Copper prices trended lower for much of 2023 before it followed most assets in a year-end rally. Copper could be in the early stage of continued upside, making copper miners an opportune play that may no longer be labeled contrarian.

The early rally could be revealing itself in the S&P GSCI Copper index’s push into the green, rising about 3% within the last few months. The technical, short-term narrative may say that it’s simply traders unwinding bearish bets on copper prices, but the long-term story has the fundamentals to support continued upside.

In a Sprott white paper entitled “Copper: The Essential Power Player in the Global Energy Transition,” the fundamentals, particularly copper’s enticing growth trajectory, offer investors a glimpse of what copper prices could do in the next decade. In effect, that should also benefit miners where increased demand paired with reduced supply could force the hand of copper mining companies to consolidate in order to bridge that gap.

“The widening gap between supply and demand may likely translate into benefits for both copper prices and the mining companies involved,” the white paper said. “Additionally, an uptick in mergers and acquisitions (M&A) within the industry could further strengthen the position of copper miners.”

Optimistic Long-Term Outlook

The white paper also stressed the rising demand for critical minerals in the coming years, which includes copper as part of that list. While the short-term demand for electric vehicles (EVs) has yet to catch up with supply, continued adoption could propel copper even higher over the long-term horizon.

“Copper prices and miners are likely to benefit from the growing supply-demand gap,” the Sprott white paper reiterated, adding that certain miners “are thriving due to the optimistic long-term outlook for copper demand.”

As mentioned, M&A activity adds another growth component for copper miners and there’s already movement in major players in the copper mining market. Additionally, an anxious automotive industry that’s sensing future supplies of copper dwindling are already allocating investment dollars into mining companies.

“Copper’s strategic importance has driven significant M&A activity in 2022-2023, with major mining companies like BHP and Rio Tinto acquiring copper miners at substantial premiums,” the white paper said. “Automakers, concerned about securing future supplies of critical minerals like copper, are also investing directly in mining companies.”

Miners Outperform Spot Copper

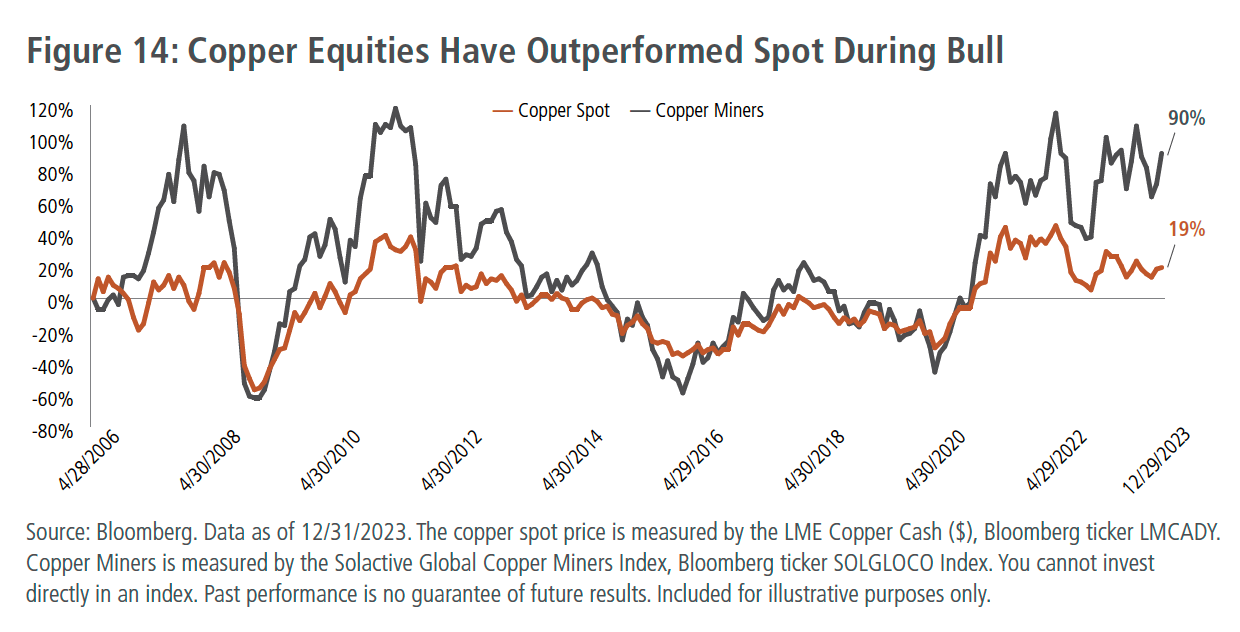

One of the more notable trend characteristics deftly identified by the Sprott whitepaper was copper miners’ outperformance in boom times when juxtaposed with spot copper. A chart dating back to April 2006 showed that when copper prices trended higher, copper miners responded with even more amplified moves to the upside.

In more recent times, this amplified outperfornance was particularly evident when the spot price of copper hit a higher of $10,368 on the last day of March in 2022. In turn, copper miners also gained over 100% shortly thereafter.

Given this explosive growth trajectory and the propensity for copper miners to move higher after a jump in spot prices, investors may want to take a look at the Sprott Junior Copper Miners ETF (COPJ). The fund seeks to provide investment results that track the total return performance of the Nasdaq Sprott Junior Copper Miners Index. The index incorporates mid-, small-, and micro-cap companies entrenched in copper-mining-related businesses.

For more news, information, and analysis, visit the Gold/Silver/Critical Materials Channel.