The first half of 2017 is now in the books. You have to love a full year’s worth of returns in the first six months of the year. My guess: Returns get harder and the ride gets bumpier from here. With volatility so low, it’s hard not to expect some mean reversion this summer. Holding some cash and being tactical around the core could be the best bet heading into year end.

Bigger picture, the equity markets look fine and the bull market trend continues. The uptrend that’s been in place since 2009 has a projected target of 2700 (top of channel) with the lower channel target at roughly 2200. Currently, we are right in the middle of the long term channel as we start the second half of 2017.

Short-term, the market is consolidating recent gains and is somewhat indecisive. Our technical work indicates a short-term top could occur near the 2475-2500 level on the S&P 500. The leading Index, the Nasdaq 100, has experienced some volatile sessions as money rotates out of growth and diversifies into more traditional value areas. Selfishly, I would love to be able to buy more of these great growth Brands if the opportunity arises. Growth is still hard to come by and assets that are scarce often trade at a premium. Many of the most important growth brands are not overly expensive so for now, the recent volatility seems like noise versus the hint of a major rotation about to happen.

Related: 3 Reasons Why the Price is Right for International Opportunities

Starting in late Q2, value stocks have been well bid as sector rotation occurs with rates moving higher.

Financials have the highest correlation & best returns when interest rates rise. Industrials and energy have historically been #2 and #3. Energy has been a horrendous performer YTD and shows no signs of breaking the yearly downtrend. The transports look particularly strong across the board.

Healthcare looks attractive as a value sector as well. Again, we will look to add back some technology exposure if the group pulls back further. Technology adoption is driving virtually every industry around the globe and with few exceptions, these iconic growth brands trade at reasonable valuations.

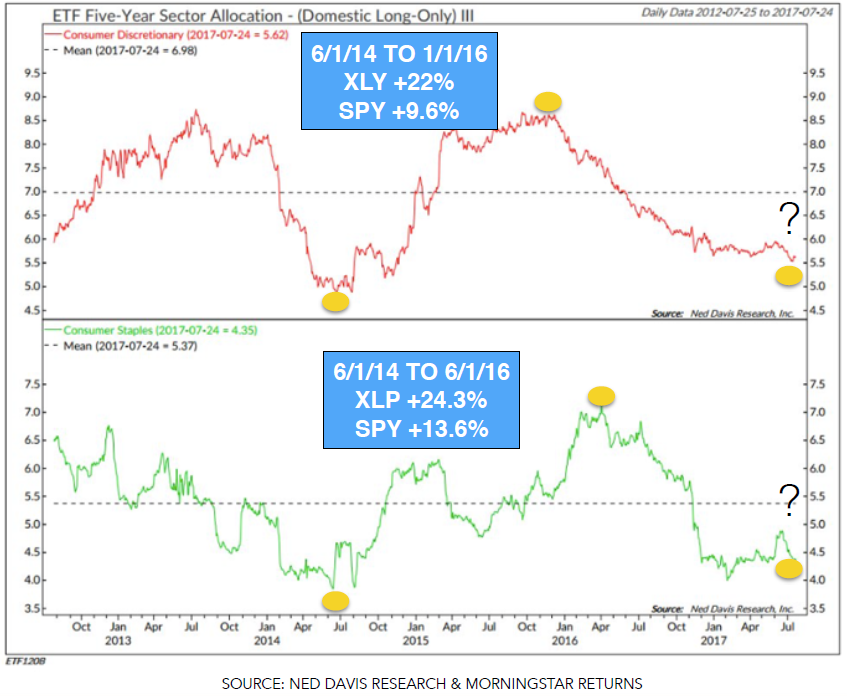

The Best Consumer Returns Often Come When Consumer Sectors Are Under-Owned