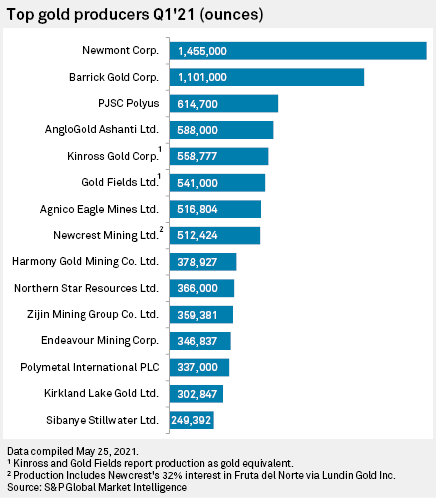

At about a 12.3% weighting, Newmont Corporation comprises the largest holding in the Sprott Gold Miners ETF (SGDM). The company was also the top gold producer in the first quarter of this year.

An S&P Global report recently explored the top gold producers by ounces. Newmont Corp stood head and shoulders above the rest. Miners were obviously in a bind last year given the pandemic, but as 2021 wears on, the industry is set to recover.

“We had seen a lot shut down in 2020 due to the pandemic. So, 2021 is very much a story of recovery,” S&P Global Market Intelligence analyst Christopher Galbraith said in a June 2 interview. “A lot of these operations that had to be shut down in 2020 due to the restrictions on movement are still bringing themselves back up to nameplate capacity.”

“Right now, we’re still in the kind of early days on testing the limits of the gold price,” Galbraith said. “There’s always going to be a lag time from that positive movement in the gold price to some of the larger players actually making decisions based on that.”

Renewed Confidence in Gold?

As inflation fears start to cede, a renewed confidence in gold could be brewing. The Federal Reserve maintains that rates won’t see increases until the year 2023, which may be helping gold prices stage a small rally.

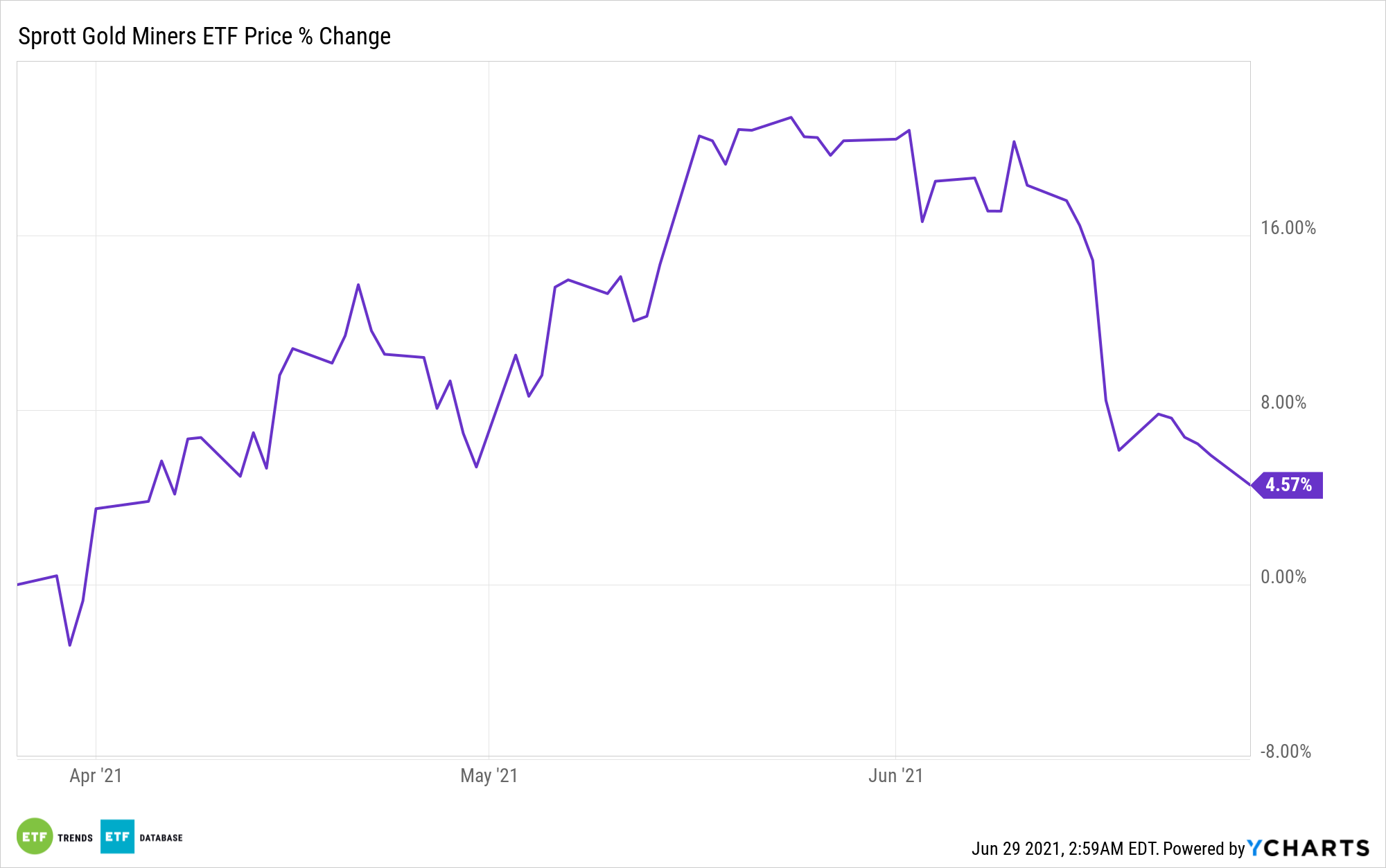

In the past few months, Newmont’s stock pushed past the 20% YTD gain marker, before falling back down to earth. Still, the stock is up about 5% on the year and more strength should translate to gains for SGDM.

Per SGDM’s fund description, the ETF seeks investment results that correspond generally to the performance of its underlying index, the Solactive Gold Miners Custom Factors Index. The Index aims to track the performance of larger-sized gold companies whose stocks are listed on Canadian and major U.S. exchanges.

The Index uses a transparent, rules-based methodology that is designed to emphasize larger-sized gold companies with the highest revenue growth, free cash flow yield, and the lowest long-term debt to equity. The Index is reconstituted on a quarterly basis to reflect the companies with the highest factor scores.

Of course, the beauty of SGDM is the backdoor play on miners. Investors are shielded from the higher volatility of gold prices.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.