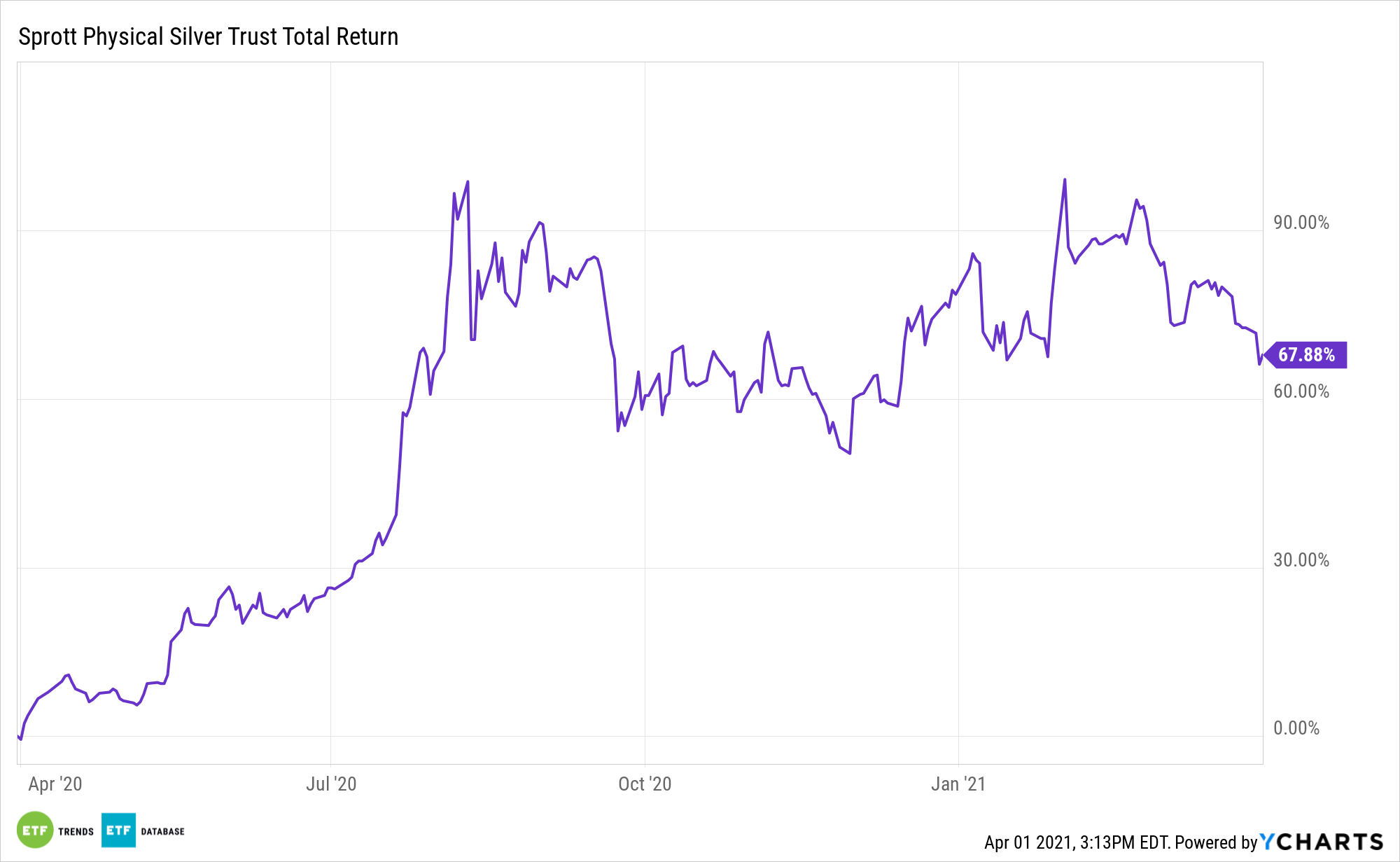

A growing chorus of market observers are wagering that silver and assets such as the Sprott Physical Silver Trust (NYSEArca: PSLV) are poised for more upside following a disappointing first quarter.

PSLV is a closed-end fund that lets investors redeem large blocks of shares in exchange for delivery of silver bullion.

The Trust often trades at a premium to net asset value (NAV). Closed-end funds can see large premiums and discounts, while exchange traded funds have an arbitrage feature that tends to keep prices in line. PSLV does possess some unique benefits however, and silver is gaining momentum as long-term idea.

“As we head towards the end of 2021’s first quarter, silver has been sleeping. Since the start of this year, the range has been $6.31 on the continuous futures contract, but the precious metal put in a marginally higher high when it traded to $30.35 on February 1,” reports Seeking Alpha. “Silver was sitting below the midpoint of its 2021 trading range on Monday, March 22, as the precious metal is consolidating and digesting its gains over the past year.”

PSVL Is a Potent Q2 Idea

The silver outlook is growing more and more encouraging, and that could lure more investors to PSLV, which is one of the more compelling silver funds on the market today.

Goldman Sachs analysts, in a research report published earlier this year, restated its bullish stance for silver, projecting prices to climb as high as $33 an ounce as President Biden pushes onward with a plan to augment alternative renewable energy production.

Inflation is another catalyst for PSLV.

“Inflation is historically bullish for silver and all commodity prices. Copper remains above $4 per pound, the highest level in a decade. Despite the recent correction, crude oil is sitting at over $61.50 per barrel. Grains are at over six-year highs, and many other raw material prices are validating the price action in the bond market. When real interest rates rise, it increases the cost of carrying commodities and weighs on their prices. However, when rates move to the upside because of inflation, commodities tend to appreciate,” adds Seeking Alpha. “Another bullish sign for the silver market is its historical price relationship with gold, the yellow metal that plays an integral role in the global financial system.”

For more news, information, and strategy, visit the Gold & Silver Investing Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.