Plenty of investors are often intrigued by new exchange traded funds, but many wait for rookie funds to mature and add assets.

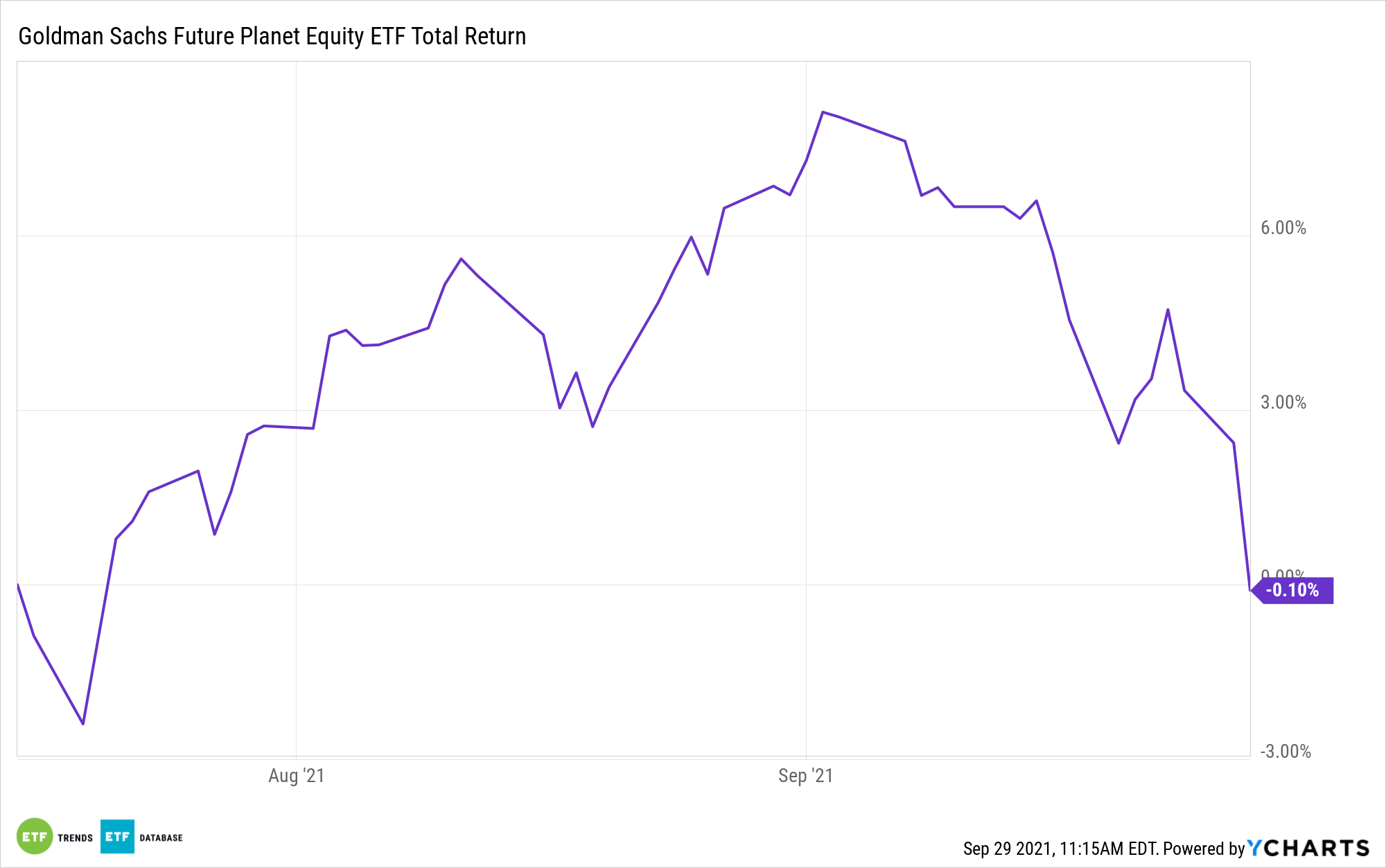

The Goldman Sachs Future Planet Equity ETF (GSFP) may be an example of a new ETF that investors might want to consider today, particularly if they’re seeking climate-aware exposure. GSFP debuted in July, and that could amount to good timing because the fund arrives at a moment when interest in climate-aware and carbon-sensitive strategies is rising and some investors are craving clarity on what exactly constitutes climate-aware investing.

“Just as governments around the world have spent the past year racing to get the coronavirus pandemic under control, we should be racing to contend with a similarly harmful global event: the threat of climate change. To be sure, a growing number of entities are doing their part. Regulators are ratcheting up efforts to combat climate change, and the investment community is offering more disclosure,” writes Morningstar analyst Elizabeth Stuart.

While plenty of environmental, social, and governance (ESG) and, more recently, sustainable funds are proving successful, there’s considerable murkiness on what makes a credible climate- or carbon-sensitive fund. GSFP eases that burden for investors by focusing on companies “with solutions to reduce greenhouse gas emissions required across many different activities.”

Said another way, GSFP delivers the goods in terms of simplicity at a time when that trait is exceedingly important to investors prioritizing climate issues.

“Climate conscious funds select or tilt toward companies that consider climate change in their business strategy and therefore are better prepared for the transition to a low-carbon economy. These funds are also well diversified,” notes Stuart. “Low carbon funds seek to invest in companies with reduced carbon intensity and/or carbon footprint relative to a benchmark index. These funds are well diversified.”

Though it’s actively managed, GSFP blends both of those concepts. In fact, active management works in the fund’s favor because that management style ensures that GSFP maintains adequate diversification and some level of carbon/climate purity.

Speaking of diversification, GSFP checks that box by featuring exposure to eight sectors and significant ex-U.S. exposure, as North American stocks account for just 40% of the fund’s weight.

For more news, information, and strategy, visit the Future ETFs Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.