Investor fears brought on by the Covid-19 Delta variant are leading to a safe-haven scramble to bonds, which pushed gold higher during Monday’s trading session—a possible sign of more upside ahead.

Gold prices moved closer to their 200-day moving average for gold prices, which could indicate long-term momentum. A Kitco News report detailed the move to start the week.

“The gold market has found a new bounce in its step, with the cash market retesting its 200-day moving average as bond yields continue to drop,” the report said. “Bond yields in New York ‘s afternoon session dropped to a session low of 1.16%, which in turn has pushed spot gold prices to $1,815.40 an ounce, roughly unchanged on the day. Gold ‘s futures prices on Comex are still trading under the 200-day moving average but are near session highs.”

A key mover for gold could be the infrastructure bill that’s looking to push through the Senate this week. The trillion-dollar plan could be an inflationary move pushing investors to head to gold as a countermeasure.

“No matter where you look, inflation is here, and the Federal Reserve is going to remain accommodative,” said Daniel Pavilonis, senior commodities broker with RJO Futures. “The infrastructure bill is going to be incredibly inflationary, and that will be good for gold.”

“Gold has managed to push back to its 200-day moving average, and if it can stay here, we could see a big move to the upside,” Pavilonis added.

Gold Exposure via Miners

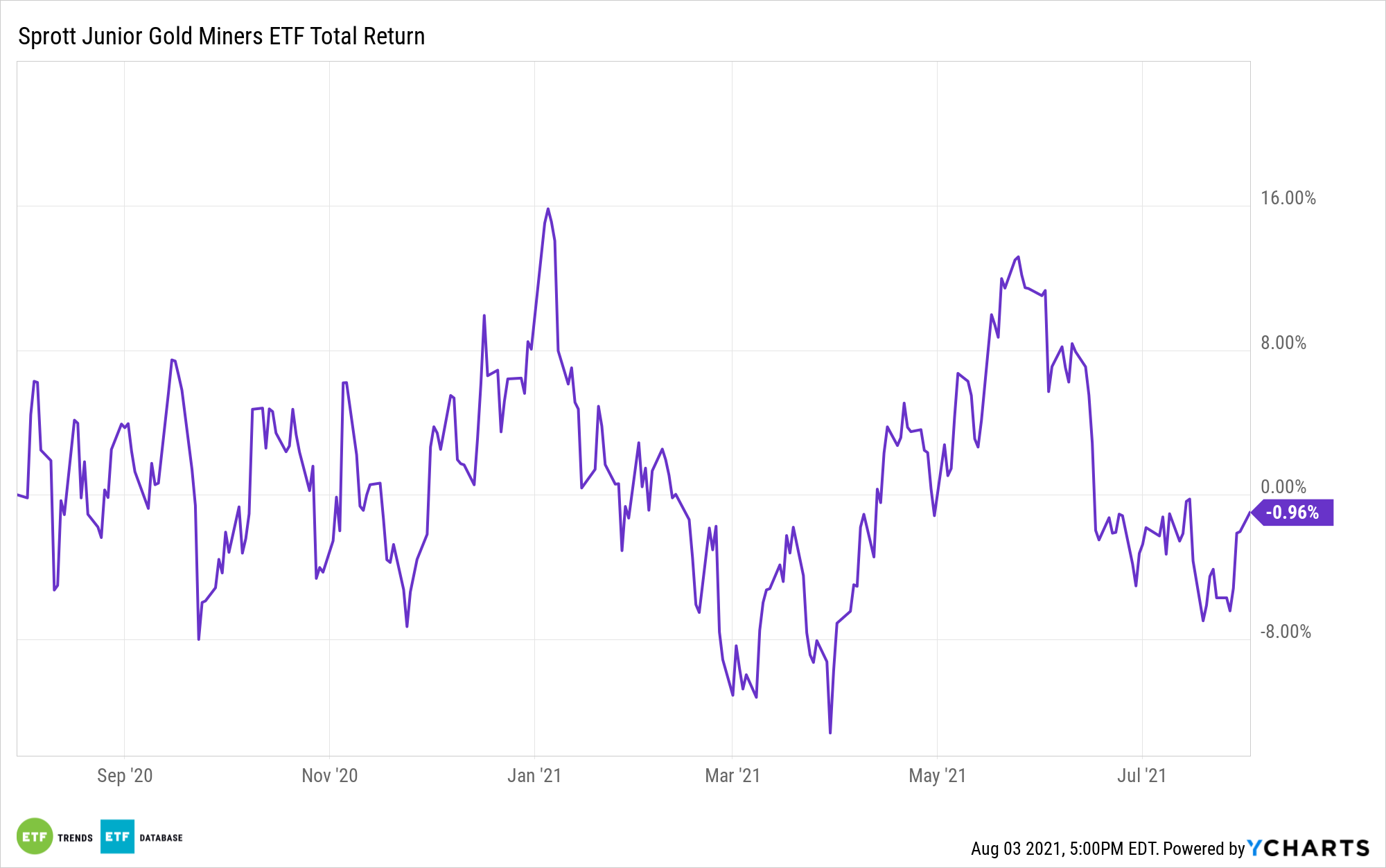

There are several ways investors can get in on the gold action without subjecting themselves to the heavy fluctuations of the gold market. One way is via ETFs like the Sprott Junior Gold Miners ETF (SGDJ).

SGDJ seeks investment results that correspond to the performance of its underlying index, the Solactive Junior Gold Miners Custom Factor Index. The index aims to track the performance of “junior” gold companies primarily located in the U.S., Canada, and Australia whose common stock, American Depositary Receipts (ADRs), or Global Depositary Receipts (GDRs) are traded on a regulated stock exchange in the form of shares tradeable for foreign investors without any restrictions.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.