Gold is making a comeback. Despite speculation that Bitcoin and other cryptocurrencies were rendering the metal less valuable by the day, the long-term prognosis for gold is looking brighter, finds a new report from Barron’s.

Recent crypto turbulence, including last week’s flash Bitcoin crash and the failure of “Doge day” to push the meme-inspired Dogecoin over $1, have J.P. Morgan’s derivatives strategists forecasting a shift in Bitcoin futures. After the cryptocurrency failed to break out above $60,000, traders began to reduce their positions.

See also: Who Let the Doge Out: ‘Doge Day’ Anticipation Keeps Value Afloat

Meanwhile, gold has been re-gaining strength. The yellow metal has seen a slow but steady recovery, closing in at an $1800/oz price. Though still down from its $1951/oz high, a client note published last Wednesday by Bespoke Investment Group said that gold had broken above its 50-day moving average, a sign of short-term trending strength.

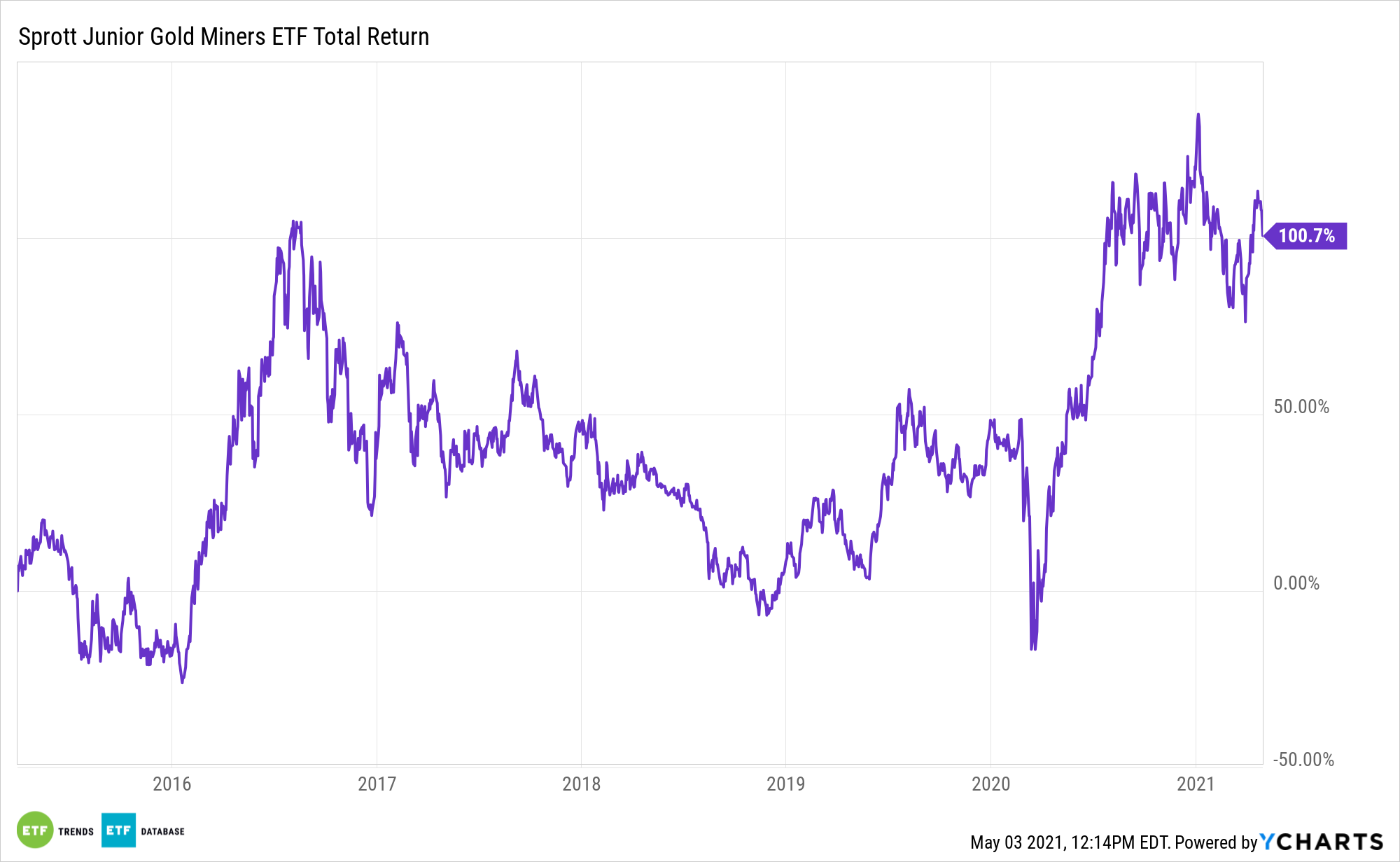

In addition, gold miners have rebounded, outpacing the broader stock market, including several of the names in the Sprott Gold Miners ETF (SGDM) and the Sprott Junior Gold Miners ETF (SGDJ). (Gold mining stocks are often an indicator for the trajectory of bullion itself.)

Why Gold Is Stronger than Crypto Right Now

Aside from failures in the Bitcoin market, gold has also experienced relative strength compared to the cryptocurrency due to a decline in real long-term interest rates (meaning inflation-adjusted bond yields) and inflationary concerns.

This fall in real rates can be seen in yields on Treasury Inflation Protected Securities (TIPS), which pay a real yield even as their principal is adjusted according to changes in the CPI.

The yield on the 10-year TIPS has gone from -0.56% in mid-March to -0.78%, even as the broader bond market has rallied.

With more inflation looking inevitable, gold and mining shares are likely to continue building strength.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.