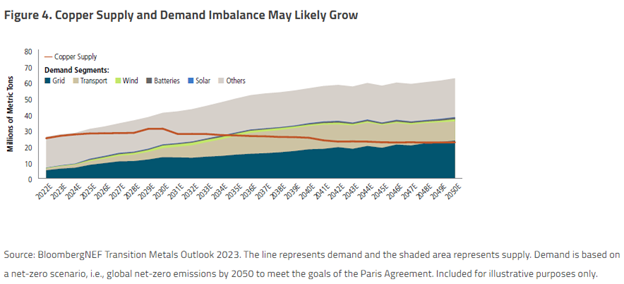

Increased demand for copper, flagging supply, as well as falling dollar strength in the second half of the year paint a constructive outlook for copper prices. For investors looking at both the short-term and long-term potential of copper price fundamentals, copper miners appear well-positioned in the coming years.

Near-Term Copper Outlook: Rising Prices, Falling Supply

In the next two years, BMI research forecasts a gain of 75% for copper prices, reported CNBC. Buoyed in the short term by recovering global demand, the shifting tides of shortening supply and growing demand could prove constructive for copper prices.

Copper, a longtime bellwether of global economic health, benefits strongly as economies decarbonize. Copper miners specifically are positioned advantageously in a world of growing supply and demand imbalances.

Image source: Sprott ETFs

The supply of the metal faces increasing constraints looking ahead. Alongside the declining availability of high-quality copper, existing mines face challenges. The two largest copper-producing countries, Peru and Chile, are embroiled in protests and strikes reported Steve Schoffstall, director, ETF product management for Sprott ETFs, in a recent report. Meanwhile, Russian supply remains a casualty of its ongoing war in Ukraine.

As a mature industry, discoveries of high-quality copper are increasingly rare. What’s more, any discoveries take an exceedingly long amount of time to bring online — over 15 years. The industry has responded by investing largely in extending the longevity of their existing, quality mines.

Energy Transition a Game Changer for Copper Fundamentals

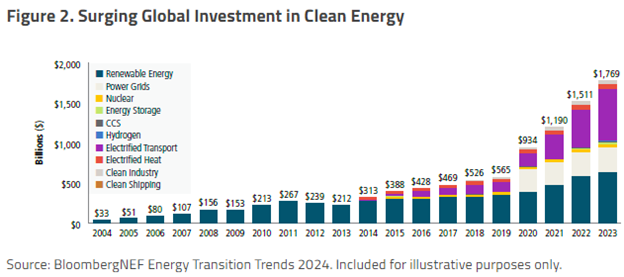

Copper is vital to the energy transition. It’s used in electric vehicles, efficient power grids, renewable energies, and more.

Energy grids will need to double their capacity by 2050 to meet increased demand. In addition, infrastructure needs to be updated to accommodate renewable energy inputs and storage. Investment to fuel the power grid transition alone is estimated at $21 trillion by 2050.

At the COP28 climate summit last year, countries committed to tripling renewable energy capacity within the next seven years. Regulatory focus and support exist and will only grow in the coming years. This creates strong long-term fundamentals for critical minerals like copper.

“The shift to cleaner technologies has created a dynamic, growing investment market,” wrote Schoffstall. “For the first time, substantial investment is following the rhetoric.”

Image source: Sprott ETFs

Copper Equities Well-Positioned Looking Ahead

Copper miners are positioned to benefit from increasing investment due to exponential demand growth. Additionally, investment is expected to grow given the historical outperformance of copper equities over copper prices in previous commodity supercycles according to Schoffstall.

Mergers and acquisitions within the copper industry recently surpassed those of gold. Premiums soared above 20% in some cases, underscoring the strong long-term outlook for copper miners.

“As a long-valued asset, copper is entering a new era with the global energy transition,” explained Schoffstall. “The anticipated increase in copper price is necessary to incentivize new production to meet rising demand.”

The Sprott Junior Copper Miners ETF (COPJ) is a one-of-a-kind fund that offers targeted exposure to small copper miners. The fund seeks to track the Nasdaq Sprott Junior Copper Miners Index. The index includes small, mid, and micro-cap copper miners or companies related to copper mining.

Junior miners carry the potential for strong growth and revenue opportunities for investors. Given growing copper demand forecasts in the coming years driven by electrification, upstream companies within the copper supply chain will likely benefit from an influx of investment.

The top countries invested in by COPJ include Canada at 53.3% weight, Australia at 21.1%, and Peru at 7.3% as of 01/31/2024.

COPJ carries an expense ratio of 0.75%.

For more news, information, and analysis, visit the Gold/Silver/Critical Materials Channel.