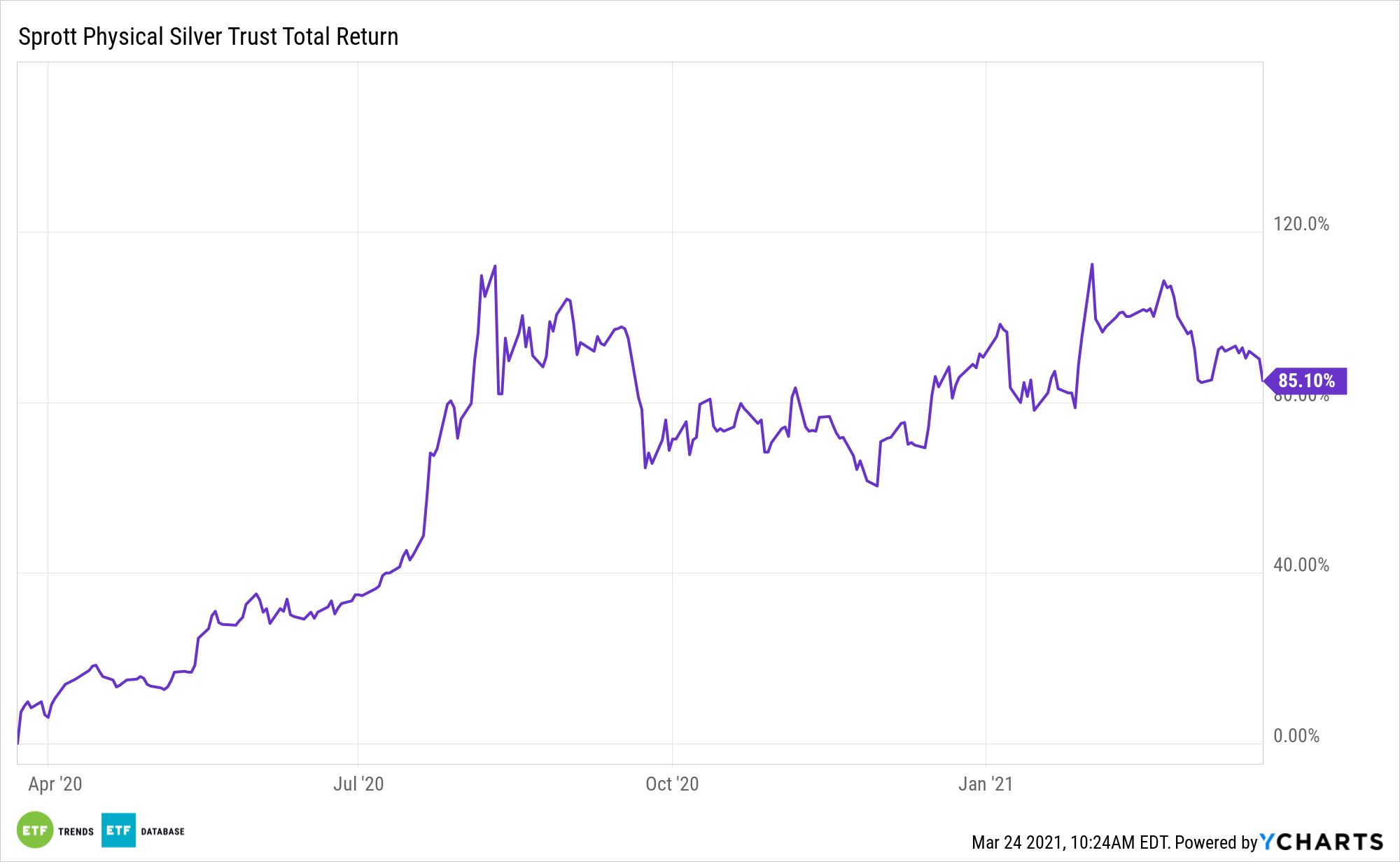

Rising Treasury yield have pressured precious metals, but some market observers see help on the way for silver. That could propel the Sprott Physical Silver Trust (NYSEArca: PSLV) much higher.

PSLV is a closed-end fund that lets investors redeem large blocks of shares in exchange for delivery of silver bullion.

The Trust often trades at a premium to net asset value (NAV). Closed-end funds can see large premiums and discounts, while exchange traded funds have an arbitrage feature that tends to keep prices much more in line. PSLV does possess some unique benefits however, and silver is gaining momentum as long-term idea.

“After five weeks of silver‘s lock-step, directional move with gold, longs in the white metal are resigning to the probability that without a significant dollar retreat, the $26 resistance will remain their point of frustration—just like gold bulls butting heads with low $1,700 pricing,” reports Investing.com.

PSLV: Is It Ready to Shine?

Easy monetary policies and the weak greenback are clearly beneficial to commodities prices, particularly precious metals, but there are other reasons to believe PSLV will rebound.

“Typically wedded to gold and regarded as little more than the yellow metal’s ‘poor cousin,’ silver breaks out occasionally on its own. Such instances are inspired either by a sudden acknowledgement of its depressed industrial value or the animal spirits of traders trying to buck the trend. But those moments are rare, more so in the present environment where yields and the dollar are commanding the universe of markets, including stocks,” according to Investing.com.

Silver prices and related ETFs have surged on improving fundamentals with demand-side support due to the coronavirus uncertainty, stimulus measures, and the recovering industrial sector. On the other side, supplies are dwindling as well.

Amid increased adoption of renewable energy sources, new, fast-growing end markets could also be emerging for silver.

PSLV “offers a potential tax advantage for certain non-corporate U.S. investors. Gains realized on the sale of the Trust’s units can be taxed at a capital gains rate of 15%/20% versus the 28% collectibles rate applied to most precious metals ETFs, coins and bars,” notes Sprott.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.