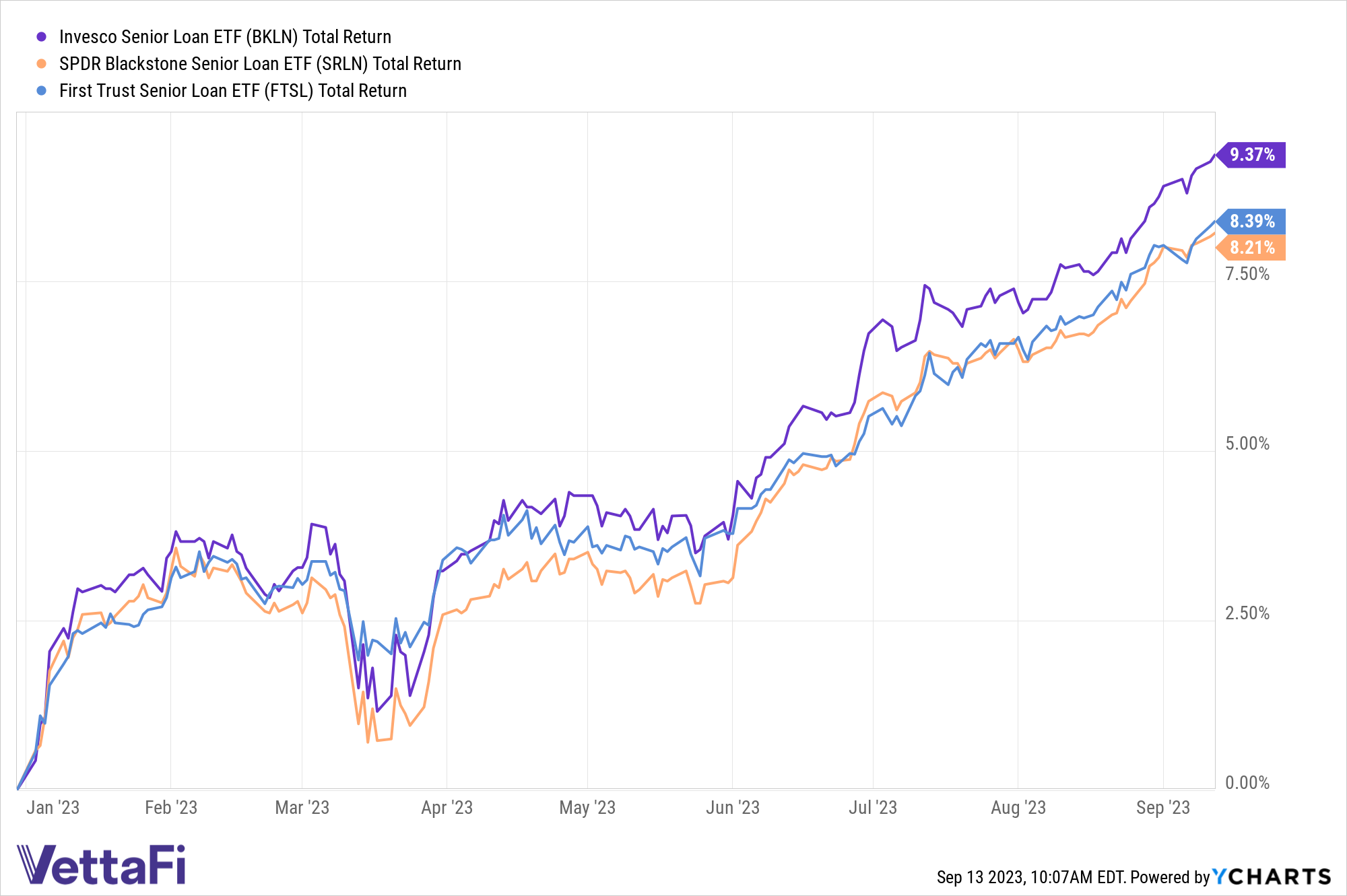

Notably, on a total return basis, BKLN has outpaced its chief competitors in the senior loan ETF category: the SPDR Blackstone Senior Loan ETF (SRLN) and the First Trust Senior Loan Fund (FTSL). SRLN and FTSL are both actively managed, while BKLN tracks the Morningstar LSTA US Leveraged Loan 100 Index.

Bank Loan ETF Performance and Flows

Year to date as of September 12, BKLN has climbed 9.4% while SRLN has gained 8.2% and FTSL has increased 8.4%, each on a total return basis.

Flows into BKLN have increased in recent months — a trend unique to the fund and not observed broadly across the bank loan ETF category. BKLN has accreted $212 million in the past month, while SRLN and FTSL have seen just $38 million and $27 million, respectively, in one-month flows.

Year to date, BKLN has seen $208 million in net flows. Meanwhile, SRLN has seen $1.5 billion and FTSL has seen $633 million in net outflows.

BKLN charges 65 basis points, while investors in SRLN and FTSL are paying more for active management. SRLN and FTSL charge 70 and 86 basis points, respectively.

For more news, information, and analysis, visit the Innovative ETFs Channel.