Sprott market strategist Paul Wong issued a new monthly report delving into gold’s performance in January.

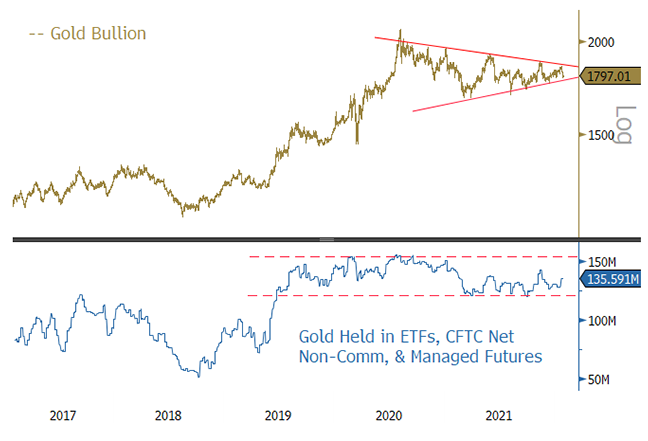

Spot gold shed $32.03 of value, or 1.75%, closing the month at $1,797.17/oz. The yellow metal had nearly hit $1,850 before a particularly hawkish January Federal Open Market Committee meeting caused it to tumble more than $50 as the market digested the Fed’s statements. Hawkish policy and sentiment continued throughout the month, causing the largest increase in real yields since 2013. The US dollar also had a big month, adding to tighter financial conditions.

Wong notes, “Short term, there is little evidence that inflation pressure is abating. By contrast, there is growing evidence of inflation broadening out and moving towards a more entrenched nature as reflected in wages, labor shortages, and prices. Furthermore, recent signs point to inflation turning contractionary as consumers appear exhausted, given that real wages, although rising, are not keeping up with the pace of inflation. As January closed, we started to see downward revisions in global growth forecasts and upward revisions in inflation expectations.”

Grabbing the Bullion By the Horns

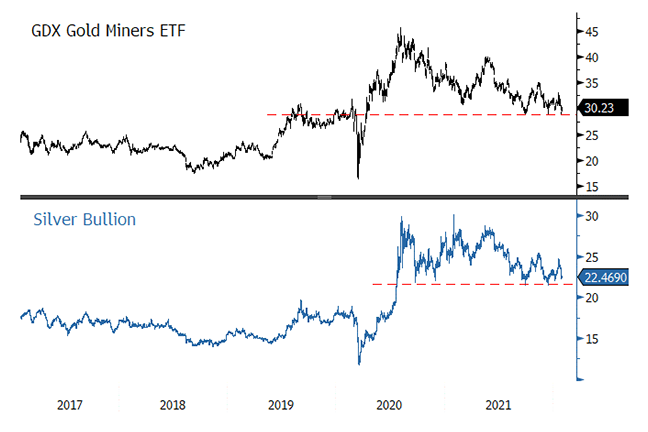

Gold came close to breaking out last month, and Wong sees technical evidence that spot gold continues to consolidate. Demand for physical gold in India, China, and central bank purchases climbed 16.6% in 2021. Equities continue to consolidate.

The Fed has initiated a tightening cycle, according to Wong. “Fed tightening cycles are painful for markets, and the pain threshold appears to lower each time. As central bank balance sheets keep expanding, asset prices drift further away from price discovery, or fair value, making them more sensitive to policy tightening. With the Fed quickly turning very hawkish after being so accommodating for so long, this abrupt change has caught the market off guard,” he noted in the report.

Past cycles were more benign because there was sufficient growth to allow rate hikes to prevent overheating without driving the economy toward recession. Wong sees risk in the Fed aggressively tightening.

2018 Parallels

Many investors see parallels to 2018. Wong notes, “from a market perspective, the tightening process in 2018 was already years in the making, with the Fed’s target being neutral. The current tightening cycle has just started, with inflation running at 7%. Already, markets are experiencing severe volatility and selling even though the first rate hike is not expected until March.”

Wong believes conditions will be exacerbated in the next few months as supply chain issues, wage growth, and rent increases keep CPI elevated. For the next few months, the market is at risk from slowing growth and the effects of the Fed interest hikes. Gold’s value as a safe haven asset should absolutely shine in this environment. Investors can get exposure to physical gold through the Sprott Physical Gold Trust (PHYS). Gold equities exposure can be gained through the Sprott Gold Miners ETF (SGDM) and the Sprott Junior Gold Miners ETF (SGDJ).

“One could use this colorful mixed metaphor: The Fed is attempting a controlled demolition with a high potential for butterfly effects.”

For more news, information, and strategy, visit the Gold & Silver Investing Channel.