The universe of funds sporting the “sustainability” label is growing at a rapid pace. For investors, more choice is usually a good thing, but in a still-young corner of the investment realm, more funds to pick from can also lead to investor confusion.

Still, investors remain devoted to sustainability and are putting their money to work with related funds.

“Assets in U.S. sustainable funds have stayed on a steady growth trajectory. As of September 2021, assets totaled more than $330 billion. That’s a 9% increase over the previous quarter and 1.8 times the $183 billion from the third quarter of 2020,” says Morningstar analyst Alyssa Stankiewicz.

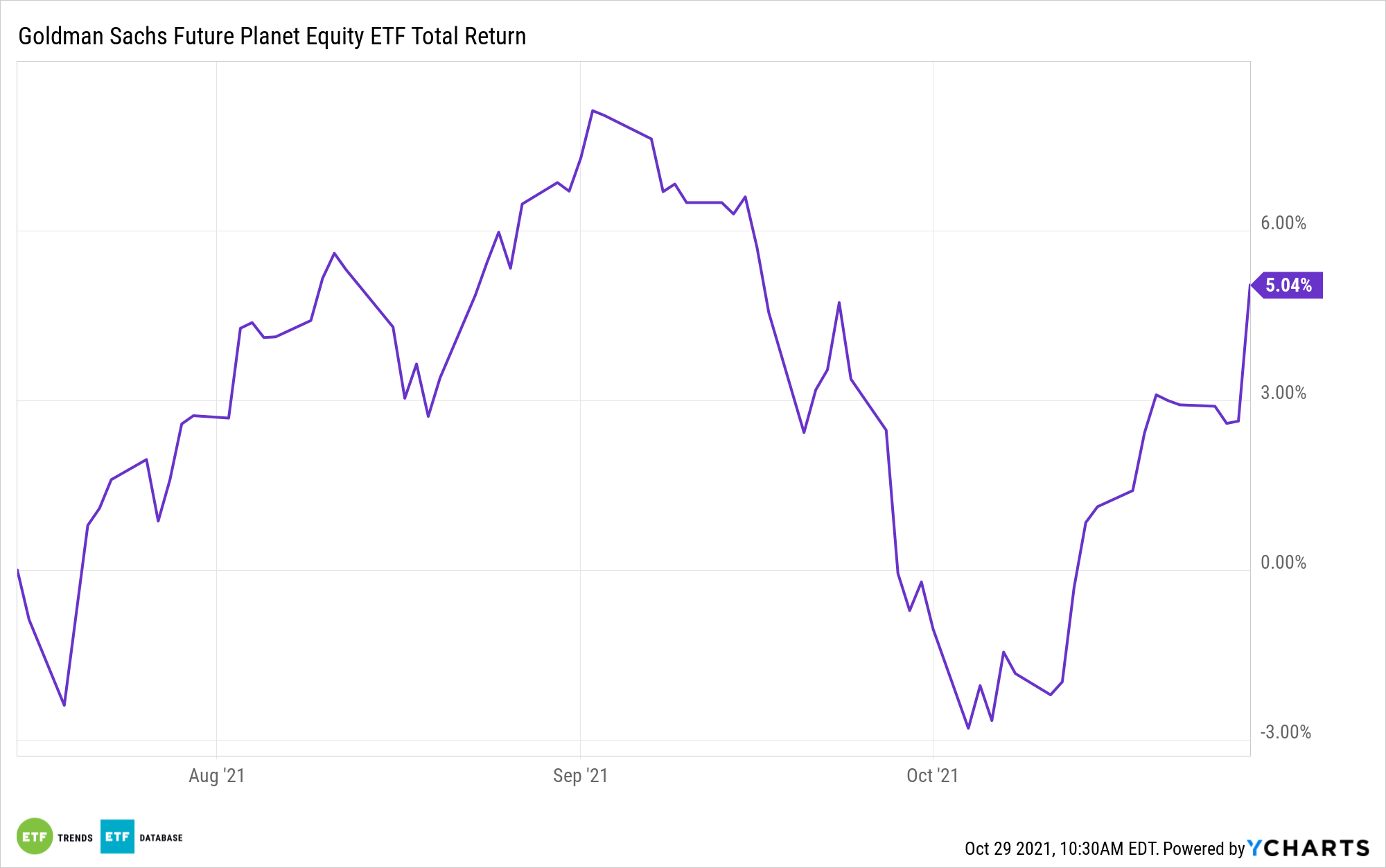

An avenue for weeding through the confusion in the sustainable funds space is the Goldman Sachs Future Planet Equity ETF (GSFP). In an increasingly confusing area of the fund landscape, GSFP cuts through the noise by emphasizing a singular, easy-to-understand concept: focusing on companies working to reduce greenhouse gas emissions.

In the fund universe, whether it’s exchange traded funds or mutual funds, simplicity and ease of use have long been valued by investors. Those could easily be reasons why GSFP already has north of $74 million in assets under management — an impressive start for a fund that debuted in mid-July. This means that GSFP was one of a long list of funds with sustainability features to launch in the July through September period.

“As U.S. flows into sustainable funds have gained traction, asset managers have responded by growing their sustainable fund lineups,” says Morningstar’s Stankiewicz. “In the third quarter of 2021, 38 funds with sustainable mandates were launched in the U.S. This is the highest number of sustainable funds launched in one quarter, beating the record of 30 funds set in the third quarter of 2020. Of those 38, 29 were equity funds, and 25 were exchange-traded funds.”

The actively managed GSFP holds 51 stocks, meaning that it’s a concentrated fund, but it leverages active management to touch multiple corners in the sustainability space.

GSFP “targets environmental sustainability themes, including clean energy, resource efficiency, sustainable consumption, the circular economy, and water sustainability,” notes Morningstar’s Stankiewicz.

For more news, information, and strategy, visit the Future ETFs Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.