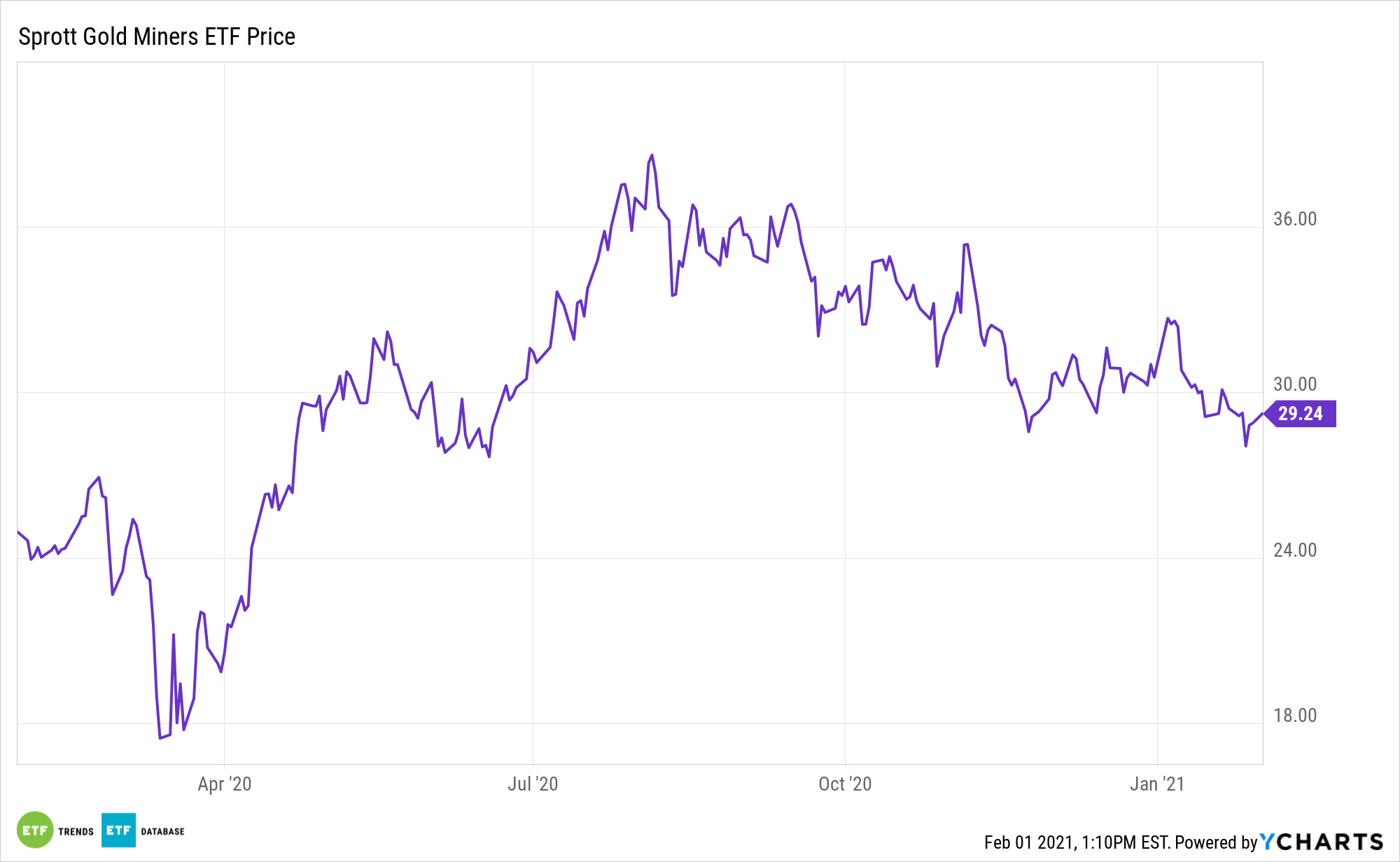

Gold miners are getting ready to step into the earnings confessional, and that could provide some spark for the Sprott Gold Miners ETF (NYSEArca: SGDM).

SGDM tracks the Solactive Gold Miners Custom Factors Index and “emphasizes gold companies with the highest revenue growth and free cash flow yield, and the lowest long-term debt to equity ratio,” according to the issuer.

Earnings season could be solid for plenty of SGDM components.

“The major gold miners’ upcoming Q4’20 financial and operational results ought to prove spectacular. Average prevailing gold prices last quarter stayed at their second-highest levels ever despite gold’s healthy correction,” according to Seeking Alpha.

Time for SGDM to Glitter

SGDM follows mid- to large-cap gold miners, but the underlying index weighs components based on quarterly revenue growth on a year-over-year basis and the quality of its balance sheet as measured by long-term debt to equity. As such, by focusing on balance sheet strength, the fund has greater exposure to companies with lower long-term debt to equity ratio, which have a greater ability to weather potential downturns.

“The major gold miners’ upcoming earnings season should prove amazing. They enjoyed some of the highest prevailing gold prices ever witnessed last quarter, which sure ought to fuel massive earnings growth,” reports Seeking Alpha. “Especially if their output levels and production costs stayed fairly stable, which is likely based on precedent. Incredibly-strong fundamentals should attract more investment capital, driving stock prices higher.”

Mining strategies such as SGDM are particularly relevant when gold prices are rising, because miners can actually overshoot gold’s upside.

“Despite falling 5.9% quarter-to-date by the end of November, gold still averaged a lofty $1,876 on close during Q4’20. That was actually the second-highest quarterly average on record, only trailing the preceding Q3’20’s $1,912! With Q4’s prevailing gold levels only running 1.9% under that, the major gold miners could hardly ask for a better gold-price environment,” concludes Seeking Alpha.

For more on precious metals, visit our Gold & Silver Investing Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.