Gold and bitcoin are often compared in the same breath. Yet there’s considerable debate about stores of value, whether either will be acceptable for everyday financial transactions, roles in portfolios, inflation-fighting merit, and so on.

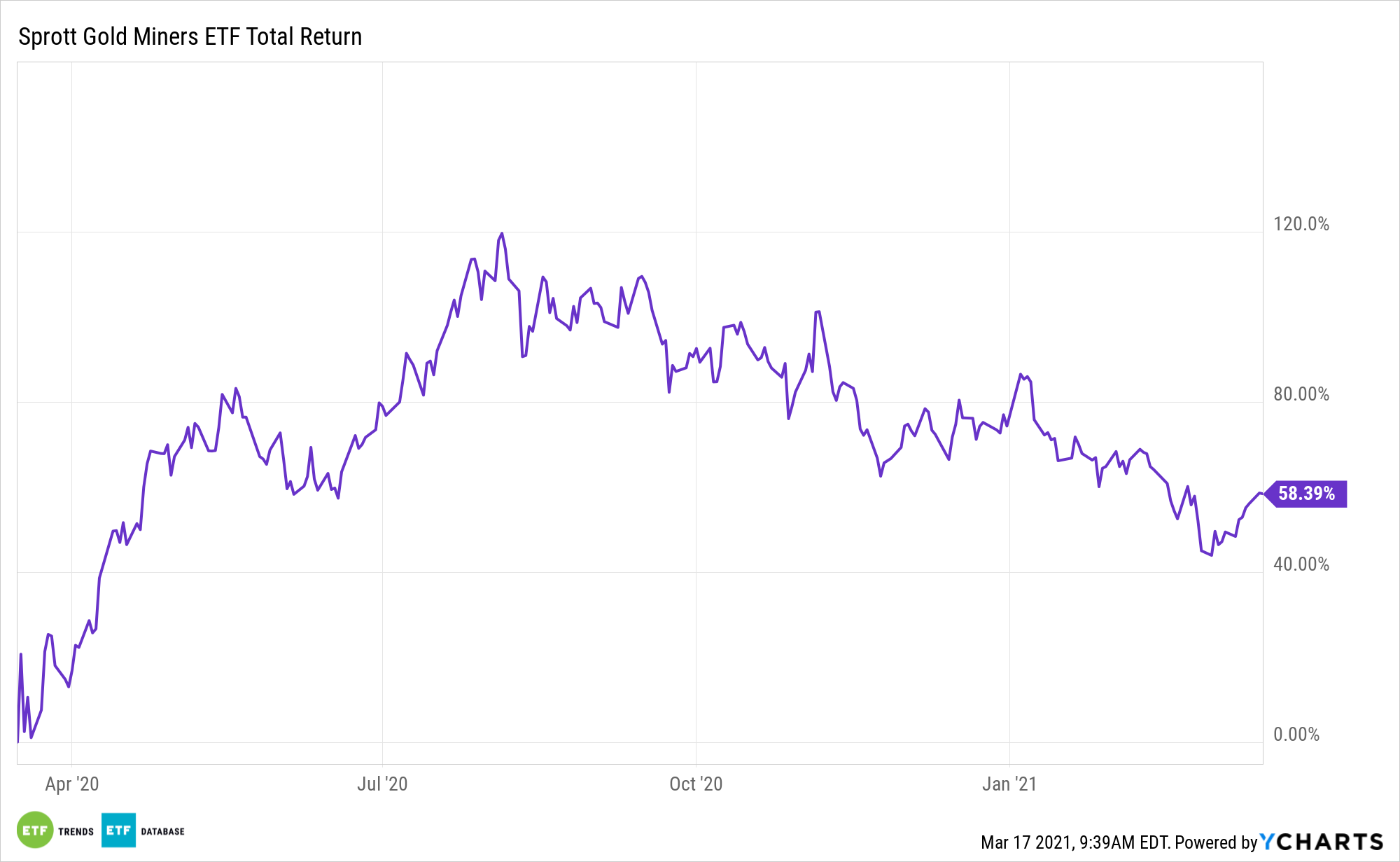

In fact, many market observers refer to bitcoin as ‘digital gold’. Yet some analysts believe those comparisons should come to a halt. That’s not a slight on either asset, but it could provide relief for funds such as the Sprott Gold Miners ETF (NYSEArca: SGDM).

SGDM tracks the Solactive Gold Miners Custom Factors Index and “emphasizes gold companies with the highest revenue growth and free cash flow yield, and the lowest long-term debt to equity ratio,” according to the issuer.

“Gold and bitcoin are often likened to gold and digital gold. Of course, they are both ‘mined,’ but solid lines are often drawn when comparing the two as assets in public discourse, and we think this is overdone,” said RBC Capital Markets strategists, including Christopher Louney.

Be Careful with the Comps

It’s no secret that gold has been a major beneficiary during the coronavirus pandemic as a viable safe haven asset amid all the uncertainty in the capital markets. But investors don’t actually have to get pure-play gold exposure in order to reap the benefits of the precious metal—enter gold miners.

Gold certainly had its run during the uncertainty of the Covid-19 pandemic, but as more economies around the world look to return to normal, the precious metal has started to lose its luster. That, however, could pose a buying opportunity for investors looking for gold exposure.

See also: How a Bounce in Bitcoin Can Get Gold Going

Bitcoin’s impressive rise does not necessarily correlate with recent tougher times for gold.

“The comparison has often led to arguments that bitcoin is stealing attention away from gold, connecting gold’s underperformance to bitcoin’s massive rally. But that is not really the case, according to the RBC report,” according to Kitco News.

At the end of the day, investors should be careful when comparing gold and Bitcoin.

“Those looking for a stateless asset with a finite supply that is not a liability of any single country or entity have long gravitated toward gold. That type of thinking is also pushing some toward Bitcoin. We think this narrative drives a lot of the likening between the two,” the RBC report continues. “To be clear, are some flows that might otherwise head toward gold instead materializing in Bitcoin and the cryptocurrency space? Probably. However, we do not think that is the dominant theme here.”

For more news, information, and strategy, visit the Gold & Silver Investing Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.