By using an objective, rules-based trend following strategy, Trendpilot ETFs automatically adjust based on three indicators:

-

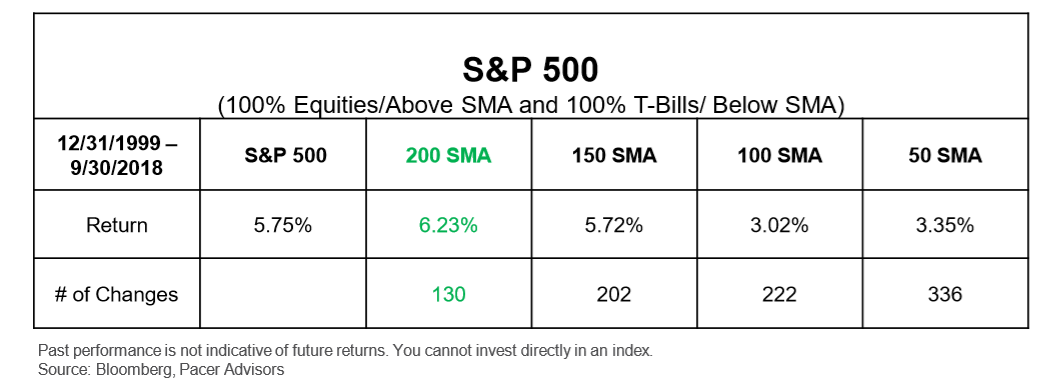

Equity Indicator: When the Benchmark Total Return Index closes above its 200-day SMA for five consecutive business days, the exposure will be 100% to the Benchmark Index. From the equity position, the Index will change to the 50/50 position or the T-Bill position depending on the 50/50 Indicator and the T-Bill Indicator.

-

Price Signal 50/50 Indicator: When the Benchmark Total Return Index closes below its 200-day SMA for five consecutive business days, the exposure will be 50% to the Benchmark Index and 50% to 3-Month US Treasury bills. From the 50/50 position, the Trendpilot™ Index will return to the equity position or change to the T-Bill position depending on the Equity Indicator or T-Bill Indicator.

-

Trend Signal T-Bill Indicator: When the Benchmark Total Return Index’s 200-day SMA closes lower than its value from five business days earlier, the exposurewill be 100% to 3-Month US Treasury bills. From the T-Bill position, the Trendpilot™ Index will change to the equity position when the Equity Indicator is triggered. The Index will not return to its 50/50 position unless the Equity Indicator is first triggered.

Furthermore, this strategy is incorporated into four ETFs–Pacer Trendpilot US Large Cap ETF (BATS: PTLC), Pacer Trendpilot US Mid Cap ETF (BATS: PTMC), Pacer Trendpilot 100 ETF (BATS: PTNQ), and the Pacer Trendpilot European Index ETF (BATS: PTEU).

During the webcast, O’Hara will discuss how these Trendpilot ETFs can provide potentially better risk-adjusted returns and increase equity exposure without taking on additional risk as opposed to other ETF products on the market. Moreover, O’Hara will delve further into how the ETFs de-risk into Treasury bills when an indicator is triggered.

Financial advisors who are interested in learning more about trend-following strategies can register for the Thursday, January 24 webcast here.