Some analysts see a major rally brewing in the gold trade.

“Gold investors are taking the wheel, setting the precious metal up for a major rally as investors realize the Federal Reserve is powerless against rising and persistent inflation, according to one strategist,” a Fox Business report noted. “The precious metal on Thursday was flirting with a sixth straight day of gains, hovering near $1,800 an ounce. It has rallied 8.5% since touching a nine-month low of $1,677.70 an ounce on March 8.”

The common narrative that the Federal Reserve is using is the notion of transitory inflation, but it doesn’t appear investors are biting on that bait. In the early trading session on Friday, the HUI Gold Index rose 2%.

“Markets are basically preparing for the wrong outcome,” said Peter Schiff, CEO and president of Euro Pacific Capital.

The Market Upside for Gold

A more contagious Delta variant of Covid-19 could also be serving as a catalyst for gold. A profound safe haven scramble to gold was seen last year at the peak of the pandemic sell-offs, and more inflows into gold funds could occur if the global economy stagnates.

“Analysts at Goldman Sachs said in a note sent to clients on Tuesday that gold has ‘material upside’ should the global recovery not play out as expected and inflation increases ‘significantly above expectations,'” the Fox Business report added.

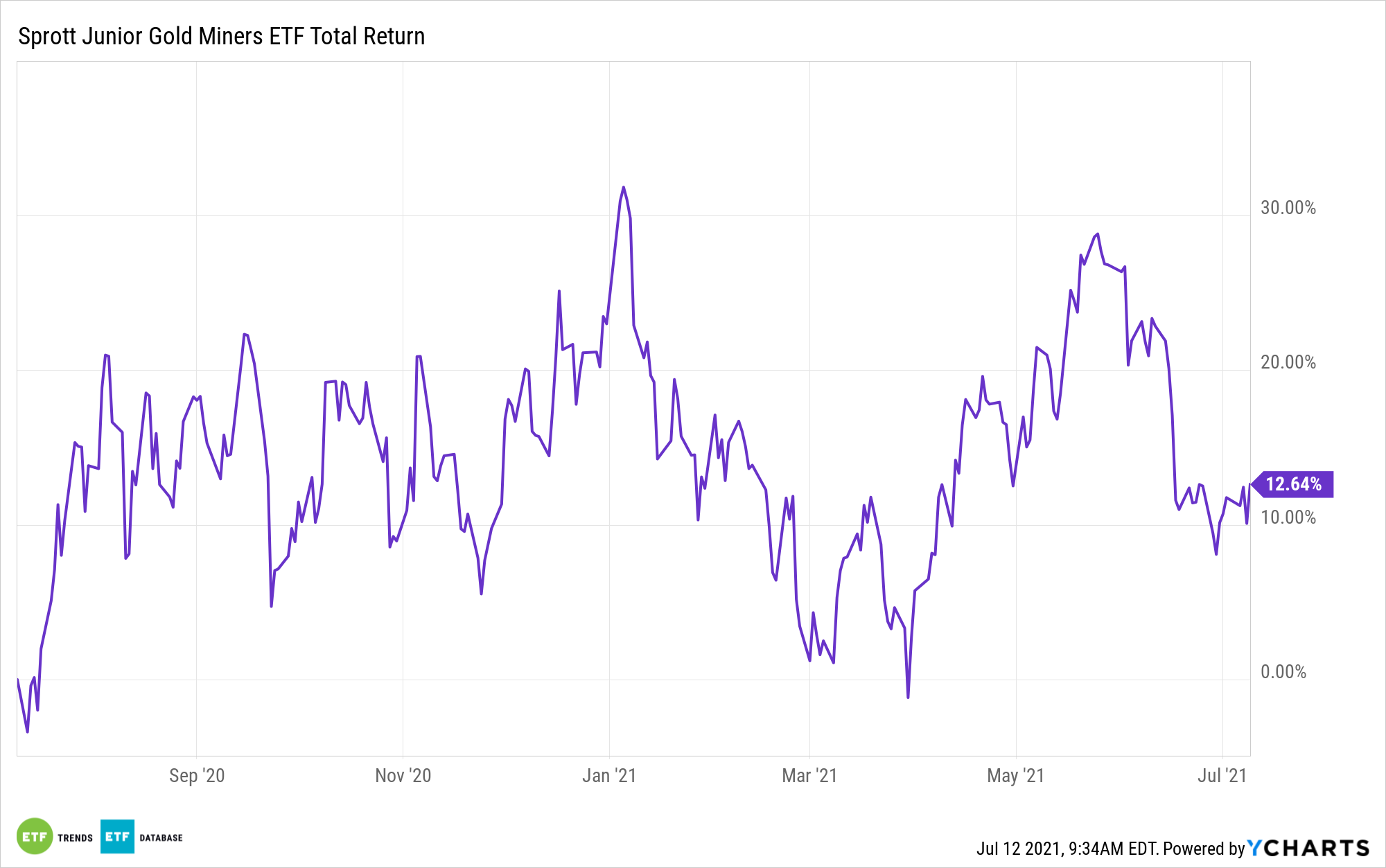

To play the move in gold prices, ETF investors can opt for funds like the Sprott Junior Gold Miners ETF (SGDJ). Miners can give investors precious metals exposure without the price volatility of investing in gold itself.

SGDJ seeks investment results that correspond to the performance of its underlying index, the Solactive Junior Gold Miners Custom Factor Index. The index aims to track the performance of “junior” gold companies primarily located in the U.S., Canada, and Australia whose common stock, American Depositary Receipts (ADRs), or Global Depositary Receipts (GDRs) are traded on a regulated stock exchange in the form of shares tradeable for foreign investors without any restrictions.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.