The energy transition provides a once-in-a-lifetime opportunity for investors to capitalize on global decarbonization and disruption. While it creates a bright future for many critical minerals, uranium continues to shine brightest this year.

2023 was a banner year for uranium, as it outperformed most commodities. This year could bring more of the same, according to analysts from Bank of America. Though uranium prices dipped since the beginning of the year, analysts forecast a bull market through 2025.

Uranium benefits from a number of demand drivers according to John Ciampaglia, CEO of Sprott Asset Management, in a recent video with Thalia Hayden, ETF reporter for ETF Guide. Primary sources for demand growth comes from the return to nuclear power as well as the evolution of technology surrounding nuclear power.

Nuclear Power No Longer the Bogeyman

Fears of atomic warfare created collective mistrust for nuclear energy among an entire generation of Americans. However, as the world moved forward and nuclear power evolved, it’s proven to be a reliable source of energy in the wake of geopolitical strife.

Nuclear power plants provide “very high levels of energy security, a term many people haven’t heard before or haven’t heard for probably 50 years,” Ciampaglia explained. In the wake of Russia’s invasion of Ukraine in 2022 and the resultant turmoil for European energy infrastructure, the need for reliable energy became apparent.

“People realized that if you didn’t have a secure supply of energy, whether natural gas, coal, oil, or uranium, they could put your economy and national security at risk,” he added.

The use case for nuclear power becomes incredibly compelling in a decarbonizing world. Because it doesn’t generate greenhouse gases inherently, it proves a strong complement to renewable energy. Nuclear power provides baseload energy for electrical grids that incorporate renewable energies. Solar, wind, and other renewable sources do not provide consistent energy, creating a need for always-available power that nuclear provides.

Alongside growing nuclear demand exists the deficit for traditional energy sources used to power grids currently.

“When there’s a supply and demand imbalance, typically you have a price that adjusts to incentivize more production,” Ciampaglia noted, adding, It’s “what the world needs in the coming decade, and that’s exactly what’s happening with uranium and why it went up 89% last year.”

Technological Evolution Goes Nuclear, Uranium Benefits

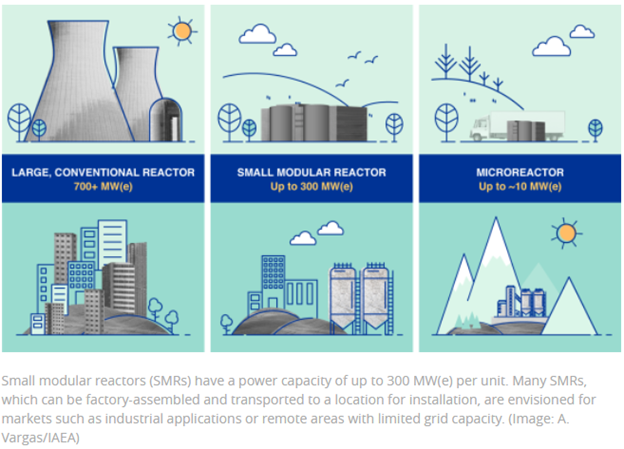

Alongside increased demand for nuclear power within the energy transition is the potential of new technology to further increase demand. Small modular reactors (SMRs) revolutionize nuclear power, allowing for greater access.

Image source: International Atomic Energy Agency

Instead of the massive, traditional reactors of the past, SMRs are, as the name implies, smaller in scale. They’re assembled in factories and transported to wherever they’re needed. They have applications industrially as well as offering nuclear power for remote locations previously too off-grid for nuclear access.

“The hope is they would be lower cost because they’re smaller scale,” said Ciampaglia. “They have a lot more applications — everything from producing electricity to producing industrial heat.”

That number of large nuclear reactors that currently exist is 434. Fifty-nine more under construction, and over 100 more are in planning stages. SMRs will revolutionize and increase nuclear power capabilities once deployed — likely another five years out. Currently, companies from the U.S., the U.K., and Canada are working to design and build to scale hundreds of SMRs for the coming years.

The “nuclear renaissance,” as Ciampaglia coins it, is one likely to last for decades to come. It provides opportunities for advisors and investors looking to invest not just in uranium but the miners that stand to benefit.

“Given the long lead times of these projects and energy policy in general, it will be very supportive for the uranium mining sector for the coming 10, 15, or 20 years,” Ciampaglia said.

Advisors and investors have an opportunity to buy the dip currently in uranium miners. The Sprott Uranium Miners ETF (URNM), up 28.75% last year on a price return basis, is currently up 0.44% YTD. Meanwhile, the Sprott Junior Uranium Miners ETF (URNJ), up 15.17% last year, is up 5.13% as of 03/12/24. URNM offers exposure to uranium producers, exploration companies, developers, and physical uranium itself. URNJ offers exposure to small producers and the next generation of uranium producers.

For more news, information, and analysis, visit the Gold/Silver/Critical Materials Channel.