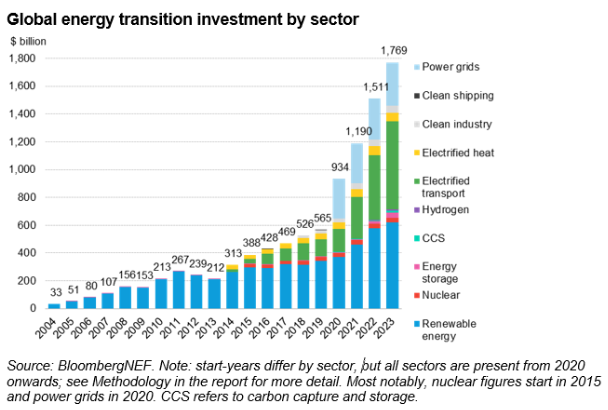

The energy transition is underway globally, with policies, innovations, and pressure ramping up to decarbonize. It creates a wealth of opportunity for investors and is one of the fastest growing areas of investment. with a CAGR that outpaces global GDP growth.

Last year, investments into clean energy crossed $1.8 trillion, according to BloombergNEF. It’s a gain of 17% year over year and a new record. In the last decade, investments into the energy transition grew at a 24% compound annual rate, reported Paul Wong, CFA, market strategist, and Jacob White, CFA, ETF product manager, both of Sprott Asset Management, in a recent paper.

Image source: BloombergNEF

However, clean energy investing is still a far cry from what’s necessary to reach net-zero goals. BloombergNEF estimates that $4.8 trillion annually between 2024-2030 is necessary to curb emissions sufficiently to align with Paris Agreement models.

“The narrative of renewable energy’s growth is now one of exponential acceleration,” wrote Wong and White in a February paper.

Renewable Energy CAGR Reflects Fundamental Shift

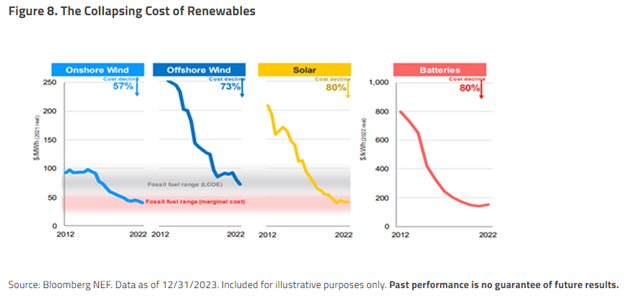

Renewable energy benefits from a number of fundamental drivers that continue to reduce costs. These include S-curve adoption growth, regulatory policies, geopolitics, the role of energy security, and more. Decreasing costs in turn leads to greater scale and market share growth as renewable energies trend to become cheaper than fossil fuels.

In 2023, investment into energy transition technologies surpassed investments in fossil-fuel supply by $671 billion, according to BloombergNEF. In 2022, that difference came to $508 billion. The growing differential reflects the commitment to a decarbonizing world and the increasing affordability of renewables.

“Renewable energy is no longer the higher-cost alternative option,” Wong and White wrote. “Solar and wind have transitioned from subsidy-reliant nascent industries to the most cost-effective sources of new electricity.”

Image source: Sprott Asset Management

The technological evolution that lifted wind and solar power from nascent to full-fledged industries relied heavily on private investment. It allowed for many new renewable technologies to develop through their S-curve, from expensive to cost effective.

The costs of onshore wind power dropped 57% between 2012-2022, while the cost of solar dropped 80% over the same period. These subsets of renewable energy are expected to reduce costs by half again by 2030.

Solar and wind uptake and broad adoption are a prime example of the opportunity the energy transition ushers in for investors. The Sprott Energy Transition Materials ETF (SETM) offers pure-play exposure to the miners of minerals critical to the energy transition. This includes miners of copper, uranium, lithium, nickel, silver, graphite, and more.

SETM seeks to track the Nasdaq Sprott Energy Transition Materials Index. The index includes companies within energy transition materials globally, including miners of rare earth elements. The ETF carries an expense ratio of 0.65%.

For more news, information, and analysis, visit the Gold/Silver/Critical Materials Channel.