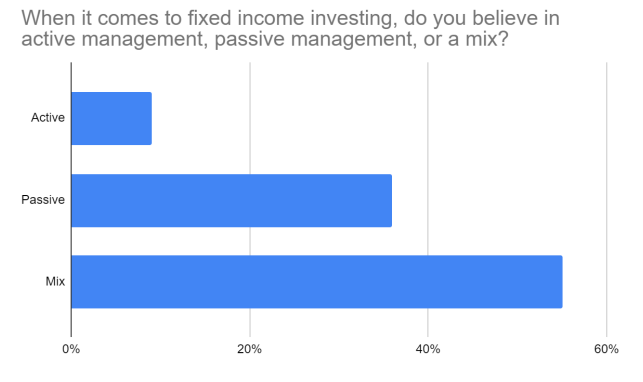

While ETFs tend to be thought of as passively tracking indexes, the majority of advisors prefer a combination of active and passive management strategies to gain fixed income exposure. During a Goldman Sachs webcast last week, VettaFi surveyed advisors and asked, “When it comes to fixed income investing, do you believe in active management, passive management, or a mix?” While 36% were firmly in the passive camp and 9% were in the active one, 55% believed in a mix of active and passive. This exclusive VettaFi data is encouraging, as the array of actively managed fixed income ETFs has grown in recent years with even more products on the way.

The first fixed income ETFs launched 20 years ago in July, and for years the only products that were available from firms like BlackRock and Vanguard, such as the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD), the iShares National Muni Bond ETF (MUB), and the Vanguard Total Bond Market ETF (BND), passively tracked an index rather than trying to outperform it.

However, asset managers have also launched actively managed fixed income ETFs, either tapping into their own in-house expertise or finding a sub-advisor to provide the security selection expertise. Such products have offered advisors a complement to index-based ETFs but also an alternative to actively managed mutual funds to meet end client demand for portfolios using only ETFs.

There are a number of actively managed core bond ETFs available, including the SPDR DoubleLine Total Return Tactical ETF (TOTL), which launched in 2015. The $2.3 billion ETF was down just 8.9% year-to-date through August 29, outperforming BND by approximately 160 basis points despite charging an expense ratio over 50 basis points more.

For tax-conscious ETF investors seeking a product that is selective about what municipalities it invests in, the PIMCO Intermediate Municipal Bond Active ETF (MUNI) is one worthy of attention. Thus far in 2022, MUNI is down just 7.2%, outperforming MUB by 80 basis points, despite an expense ratio that was 28 basis points higher.

In 2021, John Hancock Corporate Bond ETF (JHCB) launched, providing an active approach to investment-grade corporate bond style. While the ETF is quite small, with just $20 million in assets, advisors should know more about it. JHCB’s 14.1% year-to-date loss was 135 basis points narrower than that of industry heavyweight LQD, despite a higher expense ratio.

These examples show that value can be provided to end clients by advisors that incorporate active fixed income ETFs as part of the mix. However, each of these ETFs have active ETF peers that are underperforming the more well-known index alternative in 2022.

In 2022, asset managers such as AllianceBernstein, Capital Group, DoubleLine, and Touchstone have either launched active fixed income ETFs or are doing so in the coming weeks. These include the Capital Group Core Plus Income ETF (CGCP), the DoubleLine Opportunistic Bond ETF (DBND) (not a clone of TOTL), and the Touchstone Ultra Short Income ETF (TUSI). TUSI joins a particularly crowded field of active ETFs generating income despite extremely limited interest rate sensitivity. The JPMorgan Ultra-Short Income ETF (JPST), which has $21 billion in assets, is the largest of these funds, but BlackRock, Goldman Sachs, Invesco, Janus Henderson, PIMCO, and Vanguard are among the many other firms with one or more ultra-short products.

According to VettaFi data, demand remains high for active strategies, but advisors need to be made aware of them and their relative merits.

To see more of Todd’s research, reports, and commentary on a regular basis, please subscribe here.

For more news, information, and strategy, visit the Future ETFs Channel.